LiveNow

Closing Bell: Sensex, Nifty end flat amid volatility; media, realty shine

Market Close | Sensex, Nifty end flat

Indian benchmark indices ended flat in the volatile session on July 29. At close, the Sensex was up 23.12 points or 0.03 percent at 81,355.84, and the Nifty was up 0.01 points or 1.25 percent at 24,836.10,

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

Prashanth Tapse, Senior VP (Research), Mehta Equities

While benchmark indices hit fresh intra-day life-time highs and Nifty almost touched the 25k mark, most of the gains were lost and markets ended off their highs amid profit-taking in IT and telecom stocks. Going ahead, global market direction and corporate earnings will dictate the trend.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

Nifty opened on a positive note and witnessed a volatile day of trade. It managed to close marginally in the green up ~8 points. On the daily chart we can observe that the Nifty has rallied around 800 points in the last three trading sessions.

The hourly momentum indicator has triggered a fresh negative crossover suggesting loss of momentum. Thus, there is a high probability that the Nifty is likely to consolidate over the next few trading sessions.

On the downside crucial support is placed at 24650 – 24600 where the key hourly moving averages are placed. On the upside, 25000 is the key psychological hurdle from short term perspective.

Bank Nifty has also witnessed an extremely volatile day of trade today. It faced resistance at the falling trend line (52300) derived by joining the previous couple of swing highs.

On the downside, 51200 – 51000 is a crucial support zone. Thus, the Bank Nifty is also suggesting rangebound price action over the next few trading sessions. In terms of levels, 51800 – 52000 is an immediate hurdle while support is placed at 51200 – 51000.

Vinod Nair, Head of Research, Geojit Financial Services

An ease in the US personal consumption expenditure to 2.5% and the subsequent drop in the US 10-year yield have fuelled optimism that the Fed might cut rates in September, leading to a global rally. However, profit-booking was triggered in the domestic market given trading in the overbought territory and closed flat. Policy meeting is scheduled for the Fed, BOJ and BOE this week, and investors are closely monitoring the developments. It is anticipated that the BOE may implement a 25-bps rate cut in response to easing inflation.

Aditya Gaggar Director of Progressive Shares

Indian bourses commenced the week at yet another record level of 24,940. After a minor dip in the morning trade, Banking counters set the stage for the Index to surpass the psychological barrier of 25,000 but a hidden bearish divergence in the RSI pulled BankNifty lower which put pressure on the Index to trade lower to end the day at 24,836.10 with a minuscule gain of 1.25 points.

On a sectoral front, PSU Banks and Media were the outperformers while FMCG and IT ended the session in red. Despite a steep reversal in the markets, Mid and Smallcaps held their gains to outshine the Frontline Index.

On the daily chart, the Index has formed a small red candle with a probable bearish divergence in RSI indicating a temporary pause in its journey towards the north. A level of 25,000 will continue to act as an immediate resistance while 22,560 is a strong support point.

Currency Check | Rupee closes flat

Indian rupee ended flat at 83.73 per dollar on Monday versus Friday's close of 83.72.

Market Close | Sensex, Nifty end flat amid volatility; media, realty shine

Indian benchmark indices ended marginally higher in the volatile session on July 29.

Top Nifty gainers were Divis Labs, L&T, BPCL, Bajaj Finserv and SBI, while losers were Titan Company, Bharti Airtel, Hero MotoCorp, Tech Mahindra and Tata Consumer Products.

On the sectoral front, IT, FMCG, telecom down 0.4 percent each, while auto, bank, media, capital goods, oil & gas, power and realty rose 0.5-2.5 percent.

The BSE midcap index rose nearly 1 percent while smallcap index added 1.2 percent.

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Antarctica | 691309.00 | 1.76-5.38 | 102194771642276.25 |

| Ducon Infratech | 5441.00 | 8.25-5.06 | 1369018256482.55 |

| Century Extr | 97760.00 | 27.01-5.03 | 1285577501238.25 |

| MTNL | 11881306.00 | 92.22-5.01 | 2071973138301576.15 |

| Suven Life Sci | 44341.00 | 140.46-5 | 730862826154.25 |

Brokerage Call | JPMorgan keeps 'overweight' rating on Bandhan Bank, target Rs 260

