December 29, 2023 / 16:02 IST

We wrap up today's edition of the Moneycontrol live market blog, and will be back Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

December 29, 2023 / 16:01 IST

NSE Indian Indices Performance

December 29, 2023 / 15:50 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

The Indian Rupee appreciated slightly on Friday on weak US Dollar and a decline in crude oil prices. FII inflows also supported Rupee. However, weak domestic markets capped sharp gains. The US Dollar recovered slightly on short coverings but declined again today on rate cuts bets. Rising weekly jobless claims also signalled a slowdown in the labour market.

We expect the Rupee to trade with a slight positive bias on the weak tone of the US Dollar and declining crude oil prices. Fresh foreign inflows may also support the domestic currency. However, the weak tone in domestic markets caps a sharp upside. Month-end Dollar demand from OMCs and importers may weigh on the rupee at higher levels. Traders may take cues from India’s fiscal deficit and Chicago PMI data from the US. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.50.

December 29, 2023 / 15:48 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets took a breather on the final trading session of the calendar year and settled with a modest cut. After the initial downtick, the Nifty oscillated in a narrow range and finally closed at 21,731.40 levels. Meanwhile, a mixed trend on the sectoral front kept the participants busy wherein auto and FMCG edged higher while energy, IT and banking witnessed some profit taking. Besides, the buoyancy on the broader front further eased the pressure.

We may see further consolidation in the index and it would be healthy after the recent surge. We expect Nifty to hold the 21,300-21,500 zone in case of a dip during consolidation and reiterate our positional target of 22,150 level. Participants should stay focused on the selection of stocks and prefer index majors.

December 29, 2023 / 15:47 IST

December 29, 2023 / 15:44 IST

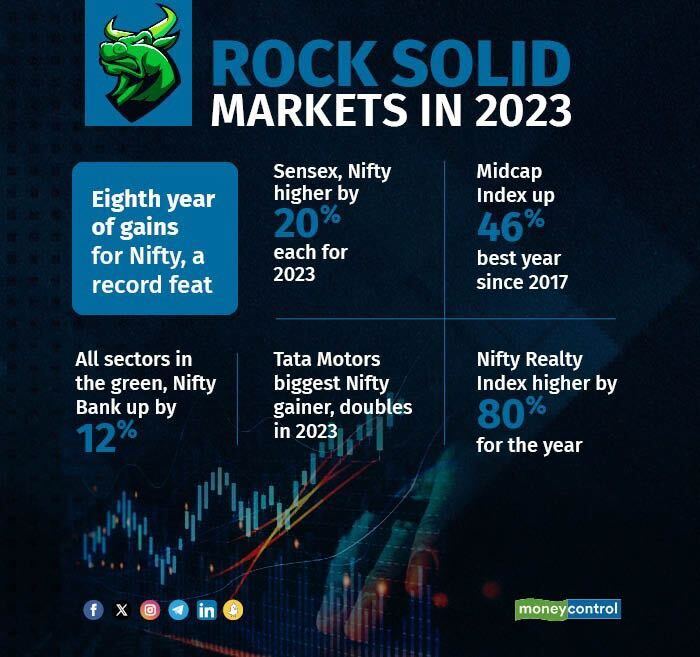

Dhiraj Relli, MD & CEO at HDFC Securities

2023 has been a great year for our markets – for both the frontline indices and the broader markets. It once again showed the impact of Retail/HNI buying and when the FPIs also turned buyers there was no going back. In 2024, we are beginning on a high base and hence it may be difficult to expect a similar performance by the time 2024 ends. However, the resurgence of FPI buying and placement of India as an attractive market, despite the seeming high valuations, may help our markets register some more gains in the early part of the year. Later we may have bouts of volatility due to elections, timing and quantum of rate cuts, and valuation concerns. The retail Indian has truly woken up and will drive the markets whenever the macros are favourable.

December 29, 2023 / 15:42 IST

Deveya Gaglani, Research Analyst - Commodities, Axis Securities

2023 has turned out to be a stellar year for Gold prices. COMEX prices gained more than 10 per cent, and in the domestic market, it is up by more than 12 per cent due to the weakness in the rupee. Gold prices have effectively navigated the challenges of solid dollar index and bond yields this year. Geopolitical tension between Israel and Hamas and expectation of a Fed Pivot and rate cut in 2024 supported Gold prices at the lower level. Overall, the outlook looks positive for prices as Central banks accumulate Gold at every dip. On the other hand, the ongoing geopolitical tension will continue next year, which will act as a cushion for Gold prices. Technically speaking, $2070 has been a vital supply zone for Gold for the past few years, which it tested this month but failed to sustain above it on account of profit booking. A monthly close above the mentioned level may push the door open for the target of $2250 and a target of Rs 70000 level in MCX for 2024.

December 29, 2023 / 15:41 IST

Pranav Haridasan, MD & CEO, Axis Securities

2023 was intriguing for both the Indian and Global equity markets. While the year commenced with restrained expectations and notable volatility in the initial months, the Indian market witnessed a remarkable recovery in the second half from its Mar 2023 bottom. In 2024, the Indian economy will continue to stand out, especially against the challenging backdrop of other emerging economies. We firmly believe that India will continue its growth momentum in the year ahead and remain the land of stability against the backdrop of a volatile global economy. The bolstered balance sheet strength of corporate India and the significantly enhanced health of the Indian banking system are positive factors. These elements are poised to facilitate Indian equities in achieving double-digit returns over the next two to three years, supported by robust double-digit earnings growth.

December 29, 2023 / 15:35 IST

Closing Bell | Sensex ends 170 pts lower, Nifty below 21,750; midcaps, smallcaps outperform

At close, the Sensex was down 170.12 points or 0.23 percent at 72,240.26, and the Nifty was down 47.30 points or 0.22 percent at 21,731.40. The market breadth favoured gainers over losers as about 1,758 shares advanced, 1,533 shares declined, and 54 shares unchanged.

December 29, 2023 / 15:28 IST

Stock Market LIVE Update | Outlook 2024: Corporate chieftains highly bullish on India growth story

Ahead of the New Year 2024, India Inc bigwigs seem to be on the same page when it comes to India's growth trajectory, as Deepak Parekh, NR Narayana Murthy, Uday Kotak and Kiran Mazumdar Shaw shared their unwavering optimism about the country's economic prospects. READ MORE