Taking Stock | Market falls 1%, Nifty below 17,900; Sensex tumbles 773 points

On the BSE, bank, power and realty indices shed 2 percent each and information technology, capital goods, healthcare and oil & gas indices fell 1-1.7 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,535.35 | 319.07 | +0.38% |

| Nifty 50 | 25,574.35 | 82.05 | +0.32% |

| Nifty Bank | 57,937.55 | 60.75 | +0.10% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Infosys | 1,513.50 | 36.70 | +2.49% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Trent | 4,283.70 | -343.60 | -7.43% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 35688.30 | 570.70 | +1.63% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 55334.40 | -102.80 | -0.19% |

Markets went into a tailspin as investors wound up their positions on the last day of F&O expiry. Traders also liquidated their position ahead of the Adani Enterprises FPO, while migration from T2 to T1 settlement starting Friday also led to some offloading.

While trading sentiment may remain volatile, the upcoming Budget and US Fed meet next week could fuel sharp sideways movement in coming sessions.

Technically, after a double top formation, the market witnessed a sharp correction. On daily charts the Nifty has formed a long bearish candle and closed below the 18000 mark which is broadly negative.

As long as the index is trading below 18000, the weak sentiment is likely to continue and below the same the index could retest the level of 17800. Any further down side could drag the index till 17700. On the flip side, above 18000, the index could move up to 18050-18100 levels.

The Bank Nifty witnessed selling pressure throughout the session. On the daily chart, an upward consolidation was followed by a sharp correction, suggesting a rise in bearish bets in the space.

Furthermore, the index has dropped below the 50-day exponential moving average, confirming the downward trend. On the lower end, immediate support is visible at 41500/40800. On the higher end, resistance is visible at 42000.

The Nifty opened on a negative note on January 25 & tumbled down sharply as the day progressed. It breached the key daily moving averages on the way down. The larger structure, however, shows that the index is still in the range, which it has been witnessing for last one month.

It recently tested the upper end of the range & thereon it has tumbled down towards the lower end i.e. 17800-17760. This zone has been acting as a strong support & is likely to provide support this time as well. Thus unless the level of 17760 breaks, the Nifty can witness recovery within the short term range.

Markets plunged sharply lower on the monthly expiry day and ended with a cut of over a percent. After the flat start, the Nifty index drifted gradually lower in the first half and remained in a narrow band thereafter. It finally settled at 17891.95 levels; down by 1.25%.

Meanwhile, the selling pressure was widespread wherein banking & financials lost maximum closely followed by energy and realty counters. The broader indices too traded in tandem with the trend and shed in the range of 1%-1.5%.

This decline has again pushed the Nifty index closer to the lower band of the prevailing consolidation range i.e. 17750 levels and indications from the banking pack, which holds considerable weight in the index, are pointing towards more pain ahead. We reiterate our view to prefer hedged positions and suggest adding a few shorts too.

Bears remained at the helm as the benchmark index Nifty shed more than 200 points on Wednesday. On the daily timeframe, the index remained below the 50-day exponential moving average.

On the lower end, however, the correction was limited to the upper band of the falling wedge pattern on the daily chart. The sentiment looks very weak, with the RSI in a bearish crossover. However, a further correction may occur if the price falls below 17,840. On the higher end, resistance is placed at 18000.

Indian equities witnessed significant sell-off as the market appeared apprehensive ahead of the upcoming Union Budget and Fed meeting next week.

Sentiments were dampened by persistent FII selling, where funds are being shifted to other EMs as a result of attractive valuations. Furthermore, a weak economic growth outlook that stoked recession fears pulled down global markets.

Indian rupee closed 13 paise higher at 81.59 per dollar against previous close of 81.72.

Consolidated revenue at Rs 9,315 crore and net profit at Rs 1,491 crore.

Benchmark indices ended lower on January 25 with Nifty around 17,900.

At Close, the Sensex was down 773.69 points or 1.27% at 60,205.06, and the Nifty was down 226.30 points or 1.25% at 17,892. About 1106 shares have advanced, 2310 shares declined, and 129 shares are unchanged.

Adani Ports, SBI, IndusInd Bank, HDFC Bank and Cipla were among the biggest losers on the Nifty, while gainers were Hindalco Industries, Maruti Suzuki, Bajaj Auto, HUL and Tata Steel.

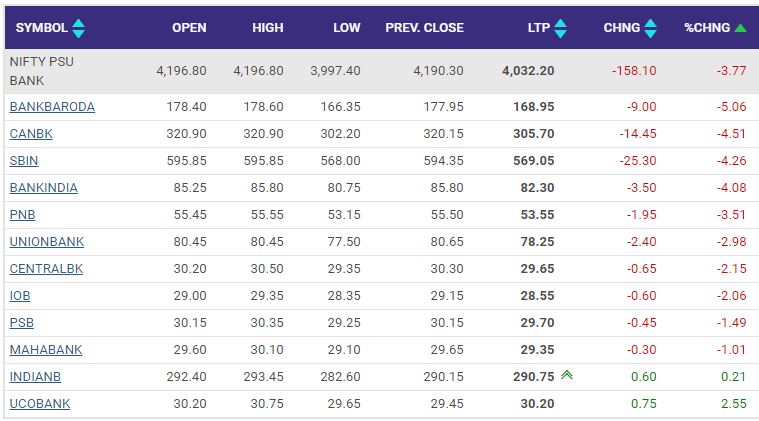

Among sectors, bank, power, PSU bank and realty down 2-3 percent each.

The BSE midcap index fell 1.5 percent and smallcap index shed 0.8 percent.

Brokerage house has maintained ‘Neutral’ rating on the stock with a target price of Rs 9,928.

The stronger ASPs drive Q3 revenue beat, while EBITDA was margin in-line. The new SUV ramp key positive, while weaker mass segments remain a concern.

The outlook is healthy and company targets ahead of industry growth & leadership in SUVs.

The cost outlook is stable for Q4 and forecast margin to be stronger in Q4.

The rising A&P spends, stronger JPY & regulatory costs may impact margin, reported CNBC-TV18.

Indraprastha Gas Q3 net profit at Rs 278 crore and revenue at Rs 3,711 crore.

Indraprastha Gas was quoting at Rs 410.80, down Rs 13.10, or 3.09 percent.