Range-bound trade continued for yet another session on August 26, the first day of September F&O series, and the benchmark indices closed with moderate gains despite mixed global trends ahead of US Federal Reserve Chair Jerome Powell speech at Jackson Hole.

For the Federal Reserve, the priority was to bring the inflation, which is at a 40-year high, down to 2 percent, Powell said, even though consumers and businesses would feel the economic pain.

The BSE Sensex rose 59 points to 58,834, while the Nifty was up 36 points at 17,559 and formed a bearish candle on the daily charts, as the closing was lower than opening levels.

"In the near-term, the index may remain directionless, confining its move between 17,726 and 17,482 levels," Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia said.

Some strength can be expected if it closes above 17,720 but weakness will be confirmed on a close below its 20-day simple moving average of 17,418.

The broader market maintained its upward trend. The Nifty midcap 100 index gained 0.55 percent and the smallcap 100 index rose 0.7 percent. Drop in volatility also supported the market, with India VIX falling 6.92 percent to 18.22 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given are the aggregates of three-month data and not of the current month only.

Key support, resistance levels on the Nifty

As per the pivot charts, the key support for the Nifty is at 17,490 followed by 17,421. If the index moves up, the key resistance levels to watch out for are 17,657 and 17,754.

The Nifty Bank gained 36 points to 38,987 and formed a bearish candle on the daily charts on August 26. The important pivot level, which will act as crucial support for the index, is 38,777 followed by 38,567. On the upside, key resistance levels are 39,267 and 39,547.

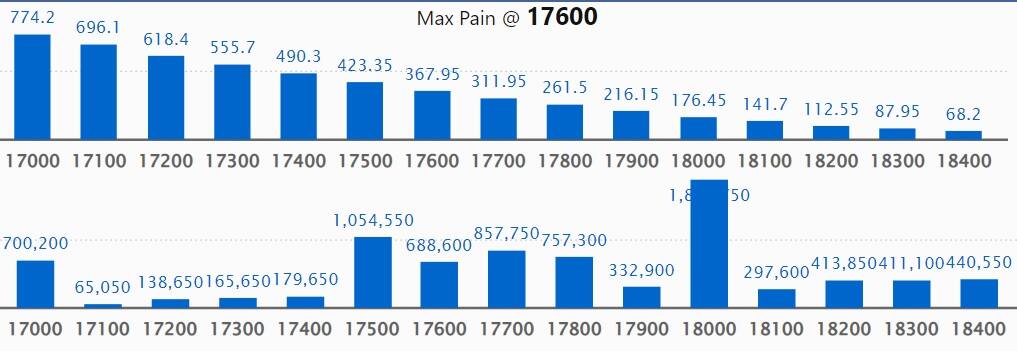

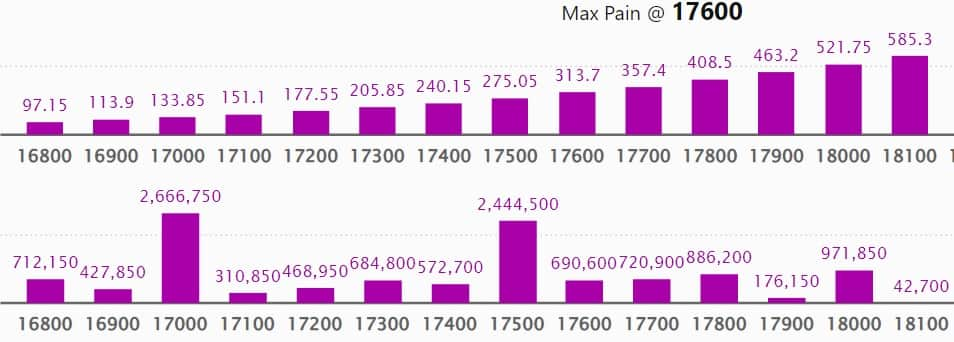

The maximum Call open interest of 18.92 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance in the September series.

This was followed by 18,500 strike, which holds 13.92 lakh contracts, and 17,500 strike, which accumulated 10.54 lakh contracts.

Call writing was seen at 18,700 strike, which added 2.75 lakh contracts followed by 18,300 strike, which added 1.42 lakh contracts, and 18,500 strike that added 1.32 lakh contracts.

