June 20, 2022 / 16:18 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets finally heaved a sigh of relief and logged steady gains after early optimism in key European indices prompted selective buying in IT, finance and healthcare stocks. However, the bearish undertone can be seen from the fact that heavy selling continued in metals, oil & gas and capital goods stocks as worries of growth slowdown resulted in a fall in these stocks.

Technically, on intraday charts, the Nifty has formed a double bottom formation which is broadly positive for the near term. The index has also formed a Hammer reversal formation on daily charts, indicating strong possibility of a fresh pullback rally from the current levels.

For day traders, 15250 would be the sacrosanct support zone. And if the index succeeds to trade above the same, then the pullback rally is likely to continue in the near future and could move up to 15500-15600 levels. On the flip side, below 15250, the uptrend would be vulnerable and below the same, the index could slip till 15180-15100.

June 20, 2022 / 16:03 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Nifty index witnessed consolidation with the heavyweights supporting the index while the broader market continued to witness deep pain. The index lower end support stands at 15200 and immediate resistance is placed at 15450, a break on either side will lead to trending moves. The resistance if taken out can witness a rally towards 15800 levels.

The Bank Nifty index witnessed sideways consolidation where the fight between the bulls and the bears continued. The index is still trading in a downtrend with lower high and lower low formations intact.

On the daily chart the immediate resistance on the upside is placed at 33,100 level and a break above this can witness some short covering. The downside support stands at 32,400 and a breach below this will lead to fresh round of selling pressure.

June 20, 2022 / 15:45 IST

Vinod Nair, Head of Research at Geojit Financial Services.

Positive trends in the global markets inspired domestic market to trade positively with large caps gaining the most while mid & small caps continued to trade with cuts.

Prevailing inflationary pressure and concerns over policy tightening limited the upside. Among the sectors, metals were the top laggard due to a sharp fall in commodity prices along with a fall in global & domestic demand.

June 20, 2022 / 15:36 IST

Rupee Close:

Indian rupee ended higher at 77.98 per dollar against Friday’s closing of 78.07.

June 20, 2022 / 15:35 IST

Market Close:

Benchmark indices ended on positive note in the highly volatile session on June 20.

At close, the Sensex was up 237.42 points or 0.46% at 51,597.84, and the Nifty was up 56.70 points or 0.37% at 15,350.20. About 673 shares have advanced, 2663 shares declined, and 156 shares are unchanged.

HUL, HDFC, Apollo Hospitals, Asian Paints and UltraTech Cement were among the top Nifty gainers, while losers were ONGC, Tata Steel, UPL, Hindalco Industries and Coal India.

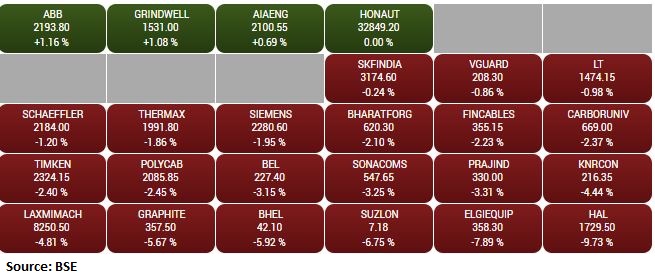

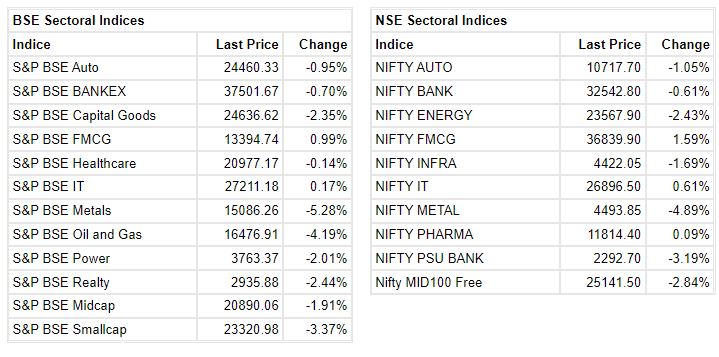

On the sectoral front, FMCG index added 1 percent and IT index up 0.4 percent, however oil & gas, metal, capital goods, power and realty down 1-4 percent.

