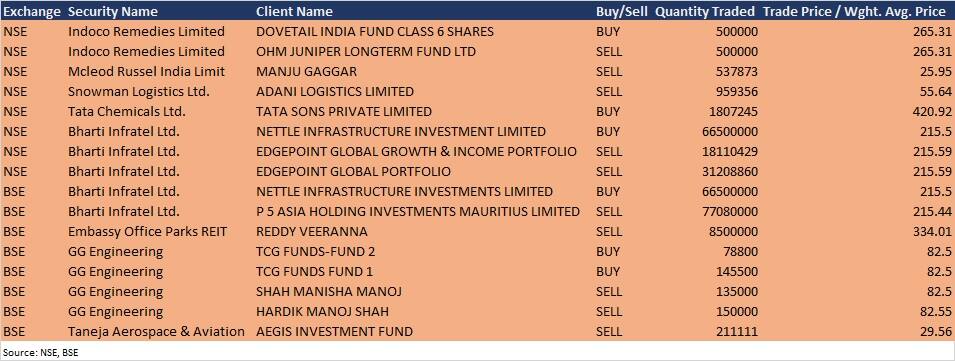

Promoter Tata Sons on December 2 acquired 0.7 percent equity stake in Tata Chemicals via open market transaction.

Tata Sons bought 18,07,245 equity shares in Tata Chemicals at Rs 420.92 per share on the National Stock Exchange (NSE), as per the bulk deals data available on exchanges.

Among other deals, Adani Logistics sold further 9,59,356 equity shares in Snowman Logistics (reprsenting 0.57 percent of total paid up equity) at Rs 55.64 per share on the NSE.

Adani Logistics, which held 26 percent equity stake in the company as of September 2020, sold 1.9 percent equity stake in Snowman in three consecutive sessions via open market transactions.

Bharti Airtel's subsidiary Nettle Infrastructure Investment acquired around 4.94 percent equity stake in Bharti Infratel via open market transactions.

Nettle bought one lot each of 6.65 crore equity shares in the company on the BSE and the NSE at Rs 215.5 per share.

"The acquisition of the equity shares of Bharti lnfratel Limited has been done at an aggregate consideration of around Rs 2,882.32 crore," said Bharti Airtel in its BSE filing.

With this acquisition by Nettle, the aggregate shareholding of Bharti Airtel and Nettle stands increased to 41.66 percent in Infratel, it added.

However, public shareholder Edgepoint Global Growth & Income Portfolio sold 1,81,10,429 equity shares in Bharti Infratel at Rs 215.59 per share and Edgepoint Global Portfolio 3,12,08,860 equity shares at the same price on the NSE, while P 5 Asia Holding Investments Mauritius sold 7,70,80,000 equity shares at Rs 215.44 per share on the BSE.

Dovetail India Fund Class 6 Shares bought 5 lakh shares in Indoco Remedies at Rs 265.31 per share on the NSE. However, OHM Juniper Longterm Fund was the seller for those shares at the same price.

Public shareholder Manju Gaggar sold 5,37,873 equity shares in Mcleod Russel India at Rs 25.95 per share on the NSE.

TCG Funds-Fund 2 acquired 78,800 equity shares and TCG Funds Fund 1 bought 1,45,500 equity shares of in GG Engineering at Rs 82.5 per share on the BSE. However, Shah Manisha Manoj sold 1.35 lakh shares at Rs 82.5 per share and Hardik Manoj Shah sold 1.5 lakh shares at Rs 82.55 per share.

Aegis Investment Fund sold 2,11,111 shares of Taneja Aerospace & Aviation at Rs 29.56 per share on the BSE, while Reddy Veeranna sold 85 lakh units of Embassy Office Parks REIT at Rs 334.01 per share on the BSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.