The Indian equity market continued witnessing buying on December 8 as the key indices Sensex and Nifty rose for the fourth and sixth consecutive sessions, respectively.

The reports of emergency vaccine rollout in India along with hopes of a stimulus package in the US and Japan underpinned the sentiment.

Sensex closed 182 points, or 0.40 percent, higher at 45,608.51 and Nifty ended 37 points, or 0.28 percent, higher at 13,392.95.

Experts pointed out that the overall structure of the market continues to remain positive due to healthy FII inflows and developments on the vaccine front.

"Nifty has to hold above 13,200 for an up-move towards 13,500-13,800 levels while on the downside, major support exists at 13,000," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

Khemka believes the momentum in PSU Banks can continue in the coming days. IT and FMCG stocks can be in focus in the coming weeks as many stocks from these sectors have come out of the consolidation of almost 6-8 weeks, he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13324.17, followed by 13255.33. If the index moves up, the key resistance levels to watch out for are 13448.67 and 13504.33.

Nifty Bank

The Bank Nifty climbed 50 points or 0.17 percent to close at 30,261.90. The important pivot level, which will act as crucial support for the index, is placed at 30070.13, followed by 29878.37. On the upside, key resistance levels are placed at 30408.73 and 30555.57.

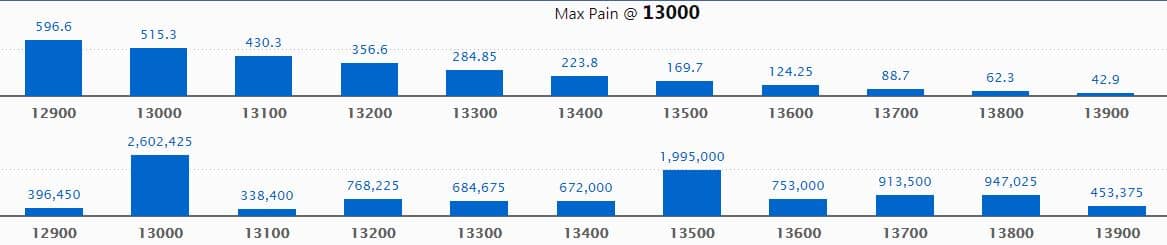

Call option data

Maximum Call open interest of 26.02 lakh contracts was seen at 13,000 strike, which will act as a crucial level in the December series.

This is followed by 13,500 strike, which holds 19.95 lakh contracts, and 13,800 strike, which has accumulated 9.5 lakh contracts.

Call writing was seen at 13,400 strike, which added 1.2 lakh contracts, followed by 13,900 strike which added 39,150 contracts.

Call unwinding was seen at 13,000 strike, which shed 42,675 contracts, followed by 13,200 strike which shed 36,225 contracts.

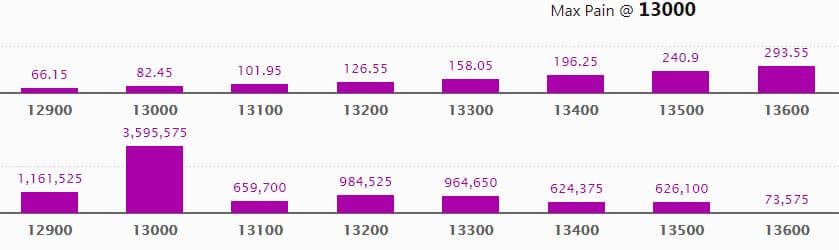

Put option data

Maximum Put open interest of 36 lakh contracts was seen at 13,000 strike, which will act as crucial support in the December series.

This is followed by 12,900 strike, which holds 11.62 lakh contracts, and 13,300 strike, which has accumulated 9.65 lakh contracts.

Put writing was seen at 13,000 strike, which added 3.54 lakh contracts, followed by 13,400 strike, which added 2.98 lakh contracts and 13,300 strike which added 2.47 lakh contracts.

There was no major Put unwinding on December 8.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

27 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which long build-up was seen.

42 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

40 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

30 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Majesco: Edelweiss ELSS Fund bought 1,58,392 shares of the company at an average price of Rs 978.01 on NSE in a bulk deal.

Malu Paper Mills: Ashwin Stocks And Investment Private Limited bought 1,51,704 shares of the company at an average price of Rs 33.08 in a bulk deal on NSE.

PRICOL RE: Vramath Financial Services Private Limited sold 1,67,898 shares of the company at an average price of Rs 16.36 in a bulk deal on NSE.

SKIL Infrastructure: IFCI sold 19,15,616 shares of the company at an average price of Rs 2.14 in a bulk deal on BSE.

(For more bulk deals, click here)

Board Meetings

Shivom Investment & Consultancy: The board will meet on December 9 to consider and approve quarterly earnings.

HAL: The board will meet on December 9 to consider and approve the interim dividend.

HKG: The board will meet on December 9 for general purposes, considering an increase in authorised capital and the preferential issue of shares.

Stocks in the news

ICICI Bank - The company approved the sale of up to 2.21 percent stake in ICICI Securities via OFS.

YES Bank - Brickwork Ratings upgrades rating of Tier I Subordinated Perpetual Bonds (Basel II) to BWR BB+/ Stable.

JSW Steel - November crude steel output at 13.32 lakh tonnes, up 3 percent YoY.

Tata Steel - S&P revises company outlook to 'stable' from 'negative' and affirms 'B+' rating.

Paisalo Digital - Meeting on December 11 for the issuance of NCDs on a private placement basis.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,909.6 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,640.93 crore in the Indian equity market on December 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Canara Bank - is under the F&O ban for December 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!