Equity benchmark indices finished 0.15 percent higher on June 11, extending their northward move for the sixth consecutive session, with market breadth favouring the bulls. A total of 1,436 shares saw buying interest compared to 1,174 shares that came under pressure on the NSE. The market may remain rangebound in the upcoming session until it decisively surpasses the previous day’s high. Below are some short-term trading ideas to consider:

Jatin Gedia, Technical Research Analyst at Mirae Asset Sharekhan

CG Power Industrial Solutions | CMP: Rs 695.75

CG Power has been consolidating after a sharp run-up. This consolidation has formed a Triangle pattern, which is typically a trend continuation pattern. We expect a breakout on the upside from this consolidation. A rise in volume in the direction of the trend suggests renewed interest in the stock.

Strategy: Buy

Target: Rs 735, Rs 760

Stop-Loss: Rs 680

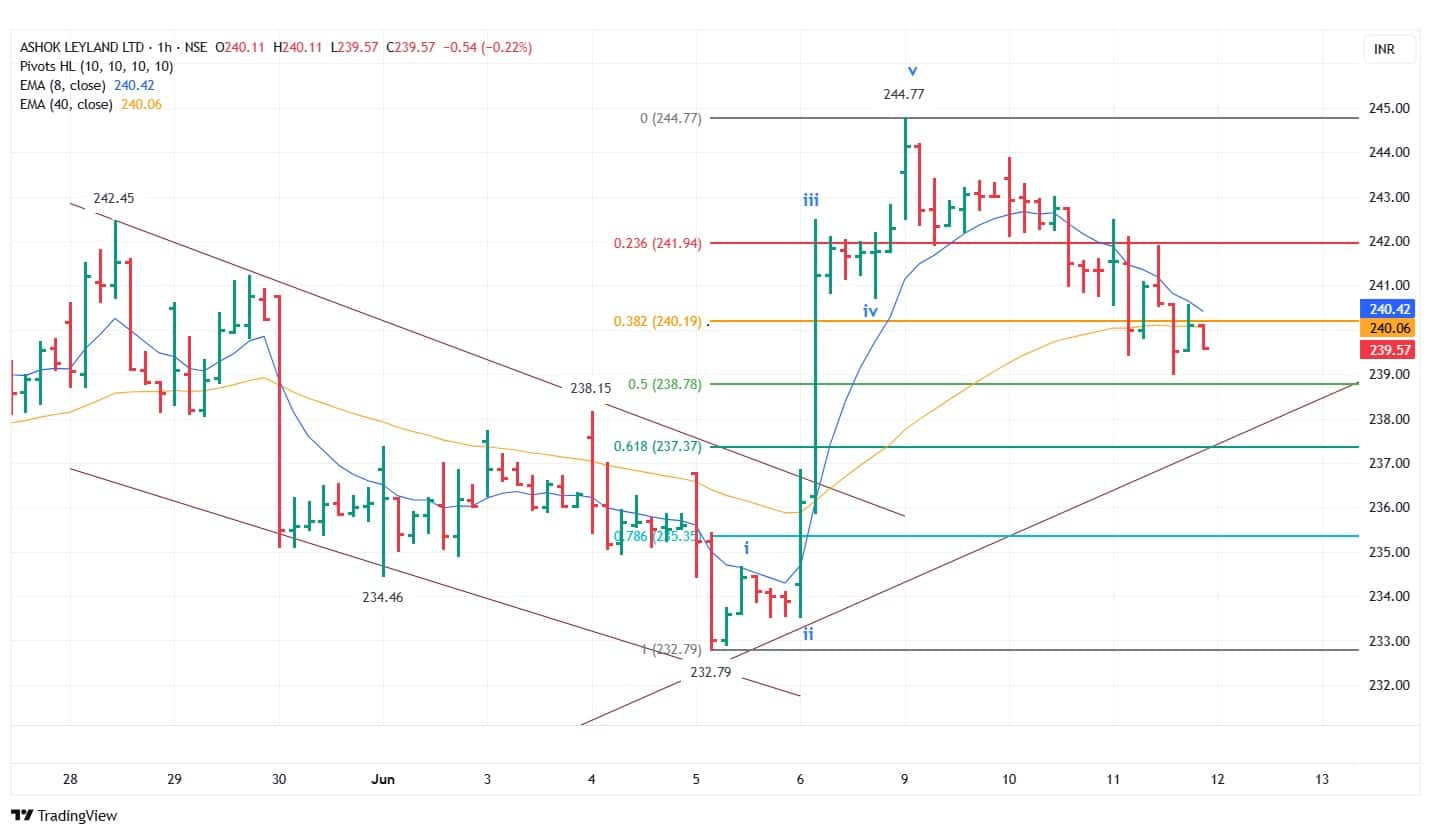

Ashok Leyland | CMP: Rs 240

Ashok Leyland is currently retracing its previous five-wave advance. Crucial Fibonacci retracement levels are placed at Rs 238.78–Rs 237.37, and hence this dip should be considered a buying opportunity. We expect the stock to find support at this Fibonacci cluster zone and resume the next set of impulsive moves to the upside, which could take the stock toward RS 252–RS 259 in the short term.

Strategy: Buy

Target: Rs 252, Rs 259

Stop-Loss: Rs 235

Sudeep Shah, the Deputy Vice President and Head of Technical and Derivative Research at SBI Securities

HCL Technologies | CMP: Rs 1,721.9

Over the last two trading sessions, the Nifty IT index has strongly outperformed the frontline indices, having given a breakout from a falling channel and surged above its crucial moving averages. HCL Technologies has also given a consolidation breakout on the daily chart, confirmed by relatively higher volume. The stock is currently trading above its short- and long-term moving averages, both of which are rising. The daily RSI has surged above the 60 mark and is on a rising trajectory—an overall bullish sign. Hence, we recommend accumulating the stock in the Rs 1,725–Rs 1,715 zone.

Strategy: Buy

Target: Rs 1,850

Stop-Loss: Rs 1,660

Bharat Petroleum Corporation | CMP: Rs 333.85

