The benchmark indices might have hit fresh record highs but investor wealth was eroded in the small & midcap space in 2019. The S&P BSE Sensex rose over 14 percent in 2019 while the S&P BSE Midcap and Smallcap indices fell 3 percent and 6.85 percent, respectively, in the same period.

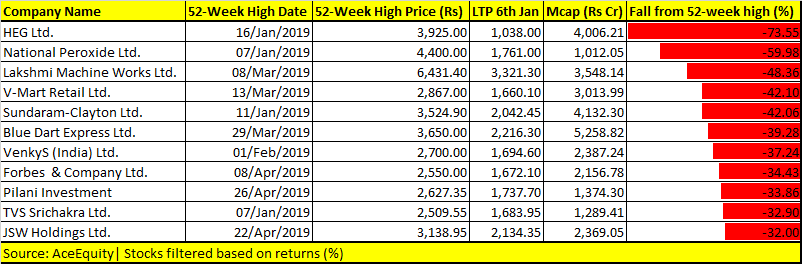

There are 11 stocks (with price band above Rs 2,500) that have fallen more than 30 percent from their 52-week high. The list includes HEG, National Peroxide, Lakshmi Machine, V-Mart, Pilani Investment and JSW Holdings.

Small & midcaps consolidated in the last two years after a blockbuster year in 2017 when the broader market indices delivered up to 60 percent return. Experts feel 2020 could be a year that could see small & midcaps regaining some of its mojo back.

But, not all stocks that have fallen are buy on dips, say experts.

Mid and smallcap names have corrected due to varied reasons. Some of them could be linked to the global slowdown, trade concerns, while others are inclined more on the domestic economy.

“For instance, HEG as well as for Graphite India, the global slowdown has affected their businesses with the double impact of a decline in graphite electrode prices and increase in raw materials,” Paras Bothra, President of Equity Research, Ashika Stock Broking told Moneycontrol.

“The slowdown in the auto industry has taken a toll on auto ancillaries like TVS Srichakra, Sundaram Clayton. Some of the other players like Lakshmi Machine works have been affected due to trouble at the domestic textile industry not resulting in enough demand for its machines,” he said.

Experts feel that among the stocks mentioned in the chart, HEG, National Peroxide and Lakshmi Machine Works are good bets and investors can start accumulating them at current levels.

Expert: Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor

The recent capacity expansion by HEG Ltd is likely to boost the investor sentiments, at the current level of the stock till around 1000 to 1050 one can start accumulating for with a time horizon of 6-9 months with an upside potential of 15-20%.

For this stock, we believe that anti-dumping duty on imports from six countries gives the company a shield from cheap imports. One can invest with a target of 2100.

This stock too is a good bet at the current level with a target of 3900. The consistent robust performance of the Machinery Tool segment gives an edge to the company.

For stocks like V-Mart Retail Ltd, Blue Dart Express Ltd, Forbes & Company Ltd, Pilani Investments & Industries Corporation Ltd, TVS Srichakra Ltd, JSW Holding Ltd, and Oracle Financial Services Software Ltd we would suggest avoid buying.

Factors to watch:

Correction in stocks from 52-week highs does not necessarily imply that it has become attractive or it is now available at fair valuations. Investors should do their own study before pressing a buy or sell button.

It is extremely important to study the business model of the company individually. The correction in stock could be a fall out of low demand either due to slowdown in the domestic economy or global, suggest experts.

“Assessing the root cause of stock price correction is important before considering it as an attractive investment. Some of the sectors, like the auto sector, is passing through disruption of upgradation in emission norms for internal combustion engines and adoption of electric vehicles,” says Bothra of Ashika Stock Broking.

“Similarly, the adoption of digital & artificial intelligence has disrupted/affected old economy business models in the consumption space. Thus, it is important to study case by case basis individually,” he said.

Gaurav Garg of CapitalVia Global Research Limited highlights 5 qualitative factors which one should study apart from financial statements:

Peer Analysis:

Peer comparison is one of the most accepted equity analysis methods. It is a very good and quick tool to compare the overvalued and undervalued stocks of a particular sector. In the industry, we must select leaders over the laggards.

Competitive Advantage:

We should look for companies that have a competitive advantage over their rivals. When a firm produces goods or services efficiently at a lower cost than its peers which leads to greater profit margins, it is known as competitive Advantage.

On the other hand, when the products or services of a firm are of higher quality than those of its competitors, it is known to be Differential Advantage. Competitive Advantage is a strength of the firm which helps to generate greater values.

Seasonality of Business:

During a particular season, there are regular periodic fluctuations in certain business cycles. While analyzing a company it is essential to look for the presence of seasonality in its business because a company may have higher gains during peak seasons while may make significant losses during off-seasons.

If this factor is not considered, then one may buy or sell the stock at a wrong time without considering the seasonal effect.

Market Direction:

We must keep an eye on the daily market movement because it gives us an idea of stock’s trend, buyers’ and sellers’ sentiments, momentum and expected future performance.

News Events:

Any headline news regarding new products, new management or new events in a company may create short-term excitement and lead to significant price movement in the stock.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.