Given the smart recovery from the day's low and the formation of the Doji candlestick pattern on the daily charts on March 20 after a large bearish candle in the previous session, the market may see some pullback rally but the sustainability of the same is the key to watch as overall sentiments are still weak, experts said, adding the index may face immediate resistance at 21,900-22,000 levels with support at 21,700 mark.

On March 20, the BSE Sensex rose 90 points to 72,102, while the Nifty 50 was up 22 points at 21,839. Doji candlestick pattern means the closing is similar to opening levels, indicating the tug-of-war between bulls and bears for further market trend, and this can also act as a trend reversal pattern.

"Normally, a Doji after a reasonable up move or down move calls for impending trend reversals. Having formed a Doji after a minor downtrend, the chance of a minor pullback rally is likely," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

Minor degree positive chart patterns like higher tops and bottoms have been negated recently as per the daily chart. Hence, any upside bounce from here is expected to be a lower top formation in the short term.

He feels the near-term trend of Nifty remains weak. "Further up move from here could find strong overhead resistance around 22,150-22,200 levels in the next few sessions and this is likely to be a sell-on-rise opportunity. Immediate support is at 21,700," he said.

Rupak De, senior technical analyst at LKP Securities also feels the overall sentiment remains negative. "A further fall is anticipated below the recent swing low on the hourly chart, which is positioned around 21,700. On the higher end, resistance is placed at 21,900-22,000."

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may take immediate support at 21,742 followed by 21,690 and 21,606. On the higher side, the index may face resistance at 21,911 followed by 21,963 and 22,047 levels.

On March 20, the Bank Nifty closed the volatile session on a negative note, falling 74 points to 46,311, and formed a small bearish candlestick pattern with long upper and lower shadows which resembles a High Wave kind of candlestick pattern on the daily timeframe, indicating increasing volatility.

The banking index defended the 46,000 mark, though continued a downtrend for the ninth consecutive trading session. "The fall has found support at the lower end of the rising channel and daily lower Bollinger band placed at 45,800," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

He feels the hourly momentum indicator has a positive crossover which is a buy signal. Thus, one can expect a recovery to 46,800 – 46,950 over the next few trading sessions, he said.

According to the pivot point calculator, Bank Nifty is expected to take support at 45,949 followed by 45,754 and 45,438. On the higher side, the index may see resistance at 46,581 followed by 46,776 and 47,092.

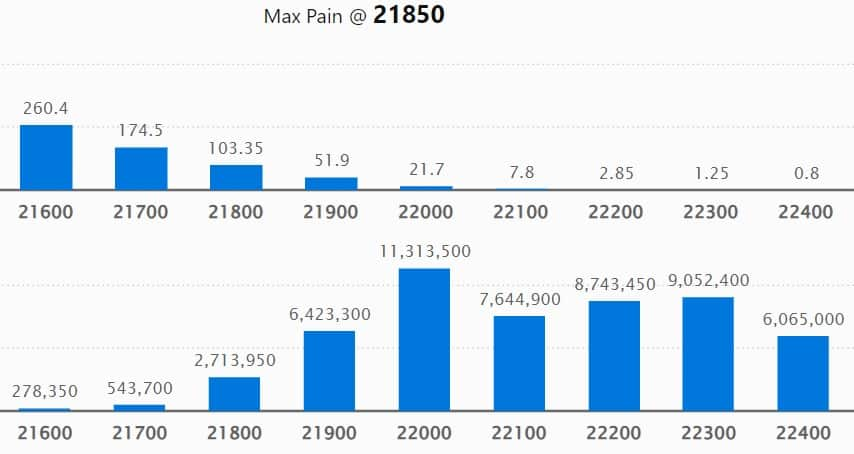

As per the weekly options data, the 22,000 strike owned the maximum Call open interest with 1.13 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,300 strike, which had 90.52 lakh contracts, while the 22,200 strike had 87.43 lakh contracts.