Call unwinding was seen at 17,700 strike, which shed 88,150 contracts, followed by 17,500 strike, which shed 38,400 contracts, and 17,600 strike that shed 16,900 contracts.

The maximum Put open interest of 29.84 lakh contracts was seen at 16,500 strike, which will act as a crucial support in the September series.

This was followed by 17,000 strike, which holds 26.66 lakh contracts, and 17,500 strike, which accumulated 24.44 lakh contracts.

Put writing was seen at 17,500 strike, which added 2.1 lakh contracts, followed by 17,000 strike, which added 1.96 lakh contracts and 16,400 strike that added 1.38 lakh contracts.

Put unwinding was seen at 17,700 strike, which shed 58,200 contracts, followed by 17,800 strike that shed 34,700 contracts and 18,200 strike, which shed 18,450 contracts.

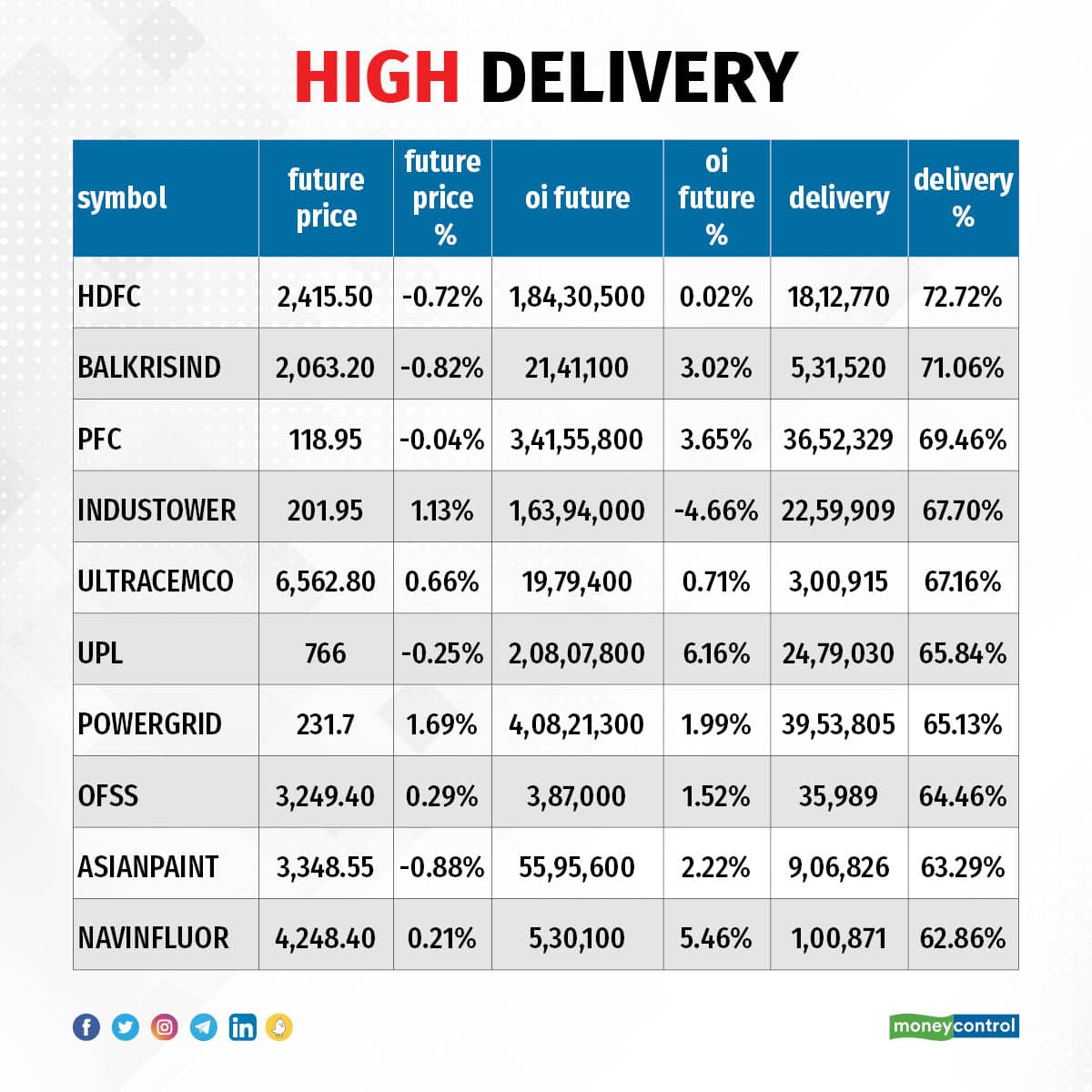

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in HDFC, Balkrishna Industries, PFC, Indus Towers, and UltraTech Cement among others.