BSE midcap index shed 1.4 percent and smallcap index fell 3 percent.

June 20, 2022 / 15:24 IST

Engineers India wins consulting services work for 3 separate projects

Engineers India has won three separate projects from specialized chemicals, sunrise and infrastructure sectors. It will provide consulting services and the estimated order value of these projects is approximately Rs 80 crore.

Engineers India touched 52-week low of Rs 55.95 and was quoting at Rs 56.45, down Rs 1.05, or 1.83 percent on the BSE.

June 20, 2022 / 15:19 IST

Wipro company Topcoder appoints Doug Hanson as Chief Executive Officer

Wipro company, Topcoder appointed Doug Hanson as Chief Executive Officer (CEO). In his new global role, Doug will be responsible for the success of Topcoder and its customers and partners.

June 20, 2022 / 15:17 IST

BSE Capital Goods index declined 2 percent dragged by the Hindustan Aeronautics, Elgi Equipments, Suzlon Energy

June 20, 2022 / 15:14 IST

Vivek Goel, Joint MD, Tailwind Financial Services

After touching a high of above 18600 in October last year, Nifty and overall markets are on a downward trend currently trading close to their 52 week lows. This has been primarily driven by a reversal of stimulus that global central banks started at the beginning of covid in 2020.

With rising inflation to all time record levels, they have been left with little choice but to opt for aggressive tightening which weighed on the already above-average valuations in equities. Despite this, Indian equities have relatively continued to outshine most global markets even on the downside as retail flows have provided strong support amidst FII selling.

In the present scenario, as market participants price in expectations of further rate hikes over this calendar year, equity valuations have started to fall back to historical averages and over the next couple of quarters, as we see policy impact on curbing inflation, markets should start to consolidate, providing attractive entry levels for investors.

We currently prefer a staggered deployment strategy through large and flexi cap mutual funds to build a diversified allocation to top 100 companies in order to position portfolios in a more defensive way.

June 20, 2022 / 15:11 IST

Artefact Projects bags projects assignments of Rs 30.72 crore

Artefact Projects has bagged projects assignments with fees of Rs 30.72 crore. This can result in additional annual revenue of approximately Rs 9 crore per annum for next 3 years.

The company has participated in 65 number of bids involving fees of approximately Rs 524.42 crore, out of which some orders are further expected.

Artefact Projects was quoting at Rs 43, down Rs 5.10, or 10.60 percent.

June 20, 2022 / 15:09 IST

Nazara Technologies to make a further strategic investment

Nazara Technologies has decided to make a further strategic investment of up to Rs 20.1 crore in material subsidiary Absolute Sports, by acquiring shares promoter Porush Jain, and up to Rs 10 crore in Brandscale Innovations by subscribing to optionally convertible debentures in one or more tranches.

Nazara Technologies touched 52-week low of Rs 1,008.05 and was quoting at Rs 1,014, down Rs 36.55, or 3.48 percent on the BSE.

June 20, 2022 / 15:02 IST

Market at 3 PM

Benchmark indices were trading flat amid volatility with metal index shed over 5 percent, while buying was seen in the FMCG names.

The Sensex was up 68.84 points or 0.13% at 51429.26, and the Nifty was up 2.40 points or 0.02% at 15295.90. About 503 shares have advanced, 2722 shares declined, and 125 shares are unchanged.

June 20, 2022 / 14:53 IST

Jeevan Scientific gets Form 483 for clinical pharmacology centre facility

The United States Food and Drug Administration (US FDA) conducted an un-announced in-person inspection of Jeevan Scientific Technology's clinical pharmacology centre facility and a remote record review of bioanalytical facility, during May 31-June 10 and June 9-16.

Clinical pharmacology centre has received a Form 483, while there was no significant objectionable observations for bioanalytical facility.

The observations are related to procedural improvements and it has addressed most of them with required evidence(s) during closeout(s), but the outcome of the audit(s) is not restrictive in nature and do not hinder the smooth operations of both facilities.

Jeevan Scientific Technology touched a 52-week low of Rs 58.45 and was quoting at Rs 58.45, down Rs 3.05, or 4.96 percent on the BSE.