Bharat Petroleum Corporation (BPCL) has given a 26-day consolidation breakout on the daily chart, confirmed by robust volume. Additionally, the stock has formed a sizeable bullish candle on the breakout day, strengthening the breakout signal. It is currently trading above its short- and long-term moving averages, which are in a rising trajectory and the desired sequence—indicating a strong trend. Furthermore, the daily RSI has given a trendline breakout, reinforcing bullish momentum. Hence, we recommend accumulating the stock in the Rs 335–Rs 333 zone.

Strategy: Buy

Target: Rs 370

Stop-Loss: Rs 320

Biocon | CMP: Rs 354.5

Biocon has broken out of a Symmetrical Triangle formation on the daily chart, backed by healthy volumes. The Nifty Pharma index has also shown renewed strength after a consolidation breakout, supporting sectoral momentum. Biocon now trades above its key moving averages, which are trending higher. Notably, the daily RSI has moved above the 60 mark for the first time since February 2025 and is on a rising trajectory—an encouraging sign for bulls. Hence, we recommend accumulating the stock in the Rs 355–Rs 353 zone.

Strategy: Buy

Target: Rs 380

Stop-Loss: Rs 340

Rupak De, Senior Technical Analyst at LKP Securities

Lupin | CMP: Rs 2,026.6

Lupin has moved higher following a phase of consolidation on the daily timeframe, signaling renewed investor interest. The stock has reclaimed its 50-day moving average, reinforcing its bullish structure. Moreover, the RSI has broken out of a falling trendline, indicating strengthening momentum. With sentiment remaining positive, the stock has the potential to move toward RS 2,150 in the short term.

Strategy: Buy

Target: Rs 2,150

Stop-Loss: Rs 1,964

Mastek | CMP: Rs 2,466.9

Mastek has advanced following a consolidation phase on the daily chart, reflecting renewed buying interest. The stock continues to trade above its 50-day moving average and appears poised to approach its 200-day moving average, currently around Rs 2,635. Additionally, the RSI has broken out of a consolidation pattern, further supporting bullish momentum.

Strategy: Buy

Target: Rs 2,615

Stop-Loss: Rs 2,389

GAIL India | CMP: Rs 200.09

GAIL has broken out of an Ascending Triangle pattern on the daily chart, indicating renewed bullish sentiment. The stock has crossed above its 200-day moving average, a key technical indicator of strength. Furthermore, the RSI is in a bullish crossover, supporting continued upward momentum.

Strategy: Buy

Target: Rs 216

Stop-Loss: Rs 193.40

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.