Continuing with the classic chart patterns, we will be discussing Head and Shoulder pattern. As the name suggests the pattern has the shape of a head and two shoulders. It can act as a reversal or continuation pattern depending on the trend prior to its formation and the type of the Head and Shoulders pattern.

Head and Shoulder pattern is a bearish reversal pattern while Inverse Head and Shoulder is a bullish reversal pattern.

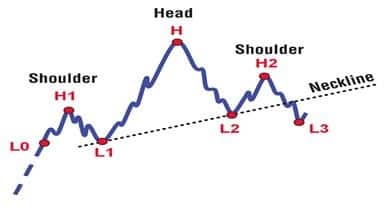

Head and Shoulder PatternA head and shoulders pattern is a chart formation that resembles a baseline with three peaks, first and third peaks are shoulders and the second peak forms the head. It comprises three component parts, i.e., after a long bullish trend, the price rises to a peak and subsequently declines to form a trough.

After that, the price rises again to form a second high substantially above the initial peak and declines again. Finally, the price rises a third time but only to the level of the first peak before declining once more. However, Head and Shoulder pattern is one of the most reliable trend reversal patterns.

Inverse Head and Shoulder Pattern

Inverse Head and Shoulder Pattern

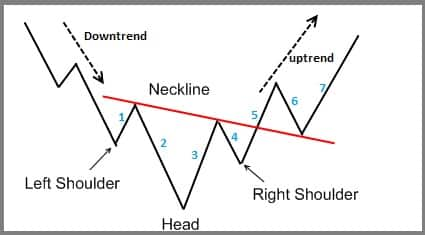

The Inverse head and shoulders pattern works as a reversal pattern that signals the end of a downtrend. As the price progresses downward, it hits a low point and then pulls back to the upside. The price then drops to a lower low and pulls back again.

When the price drops again, it's unable to reach the prior low, thereby creating a higher low before rallying again. This movement creates three troughs, or low points, called the left shoulder, head, and right shoulder. A move above the resistance, also known as the neckline, is used as a signal of a sharp move higher.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.