Meaningful Call writing was seen at the 22,300 strike, which added 25.53 lakh contracts followed by 22,100 strike and 22,200 strike, which added 12.74 lakh and 11.39 lakh contracts, respectively.

The maximum Call unwinding was at the 22,500 strike, which shed 32.4 lakh contracts followed by 23,000 and 22,700 strikes, which shed 18.41 lakh contracts and 14.99 lakh contracts, respectively.

On the Put side, the maximum open interest was seen at 21,500 strike, which can act as a key support level for the Nifty with 64.6 lakh contracts. It was followed by the 21,700 strike comprising 52.15 lakh contracts and then the 21,800 strike with 52.07 lakh contracts.

Meaningful Put writing was at the 21,500 strike, which added 23.95 lakh contracts followed by the 21,700 strike and 21,600 strike adding 22.94 lakh and 14.1 lakh contracts, respectively.

Put unwinding was seen at 22,000 strike, which shed 5.08 lakh contracts followed by 21,100 and 20,800 strikes, which shed 4.81 lakh and 2.7 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Prudential Life Insurance Company, Crompton Greaves Consumer Electricals, Hindustan Unilever, Bharti Airtel, and Divis Laboratories saw the highest delivery among the F&O stocks.

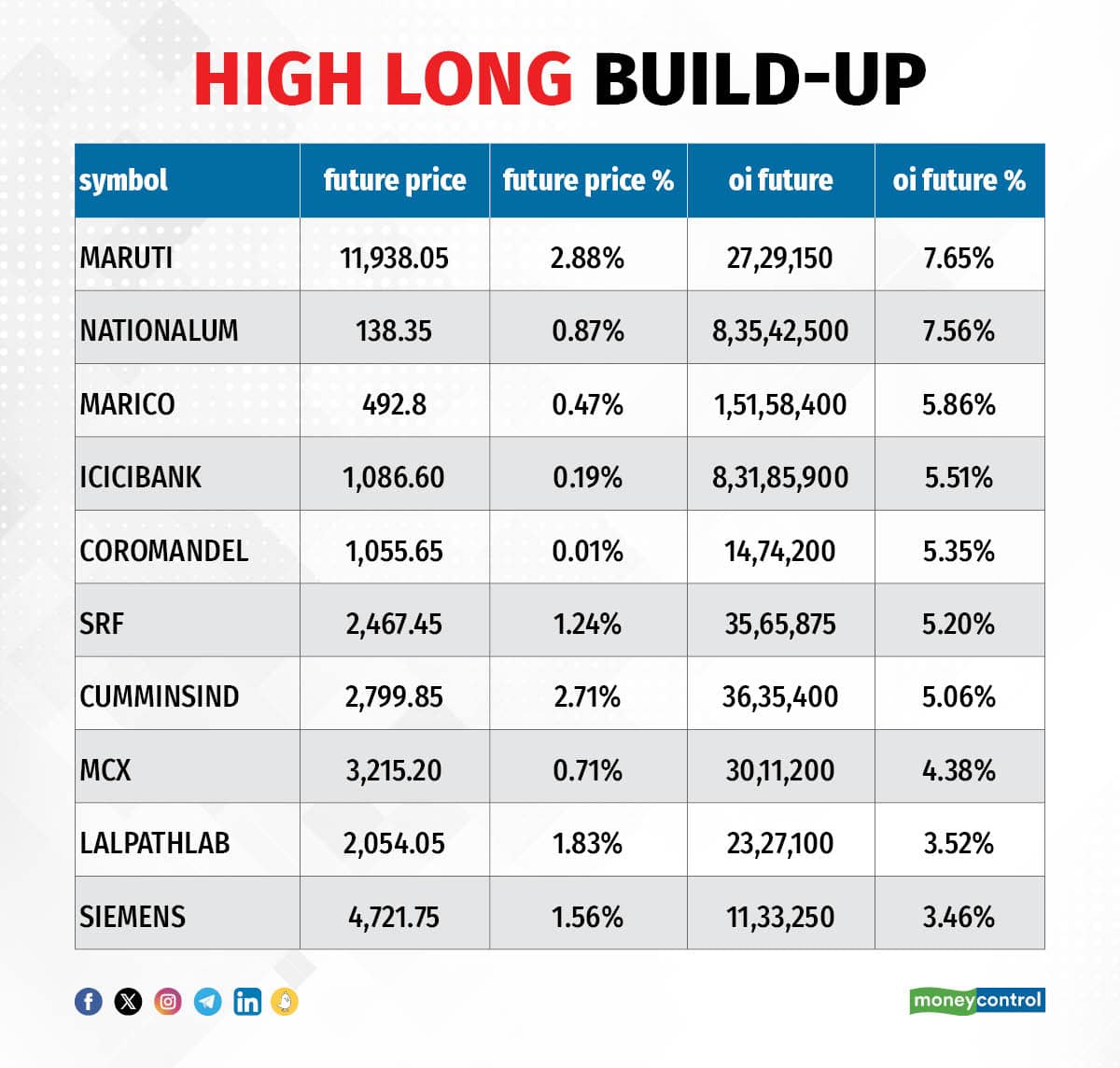

A long build-up was seen in 51 stocks, which were Maruti Suzuki India, National Aluminium Company, Marico, ICICI Bank, and Coromandel International. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 35 stocks saw long unwinding. These include Pidilite Industries, MRF, Mphasis, Balrampur Chini Mills, and Page Industries. A decline in OI and price indicates long unwinding.

52 stocks see a short build-up

A short build-up was seen in 52 stocks, including Tata Chemicals, Tata Steel, Hindustan Unilever, Bajaj Auto, and Hero MotoCorp. An increase in OI along with a fall in price points to a build-up of short positions.

46 stocks see a short covering

Based on the OI percentage, a total of 46 stocks were on the short-covering list. These included Indus Towers, Bajaj Finance, Hindustan Petroleum Corporation, Voltas, and Dalmia Bharat. A decrease in OI along with a price increase is an indication of short-covering.

Analysts and Investors Meeting

Prince Pipes and Fittings will be meeting analysts and investors on March 21.

