The benchmark Nifty 50 achieved a new record closing high for the sixth consecutive session on September 3, despite ending range-bound with a modest gain of just 1.2 points. About 1,224 shares advanced while 1,208 shares declined on the NSE. Overall, the trend is expected to remain positive despite occasional consolidation. Below are some trading ideas for the near term:

Om Mehra, Technical Analyst at Samco Securities

Ipca Laboratories | CMP: Rs 1,399.4

Ipca Laboratories has shown strong upward momentum after a brief consolidation. The previous resistance level has turned into support, and the stock is trading above its short-term DMAs (Day Moving Averages). The weekly chart further highlights the stock's strength. The positive performance of the pharma sector adds to the positive outlook for the stock. It can be accumulated in the Rs 1,370–1,400 zone.

Strategy: Buy

Target: Rs 1,500

Stop-Loss: Rs 1,360

Aegis Logistics | CMP: Rs 836.35

Aegis Logistics has broken its declining trendline after establishing a strong base around the Rs 750 level, signaling upward momentum with robust volume participation. The stock is currently trading above its 20 and 50 DMAs. Notably, the previous day's delivery volume surged by 53.94 percent compared to the 5-day average, indicating growing investor interest. With the daily RSI (Relative Strength Index) holding steady at 60, a move above Rs 845 could trigger strong traction on the higher side. Based on this technical structure, one can initiate a long position at the current market price (CMP) of Rs 836.35.

Strategy: Buy

Target: Rs 910

Stop-Loss: Rs 790

Prism Johnson | CMP: Rs 175.7

Prism Johnson formed a strong bullish candle with higher volumes on the daily chart, indicating strong momentum. The formation of a triple bottom pattern and sustaining above the previous resistance of Rs 173 further highlights the sustained trend. The stock is trading above its 20 DMA, and a bullish crossover in the daily MACD (Moving Average Convergence Divergence) further supports the positive outlook. One can initiate a long position at the current market price of Rs 175.7.

Strategy: Buy

Target: Rs 195

Stop-Loss: Rs 165

Ashish Kyal, CMT, Founder and CEO of Waves Strategy Advisors

Chalet Hotels | CMP: Rs 876

Chalet Hotels witnessed a rally of more than 2 percent in the previous session despite muted market performance. Since August 21, not a single candle has closed below the previous day’s low. The stock is currently trading at the resistance of the trendline. A breakout above this resistance could result in a fresh rise. The stock has also broken out of the upper Bollinger Bands, which is a positive sign. However, follow-up buying is needed to confirm a bullish stance. The ADX (Average Directional Index) is currently trading above 25, around 30 levels, indicating that good momentum is expected to continue. In summary, the trend for Chalet Hotels is bullish. A breach above Rs 880 can lift the price higher towards Rs 960, provided Rs 840 remains protected on the downside.

Strategy: Buy

Target: Rs 960

Stop-Loss: Rs 840

Titan Company | CMP: Rs 3,621

Titan has been closing above its previous high and has gained more than 2 percent in the last three days. The stock has been consolidating in a broader range since May, and a breakout is now expected. Prices are currently at an important resistance area near Rs 3,660. A decisive breakout above this level could result in fresh buying. In the previous session, prices were trading near the upper band of the Bollinger Band; a close above it would accelerate buying pressure. Additionally, the KST (Know Sure Thing) is trading above the zero line, suggesting good momentum is likely. In summary, Titan looks positive. A break above Rs 3,660 can lift prices towards Rs 3,960, as long as Rs 3,510 holds on the downside.

Strategy: Buy

Target: Rs 3,960

Stop-Loss: Rs 3,510

Tilaknagar Industries | CMP: Rs 301.75

Tilaknagar Industries experienced a sharp rally of more than 6.70 percent in the previous session. The stock has formed a Cup and Handle pattern and closed above Rs 289, confirming the breakout of this pattern. The daily ADX suggests that strong momentum can continue, with a reading of 26.53, which is above 25. For now, a buy-on-dips approach is advisable. Use dips towards Rs 295–298 as a buying opportunity for a move towards Rs 330–335, as long as Rs 285 holds on the downside.