#1 Q1 PAT was well ahead of estimate, driven by higher NII & lower provisions

#2 Non-II growth was aided by release of provisions on SR redemption

#3 Non-II growth was aided by recovery from written-off accounts

#4 Asset quality performance was better than estimate in a seasonally weaker Q1

#5 Overall, gross slippages fell below 3 percent after 14 quarters

#6 Net flow into 0+ MFI book was contained at 3.4 percent

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Asahi Songwon | 164501.00 | 493.8520 | 17992265223.05 |

| Ester Ind | 738524.00 | 138.9319.99 | 5638279328496.90 |

| STL Global | 88423.00 | 20.8919.99 | 168770835106.85 |

| NRB Industrial | 157056.00 | 42.7519.98 | 40704123285.30 |

| Uniinfo Telecom | 633333.00 | 48.0419.98 | 87600447675.30 |

| Parsvnath | 1178250.00 | 13.0910 | 1842981594062.05 |

| Mazagon Dock | 43848.00 | 5343.9510 | 44185735219008.25 |

| Kriti Ind | 45116.00 | 232.9210 | 701298115113.75 |

| TPL Plastech | 314454.00 | 109.729.99 | 953320658521.25 |

| Rail Vikas | 692624.00 | 607.559.99 | 4851623462199405.55 |

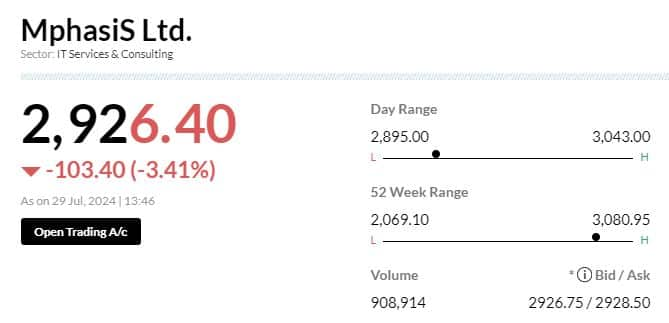

Brokerage Call | Citi maintains 'sell' rating on Mphasis, target Rs 2,235

#1 Reported in-line Q1, revenues were largely inline

#2 Margins were slightly lower

#3 TTM down 42 percent YoY in Q1

#4 There are deals won in FY24 to be converted to revenues

#5 Headcount declined ~7 percent YoY in Q1

#6 Management says, discretionary spends trends hasn’t changed versus Q4

#7 Though there are some green shoots & early signs of recovery in mortgage

Earnings Watch | Wonderla Holidays Q1 net profit down 25% at Rs 63.2 crore Vs Rs 84.5 crore, YoY

Earnings Watch | Kansai Nerolac Paints Q1 net profit down 69% at Rs 231 crore Vs Rs 738 crore, YoY

Brokerage Call | CLSA keeps 'outperform' rating on Bandhan Bank, target Rs 240

#1 Went into results with muted expectations on asset quality

#2 Were positively surprised by Q1– net slippages declined 50 percent YoY

#3 Credit costs came in at 1.7 percent vs 2.4 percent YoY

#4 Q1 is generally slow on balance sheet growth & this quarter was no exception

#5 Management still maintains its 18-20 percent loan growth target for the year

#6 See Loan growth largely coming in the second half

#7 NIM was stable & opex was in-line

#8 Raise PAT estimate by 5-7 percent driven largely by 20 bps lower credit costs

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Larsen | 3,772.35 | 2.7 | 128.64k |

| UltraTechCement | 11,860.00 | 1.55 | 19.24k |

| Bajaj Finserv | 1,608.90 | 1.44 | 26.06k |

| SBI | 871.75 | 1.02 | 1.67m |

| ICICI Bank | 1,217.05 | 0.77 | 1.52m |

| Reliance | 3,039.60 | 0.72 | 51.76k |

| M&M | 2,906.85 | 0.69 | 24.96k |

| Maruti Suzuki | 12,750.00 | 0.57 | 6.87k |

| IndusInd Bank | 1,409.80 | 0.46 | 264.18k |

| Tata Motors | 1,122.40 | 0.36 | 789.61k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Titan Company | 3,402.50 | -2.66 | 81.48k |

| Bharti Airtel | 1,484.00 | -2.03 | 275.61k |

| ITC | 496.35 | -1.24 | 705.97k |

| Tech Mahindra | 1,522.55 | -1.17 | 45.59k |

| Kotak Mahindra | 1,795.00 | -1.06 | 410.87k |

| HDFC Bank | 1,606.80 | -0.68 | 835.80k |

| NTPC | 394.20 | -0.58 | 1.24m |

| Infosys | 1,870.00 | -0.47 | 72.93k |

| Nestle | 2,468.60 | -0.41 | 27.00k |

| JSW Steel | 897.00 | -0.38 | 21.08k |

Brokerage Call | JPMorgan maintains 'outperform' call on ICICI Bank, target raises to Rs 1,375

