The bears maintained their stronghold on the markets for the sixth consecutive week that ended on March 27.

It made some recovery after the Rs 1.7 lakh crore welfare package announced by the Finance Ministry and the Rs 3.7 lakh crore liquidity stimulus package from the Reserve Bank of India (RBI) soothed sentiment.

However, benchmark indices underperformed their global peers as investors remained cautious over growth after a 21-day nationwide lockdown was announced earlier in the week to stop the spread of COVID-19.

While the BSE Sensex was down 100.37 points at 29,815.59, the Nifty50 dropped 85.20 points to 8,660.25. The carnage was much worse in the broader markets as the Nifty Midcap and Smallcap indices plunged 7-8 percent.

"The recent bounce was expected given that markets were deeply sold into virus fear. However, we expect the bounce to be approximately 38-50 percent of the fall in the next two-three weeks," Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote told Moneycontrol.

We have collated 14 data points to help you spot profitable trades:

Note: The OI and volume data of stocks given in this story are the aggregates of the three-months data and not of the current month only.

Key support and resistance level for Nifty

According to the pivot charts, the key support level is placed at 8,442.47, followed by 8,224.68. If the index moves upward, key resistance levels to watch out for are 8,958.47 and 9,256.68.

Nifty Bank

The Nifty Bank index closed at 19,969. The important pivot level, which will act as crucial support for the index, is placed at 19,211.93 followed by 18,454.87. On the upside, key resistance levels are placed at 21,094.23 and 22,219.47.

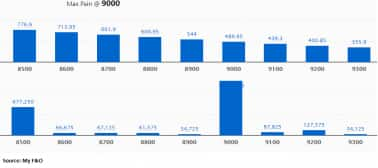

Call options data

Maximum Call Open Interest (OI) of 12.99 lakh contracts was seen at the 9,000 strike price. It will act as a crucial resistance level for the April series.

This is followed by 8,000 strike price, which now holds 6.84 lakh contracts in open interest, and 8,500, which has accumulated 6.77 lakh contracts in open interest.

Call writing was seen at the 9,000 strike price, which added 51,600 contracts, followed by 9,100 strike price, which added 27,675 lakh contracts.

Minor Call Unwinding was seen at 8,900 strike price, which shed 8,475 contracts, followed by 8,800 strike, which shed 5,550 lakh contracts.

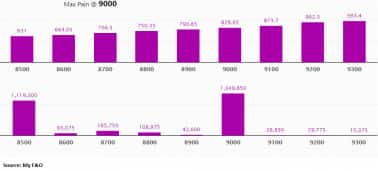

Put options data

Maximum Put Open Interest of 16.83 lakh contracts was seen at 8,000 strike price, which will act as crucial support in the April series.

This is followed by 9,000 strike price, which now holds 13.49 lakh contracts in Open Interest, and 8,500 strike price, which has accumulated 11.19 lakh contracts in open interest.

Put writing was seen at the 8,500 strike price, which added 72,225 contracts, followed by 8,800 strike, which added 53,700 contracts.

Put unwinding was seen at the 9,000 strike price, which shed 76,725 contracts.

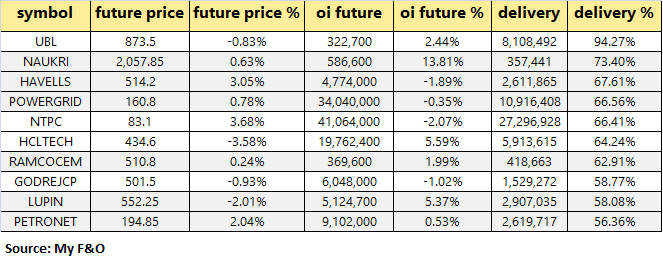

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are accepting delivery of the stock, which means they are bullish on it.

