Shubham Agarwal

Lazy first week of the December expiry for Nifty as the market stalled almost the same as last expiry. There was a drop in the indices both Nifty and Bank Nifty but not too much. Nifty lost half a percentage point for the week, while Bank Nifty lost little over a percent for the week.

On the OI front, the indices had a bit of a mismatch as Nifty added small amount of long in the first half of the week, while added small amount of short in the second half. So, net 4 percent increment in OI was more or less indecisive. On the other hand, Bank Nifty lost open interest for the week owing to unwinding of long interest.

On the stock futures front, the aggregate open interest did see net additions. It did not come as a surprise considering the previous week expiry saw reduction in OI and this week being the first week of a new series.

Typical first week built-up where the unwinding was missing as an aggregate sector OI activity. Bargain hunting in many metal stocks like Hindalco Industries and National Aluminum Company pushed the metal sector in longs. Unusual longs in stocks like Bharat Electronics pushed longs in Capital Goods, while ACC, Ramco Cements pushed cement into longs. Sun TV pushed media into deep shorts, apart from which there were none of the sectors that added meaningful shorts.

Longs were seen in many short rolling stocks, which could be just another attempt to bargain hunt. Stocks like M&M Financial in this drive have come up to their heaviest Calls, hence one should be careful in holding on to the positions.

Weaker sectors once again are topping the charts with short candidates Bajaj Auto and Sun TV, one again proving that whichever the market set-up is it is always prudent to follow long cycles.

Sentimentally though, things went a little on the pessimistic side, as though the week the OI PCR kept hovering around recent lower levels and settled amid last session weakness at 1.37.

This is not comforting as the index still within kissing distance of the highest levels yet we are relatively lower in terms of OI PCR. Similarly, India VIX is also picking up the pace without any big movement in the index. This comes as a surprise since the event of Budget falls outside of the expiry, which advocates prudence.

Weekly congestion and monthly series equal congestion (both call and put) in Nifty signify support in 12,200 on the lower side, while there is no strong immediate hurdle on the higher side.

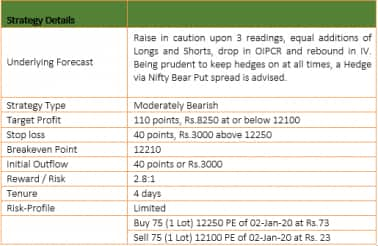

After a long time Bank Nifty OI PCR for weekly series is lower than 1. 32000 is congestion on the lower levels in weekly series, while 31500 is similar level to be reckoned with on the monthly series. Raise in caution upon 3 readings, equal additions of Longs and Shorts, drop in OI PCR and rebound in IV.

Being prudent to keep hedges on at all times, a Hedge via Nifty Bear Put spread is advised.

Bear Put Spread is a moderately bearish strategy. The strategy is built by buying a Put close to the current market price of the underlying and selling same expiry Put but of a strike lower than the Put bought. The sold Put strike would be limit the profit but fund the put buying. Profits are limited to difference between strikes minus the net premium paid.

(The author is CEO & Head of Research at Quantsapp)

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.