Strategy: Buy

Target: Rs 330, Rs 335

Stop-Loss: Rs 285

Riyank Arora, Technical Analyst at Mehta Equities

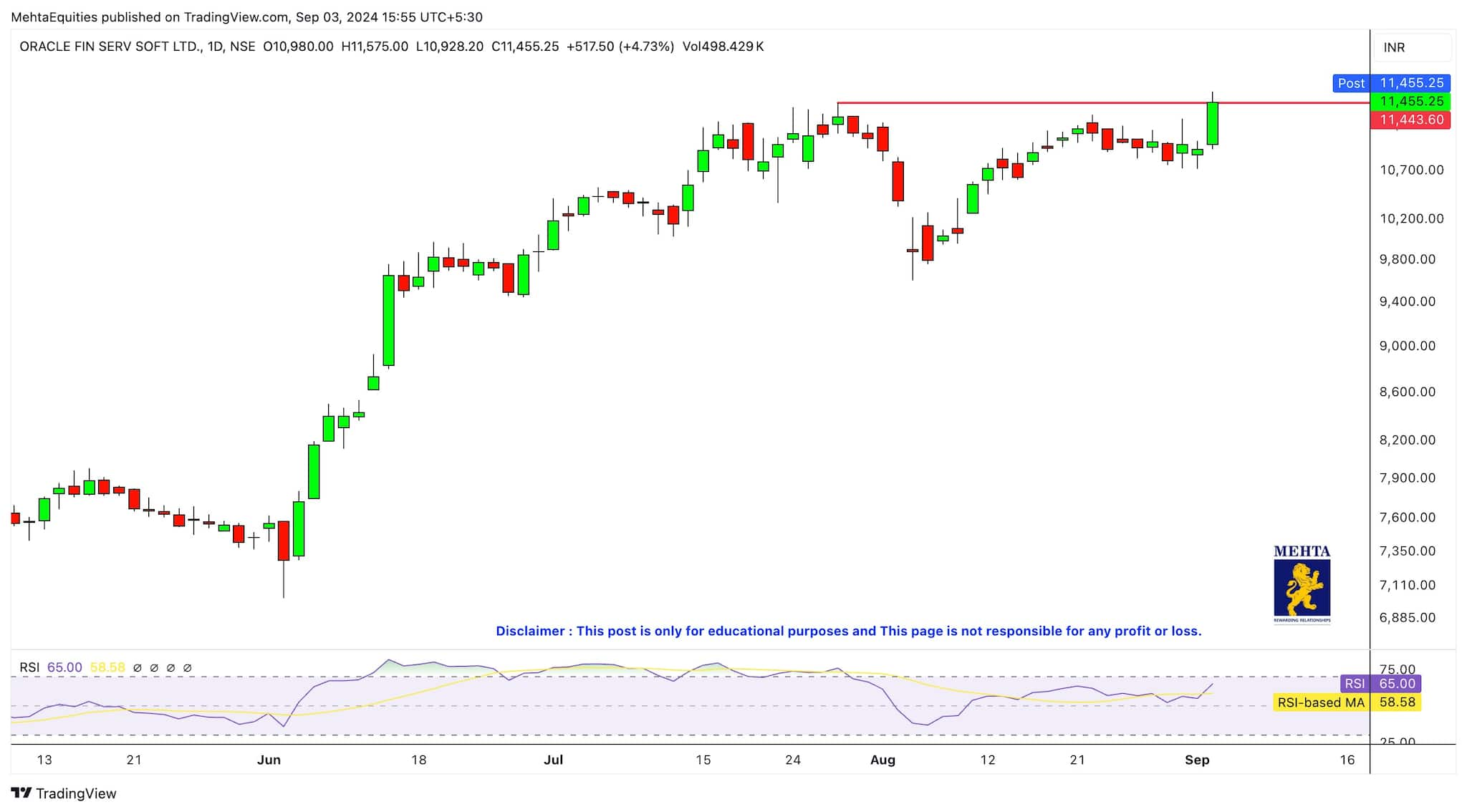

Oracle Financial Services Software | CMP: Rs 11,455

OFSS recently achieved a decisive breakout above the critical Rs 11,443 resistance level, signaling a strong bullish trend. The RSI (14) on the daily chart is positioned near 65, reflecting solid upward momentum. This technical configuration suggests that the stock is well-positioned for further gains in the near term. The stop-loss should be placed just below the recent support to manage risk effectively, offering an attractive risk-reward profile. With the current momentum, a target of Rs 12,000+ is both realistic and attainable.

Strategy: Buy

Target: Rs 12,000+

Stop-Loss: Rs 11,300

JK Cement | CMP: Rs 4,647.8

JK Cement confirmed a robust uptrend by breaking out above the pivotal Rs 4,600 level, reinforcing its bullish trajectory. The RSI (14) is nearing 68, underscoring strong momentum that supports further upward movement on the daily charts. This breakout, coupled with solid technical indicators, enhances the stock's potential for continued appreciation. The stop-loss should be set strategically below the breakout point to mitigate downside risks and ensure a favourable risk-reward balance. Given the strength of the momentum, the stock is expected to reach Rs 4,800+ in the near future.

Strategy: Buy

Target: Rs 4,800+

Stop-Loss: Rs 4,555

Dixon Technologies India | CMP: Rs 12,991.8

Dixon has demonstrated a strong recovery from the significant support level at Rs 12,500, signaling renewed buying interest and potential for further upside. The RSI (14), currently around 58.87, indicates that the stock has regained positive momentum, which is crucial for sustaining an upward trajectory. The sharp rebound observed on the hourly charts further substantiates the bullish outlook. The stop-loss should be placed below the key support level to manage risk effectively. With these factors in play, a target of Rs 13,600 appears well within reach as the stock continues to gain momentum.

Strategy: Buy

Target: Rs 13,600

Stop-Loss: Rs 12,450

Cholamandalam Investment and Finance Company | CMP: Rs 1,500

Cholamandalam Finance recently broke out above the significant Rs 1,476 resistance level, marking the onset of a strong bullish phase. The RSI (14) on the daily charts is near 66, indicating sustained momentum and further upside potential. This technical breakout, combined with robust momentum indicators, positions the stock favourably for continued gains. The stop-loss should be carefully set just below recent support to ensure that risk is well-managed while maintaining a positive risk-reward ratio. With the current bullish sentiment, the stock is poised to reach Rs 1,625+ in the near term.

Strategy: Buy

Target: Rs 1,625+

Stop-Loss: Rs 1,450

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.