The market recovered all of its Thursday's losses in the first two days of the December series, rising by six-tenths of a percent on December 2 with positive breadth. About 1,620 shares advanced against 912 declining shares on the NSE. The trend is likely to remain positive, but consolidation cannot be ruled out until the benchmark indices decisively surpass the 50 percent Fibonacci retracement. Below are some trading ideas for the near term:

Anshul Jain, Head of Research at Lakshmishree Investments

ADF Foods | CMP: Rs 338

ADF Foods has delivered a bullish breakout from a 32-day-long Cup-and-Handle pattern at the Rs 335 level, supported by a 125 percent surge in volumes above the 50-day average. This robust breakout signals strong buying interest and broad-based participation, making the stock a compelling pick.

Strategy: Buy

Target: Rs 400

Stop-Loss: Rs 299

Ashoka Buildcon | CMP: Rs 253.8

Ashoka Buildcon is showing strength with five tight closes on the monthly chart (where many months close within a small range), signaling accumulation. On the daily chart, the stock has broken out at Rs 252, accompanied by rising volumes on up days within the base—a clear sign of strong buying interest.

Strategy: Buy

Target: Rs 295

Stop-Loss: Rs 235

Geojit Financial Services | CMP: Rs 125.3

Geojit Financial is breaking out on the weekly charts from six weeks of tight closes (where many weeks close within a small range), a pattern that reflects strong accumulation. The breakout is accompanied by rising volumes, confirming the bullish structure and indicating robust buying interest.

Strategy: Buy

Target: Rs 155

Stop-Loss: Rs 115

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Reliance Industries | CMP: Rs 1,309

Reliance has provided a breakout from a downtrend line resistance with a bullish crossover in its momentum indicator MACD (Moving Average Convergence Divergence) on the daily charts. It is expected to retrace its previous fall by almost 38.2 percent at least.

On derivatives data, the stock looks quite oversold as the open interest is at its peak since 2006, and the price had fallen. So, overall, there is heavy short buildup, and with a technical reversal, the stock is likely to bounce back due to short covering. There was heavy put writing at the Rs 1,300 strike, indicating that if it sustains above the Rs 1,300 level, there will be support from call unwinding as well.