#1 Q1 PAT was in-line with estimate, NII was in-line as well

#2 NIM decline along expected lines

#3 Core PPoP was up 11 percent YoY with overall average

#4 Asset growth at 16 percent YoY with NIMs having moderated 42 bps YoY

#5 Opex growth at 11 percent YoY has been lagging overall asset growth

#6 Opex growth could offset NIM pressures to support operating margins

#7 Bank saw seasonally higher slippages in Q1 on account of its KCC portfolio

#8 Credit costs were however benign with 13 bps aid from AIF provision reversal

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ashok Leyland | 257.00 | 4.32 | 1.03m |

| Cummins | 3,778.00 | 1.8 | 4.27k |

| Balkrishna Ind | 3,311.15 | 0.92 | 8.62k |

| Tube Investment | 4,198.85 | 0.9 | 2.58k |

| Sundram | 1,432.00 | 0.82 | 1.79k |

| Bajaj Auto | 9,564.35 | 0.75 | 4.33k |

| M&M | 2,907.85 | 0.73 | 24.97k |

| Tata Motors | 1,123.70 | 0.47 | 794.63k |

| MRF | 139,465.50 | 0.44 | 395 |

| Maruti Suzuki | 12,733.10 | 0.44 | 6.94k |

Currency Check | Spot USDINR to trade between 83.50-84: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian rupee traded on flat note on Monday. Positive domestic markets and weak crude oil prices supported the Rupee. However, a recovery in the US Dollar and importer demand capped sharp gains.

We expect Rupee to trade with a slight negative bias on a month-end dollar demand from importers and OMCs. A recovery in the US Dollar ahead of FOMC meeting this week may also weigh on the Rupee. However, a positive tone in the domestic markets and fresh FII inflows may support the rupee at lower levels.

Investors may remain cautious ahead of FOMC, BoE and BoJ meeting this week. USDINR spot price is expected to trade in a range of Rs 83.50 to Rs 84.

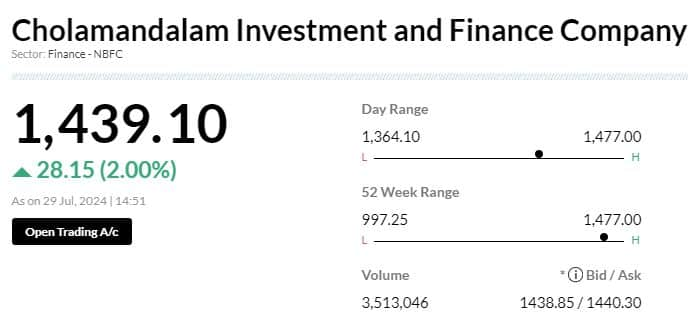

Brokerage Call | Jefferies keeps buy rating on Cholamandalam Investment and Finance Company

#1 Target Rs 1,525 per share

#2 Q1 CIFC's PAT 3 percent beat vs our estimate

#3 Stronger NII, lower opex offset higher provision

#4 AUM grew 35 percent YoY as expected, auto disbursement growth improved

#5 NIM rose 10 bps QoQ due to higher yield, lower CoF

#6 Credit cost was up 19 bps YOY at 1.5 percent versus estimate of 1.35 percent

Sensex Today | Power Grid Corp has 1.17 mln shares traded in another block: Bloomberg

Sensex Today | IndianBank Q1 net Profit up 41% At Rs2,403 Cr Vs Rs1,709 Cr (YoY)

#1 NII Up 8.3% At Rs6,178 Cr Vs Rs5,703 Cr (YoY)

#2 Net NPA At 0.39% Vs 0.43% (QoQ)

#3 Gross NPA At 3.77% Vs 3.95% (QoQ)

#4 Net NPA At Rs2,026.6 Cr Vs Rs2,222.6 Cr (QoQ)