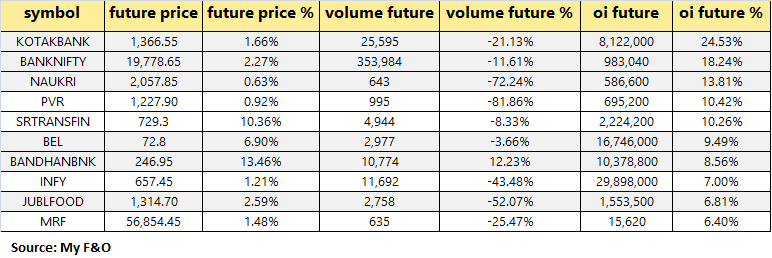

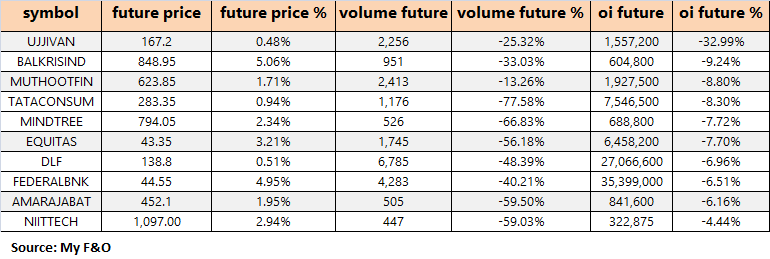

30 stocks saw a long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

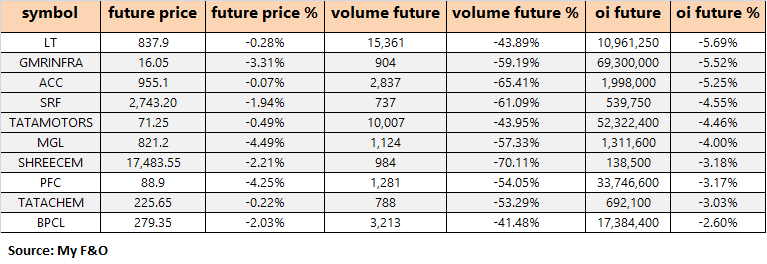

30 stocks saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

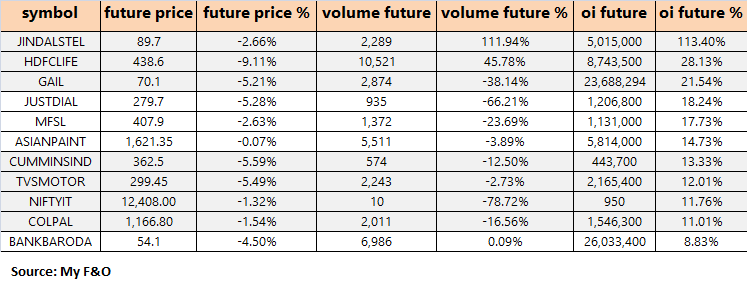

53 stocks saw a short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

32 stocks saw short-covering

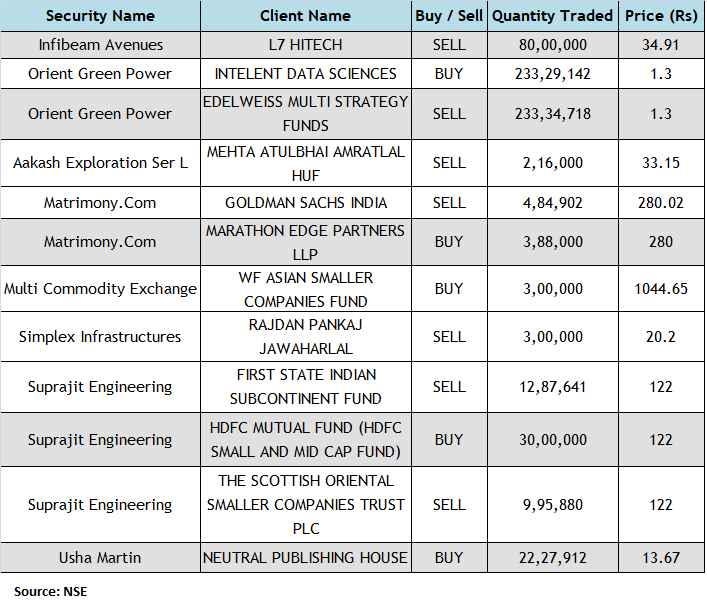

Bulk deals

(For more bulk deals, click here)

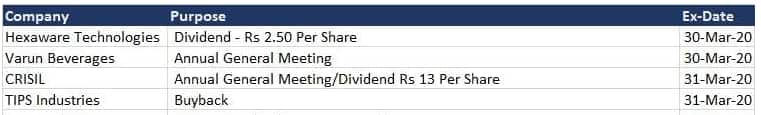

Board meetings/Corporate action

Stocks in news

Sun Pharma: Company's Halol facility classified as official action indicates. Halol plant was inspected from Dec 3-13 and issued 8 observations

Syndicate Bank branches to operate as Canara Bank branches from April 1

Andhra Bank and Corporation Bank branches to operate as Union Bank branches from April 1

Allahabad Bank branches to operate as Indian Bank branches from April 1

OBC and United Bank of India branches to operate PNB branches from April 1

Abbott India: Receives approval for the test that can detect coronavirus in 5 minutes. Company will begin making said tests available to healthcare providers next week

SpiceJet, Interblobe Aviation: Aviation Ministry allows the use of passenger aircraft for cargo movement. IndiGo, GoAir have expressed interest in cargo movement

State Bank of India: Passes on entire 75 bps repo rate cut to its borrowers

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 355.78 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 1,703.72 crore in the Indian equity market on March 27, provisional data available on the NSE showed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.