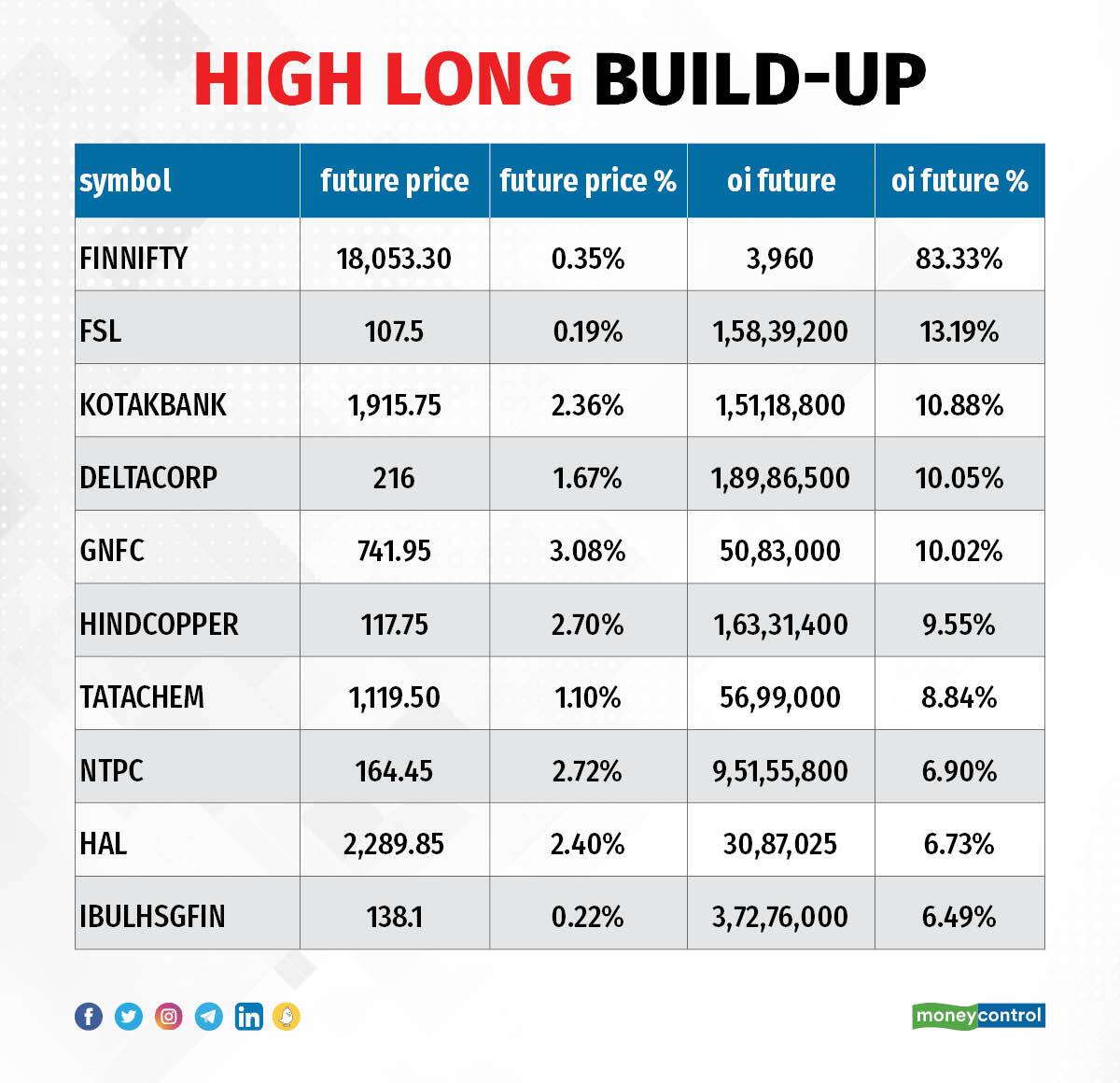

An increase in open interest, along with an increase in price, largely indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