#5 Gross NPA At Rs20,302 Cr

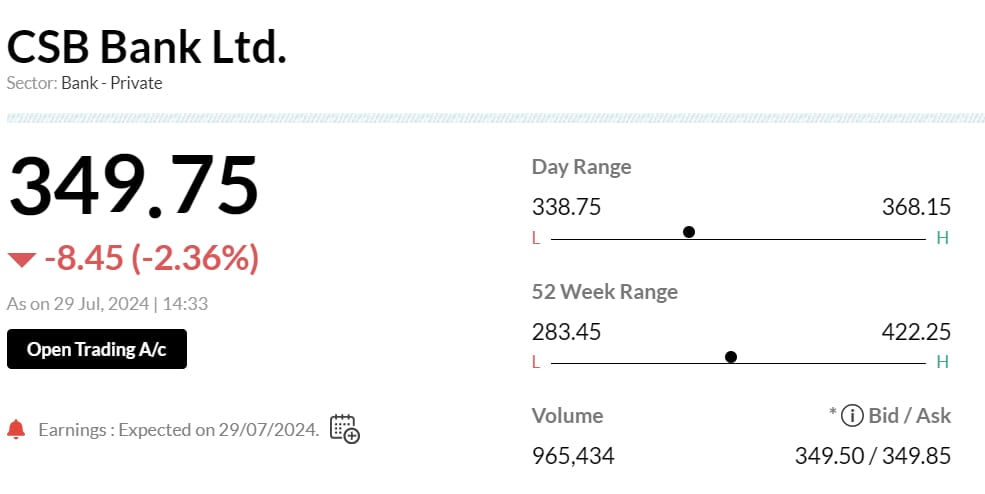

Sensex Today |CSB Bank Q1 net profit Rs113 crore, down 14% YoY

#1 Net interest income Rs 362 crore, down 0.5% YoY

#2 Gross NPA at 1.69% vs 1.47% YoY

#3 Operating Profit Rs 172 crore, down 5% YoY

#4 Provisions Rs 20 crore, down 7.4% QoQ

Sensex Today | Cyient DLM signs production contract for dreamliner battery diode module with Boeing

Sensex Today | Bharat Electronics Q1 net profit at Rs791 crore, up 49% YoY

#1 BEL Q1 revenue at Rs4240 crore, up 20% YoY

#2 BEL Q1 total costs Rs 3360 crore, up 14% YoY

Brokerage Call | Jefferies keeps hold rating on Indraprastha Gas, target Rs 485

#1 EBITDA was 20 percent ahead of estimate on lower gas costs

#2 Volumes declined YoY and were 2 percent below

#3 Expect volume growth to remain subdued over FY25-27e

#4 Slowdown in Delhi (70 percent of vol) & growing EV risk

#5 Rising APM shortfall puts a lid on margins

#6 Recent price hikes may not compensate fully for the higher Reliance on LNG

#7 Cut earnings by 8 percent/1 percent, on lower margin assumptions

Earnings Watch | Strides Pharma Q1 net profit at Rs 70.2 crore Vs loss of Rs 7.1 crore, YoY

Earnings Watch | BEL Q1 net profit at Rs 776 crore and revenue at Rs 4,199 crore

Earnings Watch | CSB Bank Q1 net profit down 14.3% at Rs 113.3 crore Vs Rs 132 crore, YoY

Earnings Watch | Indian Bank Q1 net profit rises 41% at Rs 2,403 crore Vs Rs 1,709 crore, YoY

Earnings Watch | Adani Total Gas Q1 net profit up 14.4% at Rs 171.8 crore Vs Rs 150 crore, YoY

Voltamp Transformers Q1 profit up at Rs 79.4 crore VS Rs 5.8 crore, YoY

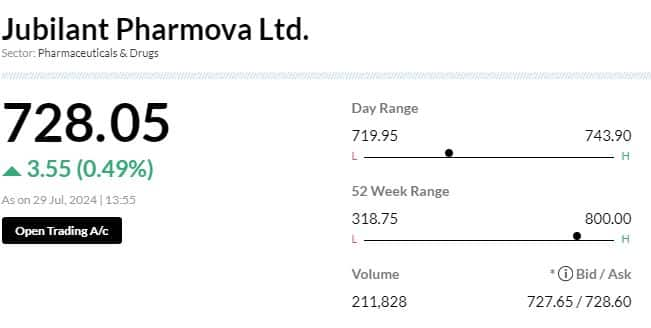

Stock Market LIVE Updates | Jubilant Pharmova gets I-T department notice for Rs 38 cr tax demand

The company has received an order from the Income Tax Department for FY20, raising a tax demand of Rs 38.13 crore on its subsidiary Jubilant Generics due to mistakes apparent from records apart from certain transfer pricing adjustments.

