The Nifty50 rallied for a fourth consecutive day in a row on February 5 and is trading well above crucial short and long-term moving averages. The index formed a bullish candle on daily charts and closed above 10,900 for the second day in a row.

One interesting thing which was visible on the charts was a buy signal triggered by MACD indicator on the daily charts. MACD stands for Moving Average Convergence/Divergence.

The MACD indicator is basically a refinement of the two moving averages system and measures the distance between the two moving average lines. The indicator gave a sell signal on January 24 and the index recorded an intraday low of 10,583 on January 29 before bouncing back towards 10,900 levels.

The index, which opened at 10,908, slipped to an intraday low of 10,886 before bouncing back towards 10900 levels. It hit an intraday high of 10,956 before closing the day at 10,934, up 22 points.

Analysts feel investors should continue holding long positions and add fresh positions only after a breakout above 10985 which could open room for the index towards higher levels of 11080-11200 levels.

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,934.3. According to Pivot charts, the key support level is placed at 10,895.1, followed by 10,855.9. If the index starts moving upward, key resistance levels to watch out are 10,965.1 and then 10,995.9.

Nifty Bank

The Nifty Bank index closed at 27,271.7. The important Pivot level, which will act as crucial support for the index, is placed at 27,167.2, followed by 27,062.7. On the upside, key resistance levels are placed at 27,362.2, followed by 27,452.7.

Call Options Data

Maximum Call open interest (OI) of 33.46 lakh contracts was seen at the 11,000 strike price. This will act as a crucial resistance level for the February series.

This was followed by the 11,200 strike price, which now holds 24.42 lakh contracts in open interest, and 10,900, which has accumulated 18.77 lakh contracts in open interest.

Meaningful Call writing was seen at the strike of 11,300 which added 1.74 lakh contracts, followed by 11,200 strike which added 1.37 lakh contracts and 11,100 strike which added 1.16 lakh contracts.

There was hardly any unwinding seen.

Put Options data

Maximum Put open interest of 32.37 lakh contracts was seen at the 10,700 strike price. This will act as a crucial support level for the February series.

This was followed by the 10,400 strike price, which now holds 31.79 lakh contracts in open interest, and the 10,500 strike price, which has now accumulated 28.75 lakh contracts in open interest.

Put writing was seen at the strike price of 10,900, which added 2.93 lakh contracts, followed by 10,400, which added 1.55 lakh contracts and 10,700, which added 1.14 lakh contracts.

Maximum Put unwinding was seen at the strike price of 11,200, which shed 3.25 lakh contracts.

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 420.65 crore and Domestic Institutional Investors bought Rs 194.31 crore worth of shares in the Indian equity market on February 5, as per provisional data available on the NSE.

Fund Flow Picture

Stocks with high delivery percentage

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

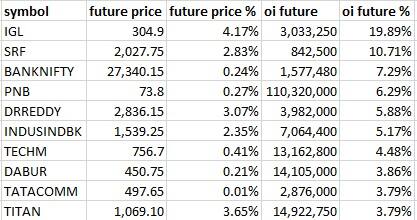

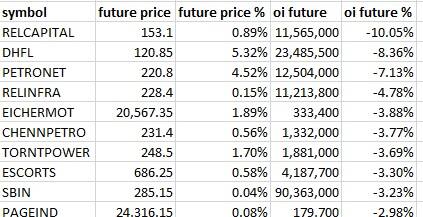

43 stocks saw a long buildup

34 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

70 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

50 stocks saw long unwinding

Bulk Deals on February 5

Dewan Housing: Tower Research Capital traded over 35.67 lakh shares at Rs 119.59-119.63 apiece.

Jet Airways: Tower Research Capital traded over 7.13 lakh shares at Rs 240.19-240.51 per share.

Reliance Communications: Tower Research Capital traded over 3.79 crore shares at Rs 6.22-6.23 apiece

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Tube Investments: The company will hold analysts call to discuss financial results on February 7, 2019.

Natco Pharma: The company will host earnings call on February 13, 2019.

CRISIL: Kayne Anderson Rudnick Investment Management will meet the company on February 15, 2019.

AIA Engineering: The company will hold a conference call on February 8, 2019.

Stocks in news

Tech Mahindra Q3 profit rises 13% QoQ, revenue surges 3.6%

Lupin Launches Clomipramine Hydrochloride Capsules USP

Marico: The company's net profit grew 13 percent at Rs 251.7 crore.

HPCL: The profit has fallen 77 percent to Rs 247.5 crore against previous quarter.

Axis Bank: RBI has imposed a penalty of Rs 2 crore.

RBI Imposes Rs 1 crore penalty on Syndicate Bank

Blue Star: Profit for Q3 fell 15 percent to Rs 13.2 crore.

Bombay Dyeing: The company has posted a net loss of Rs 142.8 crore

Two stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For February 6, DHFL, IDBI, Jet Airways and Reliance Capital are present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.