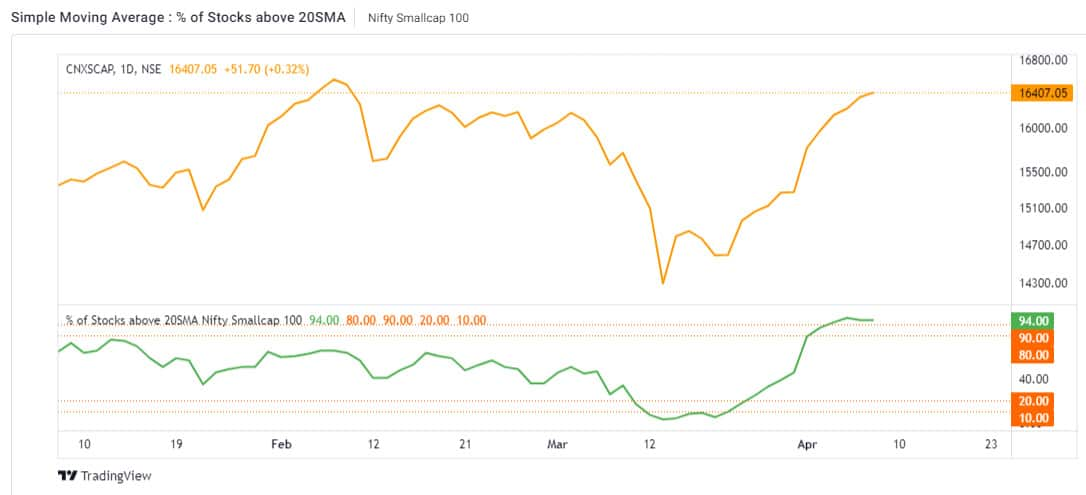

Smallcap stocks have revived from the weakness in March with the benchmark indices hitting all-time highs. The diffusion indicator, which shows the percentage of stocks that trade above the 20-day simple moving average (SMA) indicates 94 percent of Nifty Smallcap 100 index stocks are now trading above their 20-day SMA. This is in sharp contrast to March 13, where only 3 percent of stocks were trading above the 20-day SMA.

94 percent of Nifty Smallcap 100 index stocks are now trading above their 20 day SMA.Source: web.strike.money

94 percent of Nifty Smallcap 100 index stocks are now trading above their 20 day SMA.Source: web.strike.money

The Nifty Smallcap index has shown a strong recovery from the previous month’s low as it gained over 14.86 percent in this time period. On March 13, the Nifty Smallcap 100 index had fallen 5.28 percent.

The smallcap stocks were under pressure during March due to multiple factors such as market regulator SEBI flagging froth in small and midcap stocks and asking mutual funds to run a stress test, while ED raids on market players who dealt in small-cap stocks had dented the sentiment.

The rally in the Nifty Smallcap index has been strong and broad-based. Among the Nifty Smallcap 100 index, 26 stocks clocked returns above 20 percent between March 13 and April 8. Only two stocks have given negative returns in the period.

Experts have cautioned that small-cap stocks are still trading at expensive valuations. “If investors are looking to buy a small-cap ETFs or small-cap funds, they are trading at high valuations. It's better to do their own research and find out stocks trading below their intrinsic value. It is possible to identify 20-25 undervalued stocks from the large universe of small-cap stocks,” Vikas Gupta, CEO and chief investment strategist at Omniscience Capital, said.

“The Nifty Smallcap index closed at 16,407 on April 8. It is trading near its all-time high of 16,691.6. The index needs to cross its all-time high for any future gains. It’s not easy for the small-cap index to cross its all-time high. Traders need to watch the sector closely in the coming days. If it does not cross the all-time high, selling will come back,” said, Shailesh Saraf, managing director of Dynamic Equities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!