Stock Market LIVE Updates | Manappuram Finance gets intimation from its subsidiary of potential fraud

The gold financing company has received intimation from its subsidiary company and its service vendor (Manappuram Comptech and Consultants) about a potential fraud perpetuated by an employee.

The estimated quantum of the potential fraud is Rs 20 crore.

It has appointed KPMG to conduct a detailed analysis of the fraud.

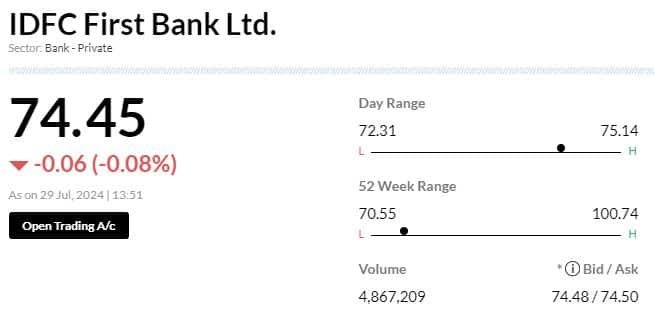

Brokerage Call | Jefferies keeps 'buy' rating on IDFC First Bank, target cut to Rs 95

#1 Q1 profit missed estimates due to higher credit losses in MFI segment

#2 Drag may sustain in Q2-Q4 as well

#3 New disclosure on vintage delinquency of other retail loans is encouraging

#4 Deposit growth of 36 percent to aid loan growth & improvement in LDR (97 percent now)

#5 Operating efficiencies are evident and will aid profits over H2FY25-27

#6 Lower estimate for MFI losses, but see RoA rising to 1.4 percent in FY27

Sensex Today | Nifty falls more than 130 points from day's high

Brokerage Call | Morgan Stanley maintains 'equal-weight' rating on Mphasis, target raises to Rs 2,900

#1 Management commentary continues to be constructive

#2 BFS vertical has been witnessing improving trends

#3 However, execution has scope to improve

#4 Post the run-up since end of May, valuations are not cheap

Sensex Today | 1.02 million shares of Power Grid traded in another block: Bloomberg

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bayer CropScien | 6,964.45 | 5.23 | 2.06k |

| Bank of India | 125.40 | 5.11 | 1.02m |

| PI Industries | 4,394.95 | 4.52 | 21.79k |

| Whirlpool | 2,149.90 | 4.43 | 24.14k |

| Ashok Leyland | 257.05 | 4.34 | 932.57k |

| Oil India | 584.65 | 4.29 | 356.92k |

| Sun TV Network | 864.65 | 4.19 | 32.65k |

| Piramal Enter | 1,031.10 | 3.95 | 64.94k |

| Delhivery | 411.35 | 3.58 | 468.72k |

| Coromandel Int | 1,679.30 | 3.34 | 21.30k |

Brokerage Call | Goldman Sachs maintains 'buy' rating on IndiGo, target Rs 4,800

#1 Q1 EPS of Rs 71 was above estimate

#2 Beat driven largely by higher one-off compensation booking

#3 Beat partially offset by higher costs

#4 Yields and ASK/RPK were largely in-line with estimate

#5 Passenger fleet size increased to 379 planes, with 8 from new deliveries

#6 Aircraft groundings were stable at mid-70s

#7 Company expects groundings to start coming down by end of FY25

#8 For Q2, company expects high-single digit YoY ASK growth

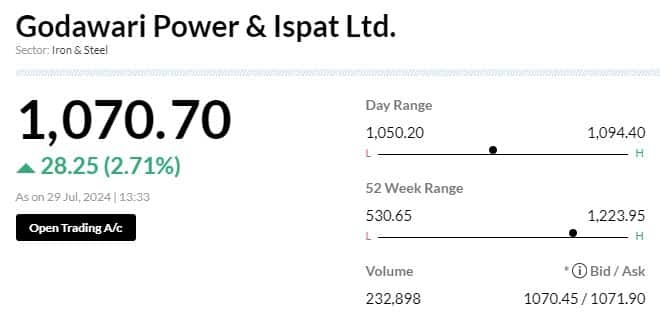

Stock Market LIVE Updates | Godawari Power gets Chhattisgarh Environment Conservation Board permission

The company has received permission from the Chhattisgarh Environment Conservation Board for setting up a 2 million ton pellet plant for the expansion of iron ore pelletisation capacity from 2.7 to 4.7 MTPA.