Strategy: Buy

Target: Rs 1,340, Rs 1,360

Stop-Loss: Rs 1,284

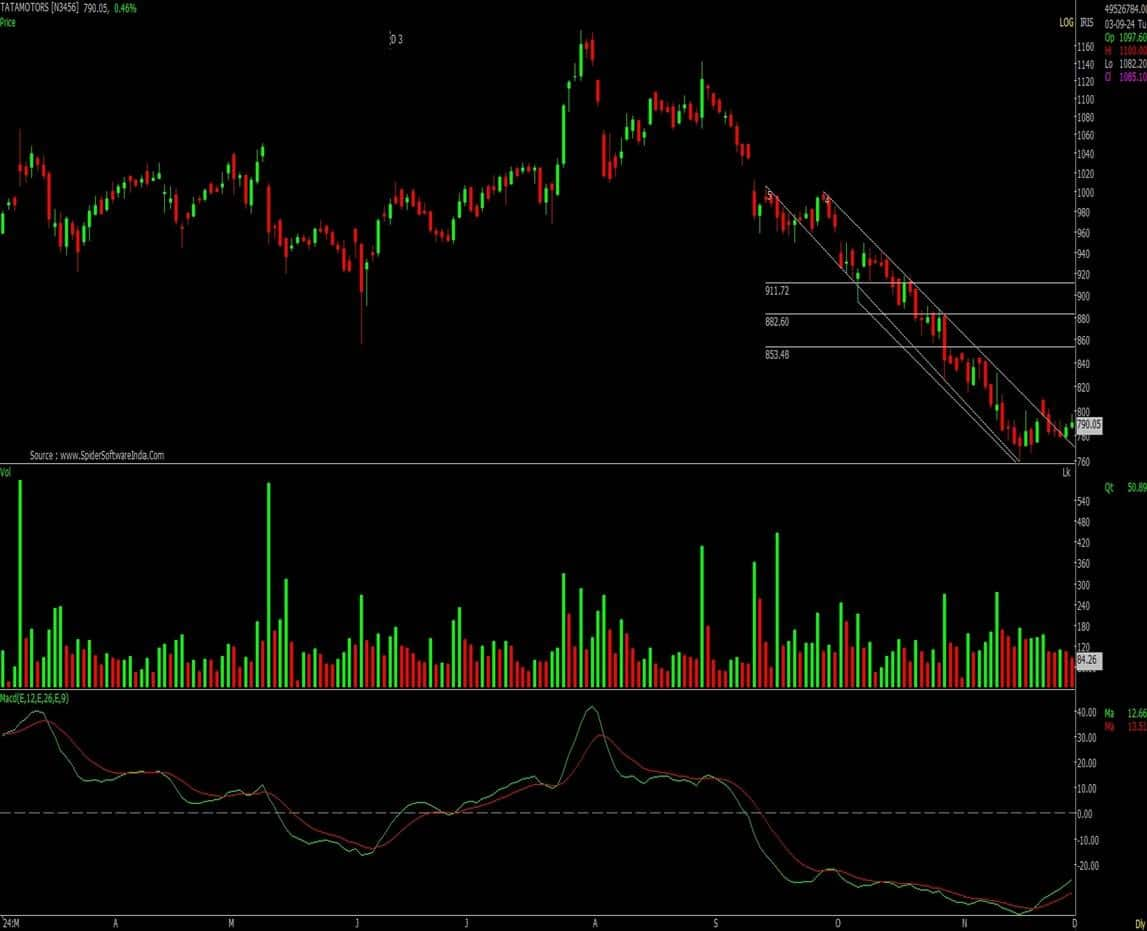

Tata Motors | CMP: Rs 790

Tata Motors has provided a breakout from the falling trendline with a bullish crossover on its momentum indicator MACD on the daily charts. The stock has witnessed heavy shorts in futures, and there is an early reversal from the point of view of short covering. There is massive Call writing at the Rs 800 strike, so above the Rs 800 level, the stock is likely to witness heavy short covering.

Strategy: Buy

Target: Rs 815, Rs 830

Stop-Loss: Rs 777

Tata Steel | CMP: Rs 146.4

Tata Steel has technically provided a breakout from a symmetrical triangular pattern with a bullish crossover in its momentum indicator MACD on the hourly charts, which is a positive sign in the short term. The stock has heavy Call writing at the Rs 150 strike, which, when taken off, will lead to further short covering. There has been a positive divergence on the hourly charts in its momentum indicators, and the futures open interest indicates some further short covering in the near term.

Strategy: Buy

Target: Rs 151, Rs 155

Stop-Loss: Rs 142

Pravesh Gour, Senior Technical Analyst at Swastika Investmart

Affle India | CMP: Rs 1,736

Affle India is currently experiencing a breakout from a long-term consolidation phase on the daily chart, forming an Inverse Head & Shoulders pattern. This breakout is accompanied by strong volume and a close above the breakout level after a three-month period. On the upside, the immediate resistance is at Rs 1,800. If this level is surpassed, we can expect the price to move towards Rs 1,900 and beyond. On the downside, Rs 1,590 serves as a strong support zone in the event of a pullback.

Additionally, the momentum indicators are showing a positive outlook, with the RSI (Relative Strength Index) indicating strength, and the MACD also reinforcing the current bullish momentum.

Strategy: Buy

Target: Rs 1,946

Stop-Loss: Rs 1,590

Kaynes Technology India | CMP: Rs 6,319

Kaynes Technology is currently in a classic bullish trend, with a consistent pattern of higher highs and higher lows on the longer timeframe. The immediate resistance is around the previous swing high of Rs 6,600. A move above this level could drive the price towards Rs 6,800 in the near term. On the downside, the key support level is the previous breakout level of Rs 6,000, while Rs 5,800 acts as a strong demand zone. Momentum indicators remain positively aligned, further supporting the strength of the ongoing trend.

Strategy: Buy

Target: Rs 6,830

Stop-Loss: Rs 5,990

PB Fintech | CMP: Rs 1,945

PB Fintech has experienced a breakout from a Saucer pattern, forming a strong base around the 100-DMA (Day Moving Average) and surpassing its all-time high levels in the last trading session. The structure remains favourable as the counter is trading above all key moving averages. The momentum indicators are supportive, with the RSI showing positive momentum and the MACD undergoing an upward centerline crossover. On the upside, Rs 2,000 serves as a significant psychological resistance level, and a breakout above this could drive the price towards Rs 2,100+ in the near term. On the downside, Rs 1,800 is a key support level during any potential correction.

Strategy: Buy

Target: Rs 2,140

Stop-Loss: Rs 1,800

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.