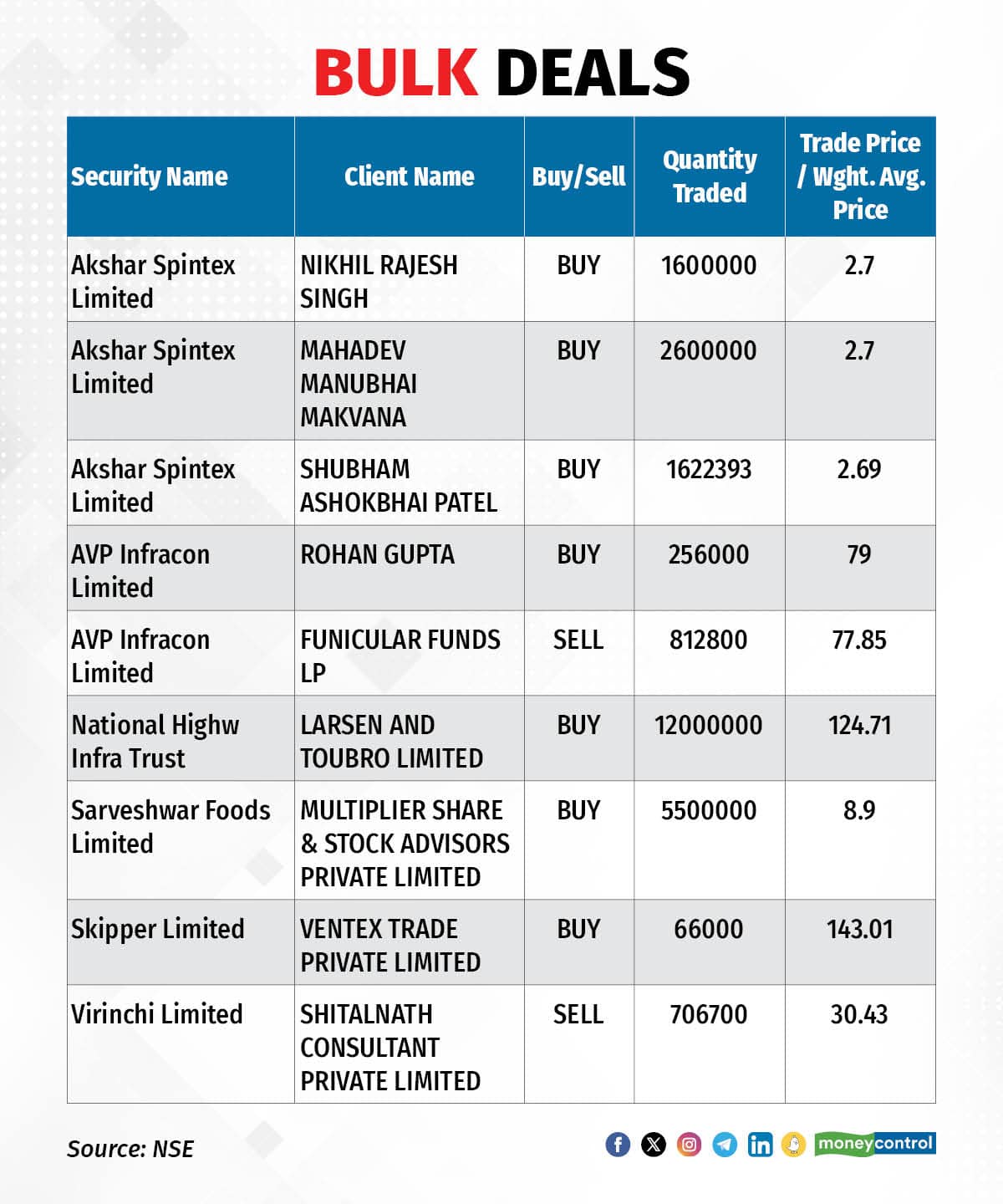

For more bulk deals, click here

Stocks in the news

Wipro: The technology services and consulting company said Anne-Marie (Annie) Rowland has been appointed as the Chief Executive Officer of Capco, with effect from April 1, 2024. Annie is currently Managing Partner of Capco’s business in the United Kingdom and Ireland and a member of Capco’s Global Leadership Team.

Krystal Integrated Services: The facilities management services provider is set to debut on the bourses on March 21. The final issue price has been fixed at Rs 715 per share. Experts expect the stock to debut with moderate gains.

Cyient: The IT services company said Infotech HAL has filed an application for initiation of the corporate insolvency resolution process under the Insolvency and Bankruptcy Code (IBC) before the National Company Law Tribunal, Bangalore. Infotech HAL is a 50:50 joint venture of Cyient Limited with HAL.

Rail Vikas Nigam: Rail Vikas Nigam has emerged as the lowest bidder for an electric traction system project worth Rs 167.28 crore of SER HQ-Electrical/South Eastern Railway.

Prince Pipes and Fittings: The piping solutions provider has signed an asset purchase agreement with Klaus Waren Fixtures, for the acquisition of the brand Aquel and plant in Bhuj, Gujarat, for Rs 55 crore.

Sasken Technologies: The company has invested Rs 33.20 crore for a 60 percent stake in Anups Silicon Services (ASSPL). With this investment, ASSPL will become a subsidiary of the company.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 2,599.19 crore, while domestic institutional investors (DIIs) bought Rs 2,667.52 crore worth of stocks on March 20, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Tata Chemicals to the F&O ban list for March 21, while retaining Balrampur Chini Mills, Biocon, Hindustan Copper, Indus Towers, Piramal Enterprises, RBL Bank, and Zee Entertainment Enterprises on the said list. BHEL and SAIL were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.