Given the strong rebound after the fall in the previous two sessions, the bulls seem to be still in a healthy position and may help the Nifty50 march towards its 21,800-21,850 area in coming sessions as the index strongly held on to 21,500 as a support and if the said hurdle gets surpassed then psychological 22,000 mark can't be ruled out, experts said.

On January 4, the BSE Sensex jumped 491 points to 71,848, while the Nifty 50 climbed 141 points to 21,659, and formed a small bullish candlestick pattern on the daily timeframe.

"A small positive candle was formed on the daily chart, which is placed within a high-low range of Wednesday's bear candle. Technically, this could be considered a bullish Inside Day-type candle pattern. Hence, more upside in the next session is likely to confirm this bullish pattern," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels the short-term trend of Nifty seems to have reversed on the upside after two sessions of minor weakness. "Nifty sustaining above 21,550-21,600 levels could open the next upside towards 21,850-21,900 levels and higher in the near term. Immediate support is at 21,550," he said.

Considering the overall chart structure, Vidnyan Sawant, HOD - Research at GEPL Capital also maintains a bullish stance with specific targets set at 21,834 (the record high between 21,800-21,850) and 22,000 for the short to medium term. This analysis suggests a positive trajectory for the index, indicating a likelihood of sustained gains in the near term, he said.

The Nifty Midcap 100 and Smallcap 100 indices performed better than benchmarks after consolidation, rising 1.7 percent and 1 percent, respectively on positive breadth, while the declining volatility also supported bulls as the fear index India VIX fell 5.44 percent to 13.33 levels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,670 followed by 21,711 and 21,757 levels, while on the lower side, it can take support at 21,590 followed by 21,561 and 21,515 levels.

On January 4, the Bank Nifty snapped four-day losses and bounced back sharply above the 48,000 mark. The index jumped 491 points to 48,196 and formed a long bullish candlestick pattern on the daily timeframe.

Bank Nifty has held on to the support of the 20-day moving average (47,920) and started the next leg of up move. "Until 48,000 is not breached on the downside we can expect the rally to continue. On the upside, we expect 49,500 from a short-term perspective," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at the 48,246 level followed by 48,407 and 48,615 levels, while on the lower side, it may take support at 47,864 followed by 47,736 and 47,529 levels.

According to the weekly options data, the 21,900 strike owned the maximum Call open interest with 1.77 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,700 strike, which had 1.47 crore contracts, while the 21,800 strike had 1.09 crore contracts.

Meaningful Call writing was seen at the 21,900 strike, which added 89.48 lakh contracts followed by 21,700 and 22,200 strikes adding 8.95 lakh and 5.89 lakh contracts, respectively.

The maximum Call unwinding was at the 21,600 strike, which shed 66.76 lakh contracts followed by 21,500 and 22,000 strikes that shed 51.87 lakh and 40.44 lakh contracts.

On the Put front, the maximum open interest was seen at 21,600 strike, which can act as a key support area for the Nifty with 2.07 crore contracts. It was followed by 21,000 strike comprising 1.018 crore contracts and then 21,500 strike with 1.014 crore contracts.

Meaningful Put writing was at 21,600 strike, which added 1.72 crore contracts followed by 21,300 strike and 21,100 strike adding 20.75 lakh contracts and 18.66 lakh contracts, respectively.

The Put unwinding was seen at 21,800 strike, which shed 11.77 lakh contracts followed by 20,800 strike, which shed 6.68 lakh contracts and then at 21,900 strike, which shed 6.03 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Prudential Life Insurance Company, ICICI Bank, Maruti Suzuki India, Tata Consultancy Services and Max Financial Services saw the highest delivery among the F&O stocks.

A long build-up was seen in 75 stocks, which included Alkem Laboratories, India Cements, L&T Technology Services, Abbott India and GNFC. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 14 stocks saw long unwinding, including Lupin, Delta Corp, UltraTech Cement, Cipla and Hindustan Petroleum Corporation. A decline in OI and price indicates long unwinding.

33 stocks see a short build-up

A short build-up was seen in 33 stocks including Escorts Kubota, LTIMindtree, Navin Fluorine International, PVR INOX and Chambal Fertilisers & Chemicals. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 65 stocks were on the short-covering list. This included ONGC, National Aluminium Company, Federal Bank, GMR Airports Infrastructure and Godrej Consumer Products. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, climbed above the 1 mark, rising to 1.22 on January 4, from 0.77 levels in the previous session. The above 1 PCR indicates that the traders are buying more Puts options than Calls, which generally indicates an increase in bearish sentiment.