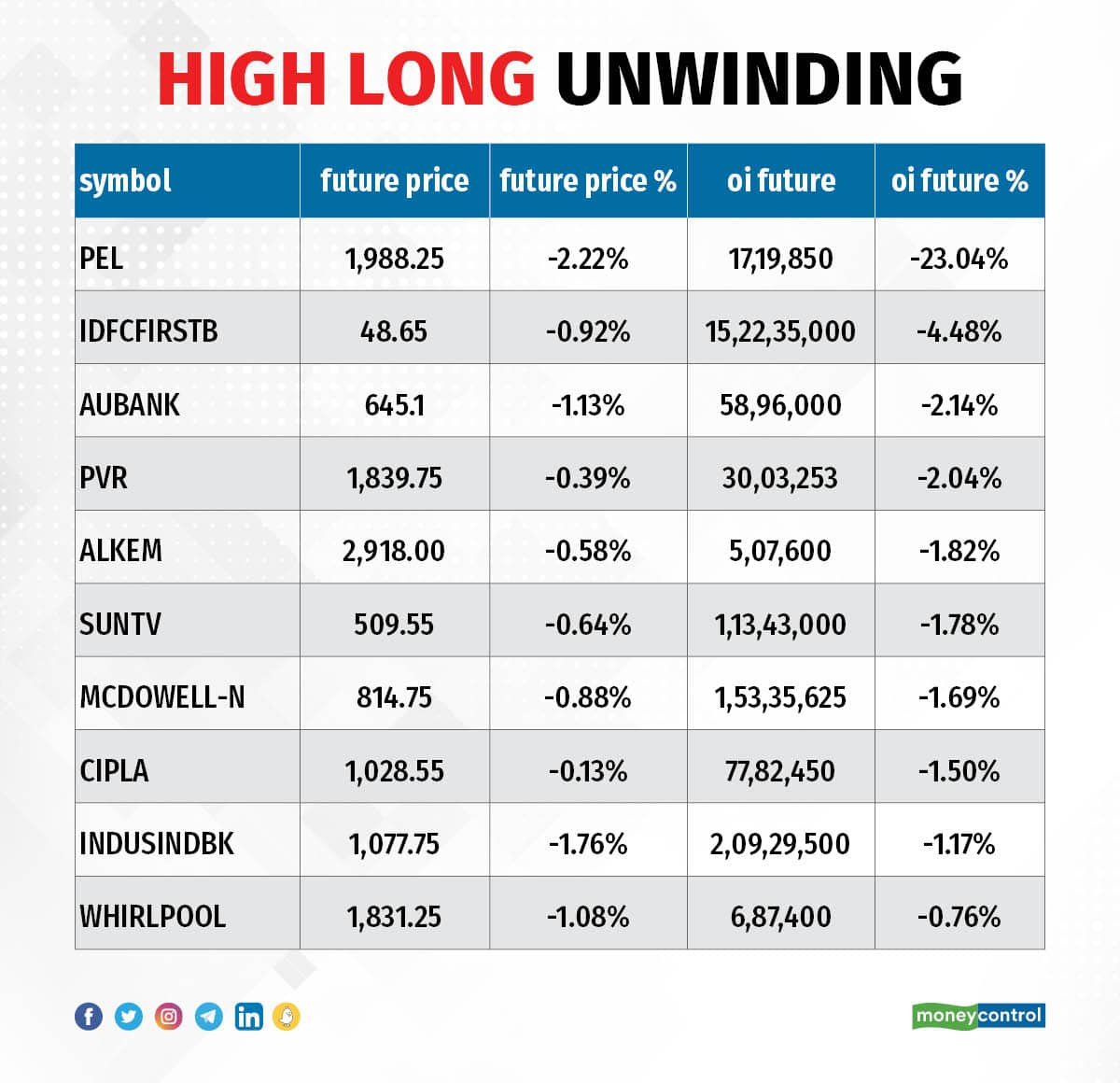

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

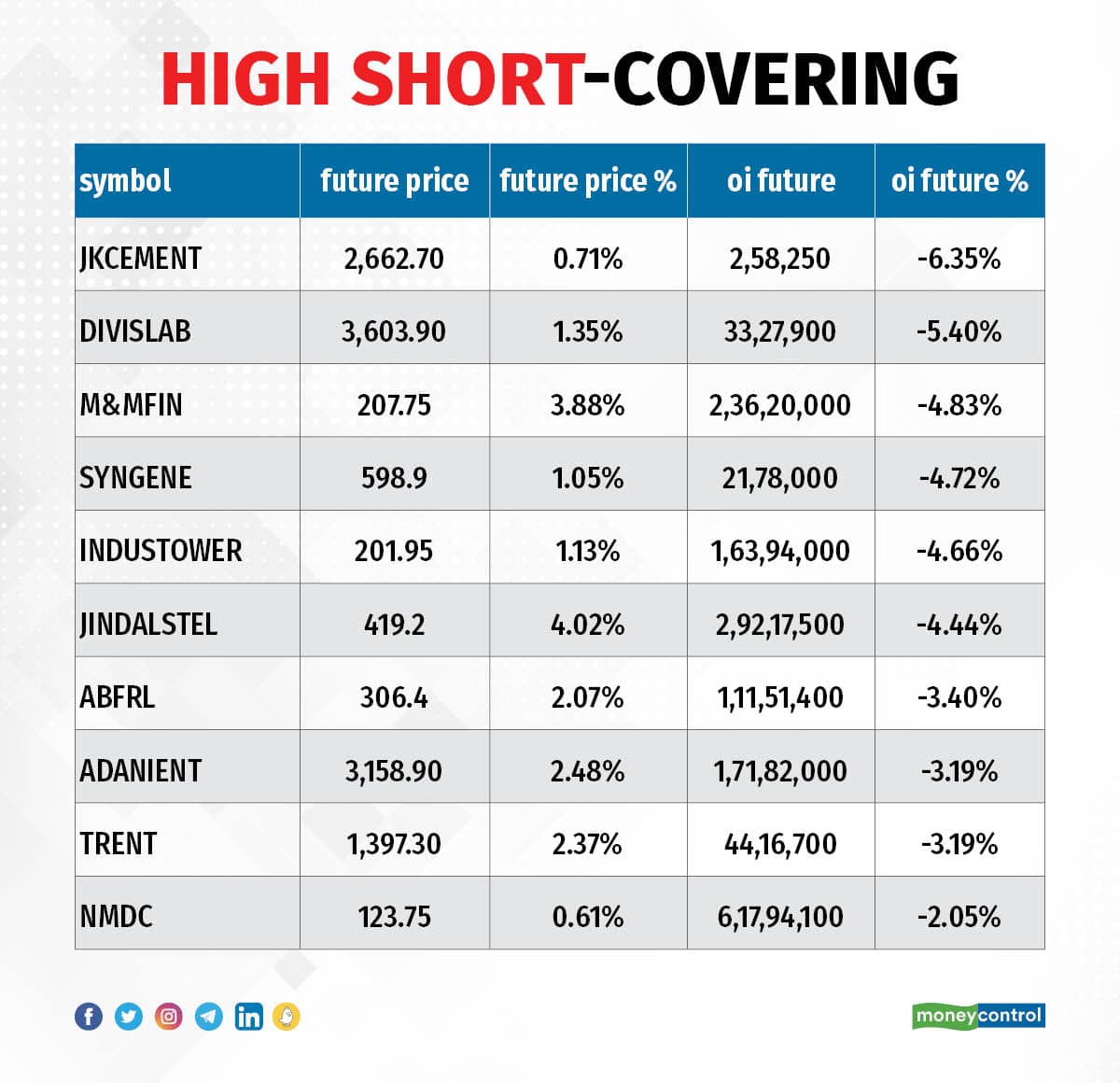

37 stocks witness short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

Orient Electric: PGIM India Mutual Fund sold 13,08,014 equity shares in the company through open market transactions. These shares were sold at an average price of Rs 261.79 a share.

Rolex Rings: PGIM India Midcap Opportunities Fund bought 2,63,433 equity shares in the company, PGIM India Small Cap Fund acquired 2,23,894 shares, Kotak Funds-India Midcap Fund purchased 4,31,679 shares, ICICI Prudential Life Insurance Company bought 3,52,941 shares, ICICI Prudential Flexicap Fund 1,86,246 shares, ICICI Prudential Bharat Consumption Fund purchased 1,65,369 shares, DSP Mutual Fund bought 3,82,352 shares, Canara Robeco Small Cap Fund 2,35,294 shares, Aditya Birla Sun Life Equity Hybrid 95 Fund bought 2,79,247 shares, and Aditya Birla Sun Life Equity Advantage Fund acquired 2,79,247 shares through open market transactions. These shares were bought by these funds at an average price of Rs 1,700 a share. Investor Rivendell PE LLC offloaded 34,14,423 shares at an average price of Rs 1,700.13 a share.