The pellet plant is proposed to be financed from internal accruals of the company and is expected to be commissioned by Q1FY26.

Sanghi Industries Q1 net loss at Rs 89 crore Vs loss of Rs 189 crore, YoY

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 128.18 | 6.86 | 122.36m |

| Bank of India | 125.46 | 5.1 | 19.88m |

| JK Bank | 113.62 | 4.81 | 12.75m |

| Bank of Baroda | 257.20 | 3 | 25.39m |

| Union Bank | 136.50 | 2.73 | 10.45m |

| IOB | 68.97 | 2.44 | 44.08m |

| Canara Bank | 116.45 | 2.27 | 40.69m |

| UCO Bank | 58.42 | 2.24 | 25.30m |

| Punjab & Sind | 69.65 | 1.77 | 8.98m |

| SBI | 876.60 | 1.64 | 18.41m |

Stock Market LIVE Updates | Hindustan Zinc gets I-T order for Rs 1,884.3 crore

The company has received an order from the Assessment Unit, Income Tax Department (NFAC) for the Assessment Year 2013-14, demanding Rs 1,884.3 crore on July 25. It has already filed an application for rectification of mistakes on July 26 and is hopeful of a favourable outcome from the said rectification application. It also believes that the erroneous demand should be revised to reflect the correct tax liability of NIL.

Earnings Watch | Whirlpool Q1 net profit up 92% at Rs 143.8 crore Vs Rs 75 crore, YoY

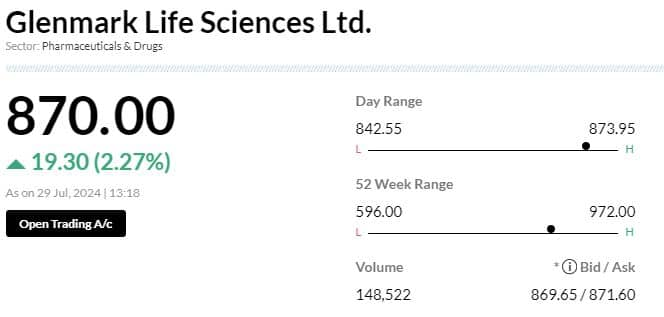

Stock Market LIVE Updates | GPCB issues a closure notice to Glenmark Life Sciences' Ankleshwar facility

The Gujarat Pollution Control Board (GPCB) has issued a closure notice for the company’s Ankleshwar facility. The sample collected from the GIDC storm water drain was found to be contaminated with high COD levels and other parameters.

GPCB has ordered the company to deposit interim environment damage compensation as determined by GPCB and to submit a bank guarantee of Rs 15 lakh for compliance assurance at the time of revocation.

Stock Market LIVE Updates | Sun Pharma Advanced Research redesignates Nitin Dharmadhikari as COO

The pharma research company has re-designated Nitin Dharmadhikari as Chief Operation Officer effective July 26. Mudgal Kothekar, Vice President, and Sandeep Inamdar, Vice President - Clinical Development, have been designated as senior management personnel of the company effective July 26.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oil India | 583.15 | 4.02 | 346.25k |

| BPCL | 337.25 | 2.6 | 592.26k |

| IOC | 179.75 | 1.81 | 2.68m |

| HINDPETRO | 382.40 | 1.58 | 394.70k |

| Adani Total Gas | 899.00 | 1.22 | 42.97k |

| Reliance | 3,046.00 | 0.93 | 45.03k |

| IGL | 544.80 | 0.83 | 25.33k |

| ONGC | 333.35 | 0.63 | 1.14m |

| Petronet LNG | 373.50 | 0.27 | 131.77k |

| GAIL | 231.00 | 0.17 | 1.22m |

Stock Market LIVE Updates | Sumitomo Chemicals surges 5% post Q1 results

#1 Profit zooms 105.4 percent to Rs 126.7 crore Vs Rs 61.7 crore, YoY

#2 Revenue increases 15.8 percent to Rs 838.9 crore Vs Rs 724.2 crore, YoY