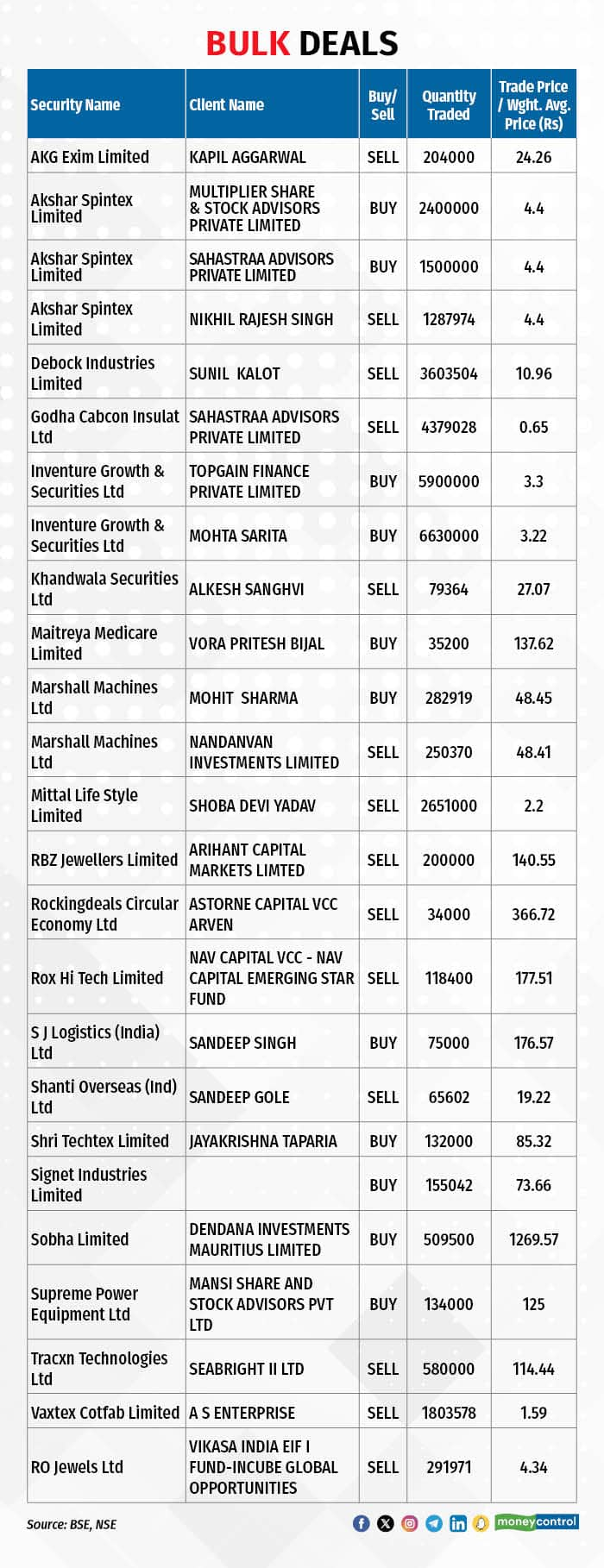

For more bulk deals, click here

Stocks in the news

Grasim Industries: The Aditya Birla Group company has received approval from the Board of Directors for the rights issue worth Rs 3,999.80 crore and set the issue price at Rs 1,812 per share. The rights issue will open between January 17 and January 29.

RBL Bank: The private sector lender has registered a 13 percent on-year growth in total deposits at Rs 92,743 crore for the quarter ended December FY24, with retail LCR deposits growing 16 percent YoY to Rs 41,209 crore. Gross advances grew by 20 percent YoY to Rs 81,870 crore with retail advances rising 32 percent YoY and wholesale advances 6 percent YoY during the quarter.

Dabur India: The consolidated revenue is expected to register mid to high single-digit growth during Q3 FY24. In Indian business, the food and beverages (F&B) segment is expected to grow in the high-single digits and home & personal care (HPC) is expected to record growth in the mid-single digits, while the international business is expected to register double-digit growth in constant currency terms, led by good momentum in MENA region.

L&T Finance Holdings: The retail disbursements for Q3FY24 are estimated at around Rs 14,500 crore, a growth of 25 percent on a YoY basis, while the retail loan book at the end of Q3FY24 is estimated at Rs 74,750 crore, growing 31 percent YoY. Realisation of the portfolio is estimated at 91 percent at the end of Q3FY24.

Lupin: The global pharma major has received tentative approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application for Dapagliflozin and Saxagliptin tablets, which are available in 5 mg/5 mg and 10 mg/5 mg strengths, to market a generic equivalent of Qtern tablets of AstraZeneca AB.

Utkarsh Small Finance Bank: The small finance bank has recorded a 30.8 percent on-year growth (up 10.2 percent QoQ) in the gross loan portfolio at Rs 16,408 crore for the quarter ended December FY24, while total deposits increased by 17.6 percent YoY and 8.2 percent QoQ to Rs 15,111 crore during the quarter.

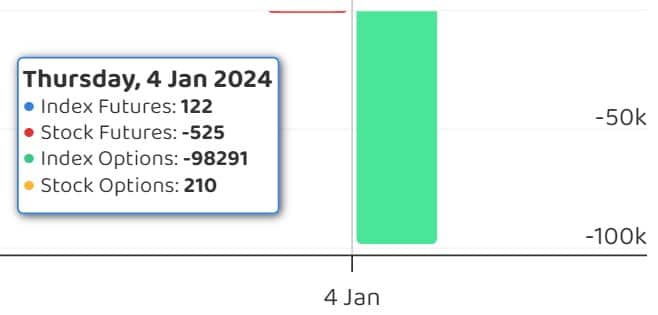

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) bought shares worth Rs 1,513.41 crore, while domestic institutional investors (DIIs) sold Rs 1,387.36 crore worth of stocks on January 4, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Chambal Fertilisers & Chemicals, Escorts Kubota, GNFC (Gujarat Narmada Valley Fertilisers & Chemicals) and India Cements to its F&O ban list for January 5, while retaining Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indian Energy Exchange, National Aluminium Company, SAIL and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.