Sapphire Foods India: Edelweiss Finance and Investments sold 3,43,250 equity shares in the company at an average price of Rs 1,220.22 a share.

(For more bulk deals, click here)

Investors Meetings on August 29

UltraTech Cement: Officials of the company will meet Matthews International, and SBI Mutual Fund.

Ujjivan Small Finance Bank: Officials of the company will meet ICICI Prudential Mutual Fund, MK Ventures, Max Life Insurance, and Abakkus Asset Manager LLP.

Indian Energy Exchange: Officials of the company will meet Ward Ferry.

Hindustan Aeronautics: Officials of the company will participate in the business update conference call hosted by ICICI Securities.

Eicher Motors: Officials of the company will meet Ethos Investment, and Canara Robeco.

SRF: Management will be interacting with certain institutional investors and analysts.

Crompton Greaves Consumer Electrical: Officials of the company will attend CLSA India Consumer Durable Access Day.

Blue Star: Officials of the company will meet Aditya Birla Sun Life AMC and Veritas Asset Management LLP.

One 97 Communications: Officials of the company will meet institutional investors and analysts.

Ashiana Housing: Officials of the company will meet Emkay Global Financial Services.

Stocks in News

Reliance Industries: The 45th Annual General Meeting will start at 2 pm on August 29, with addresses and presentations expected from Chairman Mukesh Ambani and other members of the company’s board and subsidiaries. Analysts think this year, the focus may be on the consumer retail business once again.

Cipla: The company has now received six observations, with some referencing to the observations made during the September 2019 inspection, for its Goa plant. There are no data integrity (DI) observations. The USFDA inspected company's Goa plant during August 16-26. The US health regulator inspected the facility in September 2019 and issued a warning letter in February 2020.

Syngene International: The company has entered into an agreement for the acquisition of renewable power by acquiring up to 26 percent equity stake in O2 Renewable Energy II Private Limited. O2 Renewable Energy II Private Limited is the special purpose vehicle formed by O2 Energy SG Pte Ltd for the generation and the supply of renewable power.

NHPC: NHPC and the Himachal Pradesh Government signed an implementation agreement for Dugar HE project. Both the parties signed a memorandum of understanding in September 2019 for the execution of the project.

Jubilant Pharmova: Subsidiary Jubilant Draximage Inc has received the Establishment Inspection Report (EIR) with voluntary action indicated (VAI) status from the USFDA for its radiopharmaceuticals manufacturing facility in Montreal, Canada. The USFDA had conducted an inspection from June 6 to June 10. With the receipt of the EIR, the inspection stands successfully closed.

RITES: The company has secured a new order with JV partner for the redevelopment of the Kollam railway station for Rs 361.18 crore from Southern Railways. The share of RITES in the order is 51 percent.

UltraTech Cement: As part of its ongoing expansion plan, the company has commissioned cement capacity of 1.3 mtpa at Dalla Cement Works, Uttar Pradesh, which resulted in increase in the unit's capacity to 1.8 mtpa. This is the first phase of capacity expansion announced in December 2020. With this commissioning, the company’s total cement manufacturing capacity in India now stands at 115.85 mtpa.

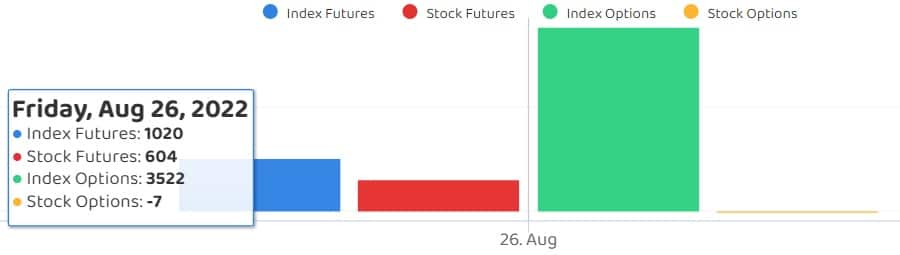

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 51.12 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 453.59 crore on August 26, as per the provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the September series, there is no stock on in F&O ban list for August 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.