Taking Stock | Sensex, Nifty End Flat In Lacklustre Session; ITC Slips 4% After Q3 Numbers

The broader markets performed in line with the benchmarks, with BSE midcap and smallcap indices ending flat.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,666.28 | -436.41 | -0.51% |

| Nifty 50 | 25,839.65 | -120.90 | -0.47% |

| Nifty Bank | 59,222.35 | -16.20 | -0.03% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Titan Company | 3,849.00 | 82.00 | +2.18% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Asian Paints | 2,796.00 | -132.30 | -4.52% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8251.30 | 105.20 | +1.29% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 38130.60 | -460.10 | -1.19% |

The USDINR spot is trading within the range of 72.65-73.15. Global markets sentiments are optimistic with world stocks hovering just near records highs on hopes that a $1.9 trillion covid-19 aid package will be passed by US policymakers as soon as this month just as coronavirus vaccines are being rolled out globally. However, renewed geopolitical tensions between US-China led investor’s enthusiasm to calm a bit.

Good risk appetite coupled with inflows into local stocks will help Indian Rupee to appreciate, but likely RBI intervention at around 75.70-72.60 zone may limit the fall in USDINR pair.

We expect USDINR Spot to trade sideways with negative with 72.65/72.50 being key support zone below which next support is at 72.30. On the upside, 73.0-73.15-73.25 will act as the crucial resistance levels.

Market can undergo some consolidation after the sharp gains made post the reformist union budget. The broad undercurrent of the market may remain constructive especially on the small and midcaps. But the sentiment of global market will play an important role in deciding the short-term trend which is getting mixed due to weakening European market.

Index managed to hold the bullish stream throughout the week and closed a week at 15163 with gains 1.60 percent and formed a small bullish candle on weekly chart. The index has formed good support at 15k mark and any dip near said levels will be again buying opportunity for the overall targets of 15,250 zone which is the strong hurdle on the higher side. The current range is 15,000-15,250 zone either side breakout will decide the final direction of index.

The markets continued their lacklustre move throughout the day. This was characterised by less than average volumes on the Nifty futures contract as well. The target of 15,500 is still open and traders can accumulate positions for this target with a strict stop below the 14,500 mark which is good support for the index. Since the risk reward ratio is skewed, a buy on intraday corrections would be a prudent way to enter long positions.

Rupee Close:Indian rupeeended11paise higher at 72.75per dollar, amid volatile tradewitnessedin the domestic equity market.It opened higher at 72.81 per dollar against previous close of 72.86 and traded in the range of 72.73-72.83.

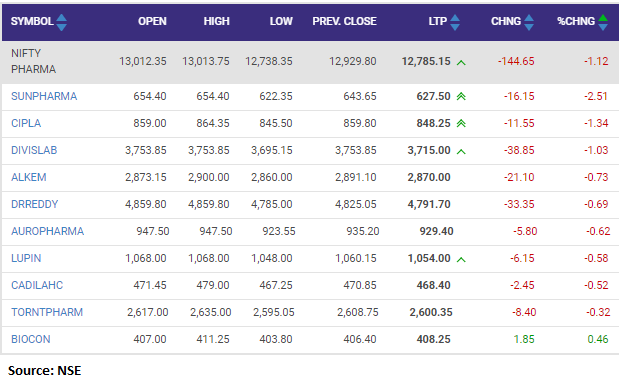

In the highly volatile day, benchmark indices ended flat with selling seen in the metal, pharma and FMCG stocks.

At close, the Sensex was up 12.78 points or 0.02% at 51,544.30, and the Nifty was down 10 points or 0.07% at 15,163.30. About 1400 shares have advanced, 1520 shares declined, and 159 shares are unchanged.

ITC, GAIL, ONGC, Sun Pharma and Coal India were among major losers on the Nifty, while gainers were Adani Ports, ICICI Bank, Infosys, Axis Bank and Wipro.

Except bank and IT all other sectoral indices ended in the red with metal, pharma, FMCG and energy lost 1 percent each. BSE Midcap and Smallcap indices ended flat.

The market's short-term technical conditions favoring a sideways correction is in the process. While it is subject to further price action evolution, we retain our cautious stance and advise the traders to refrain from building a new buying position until we see further improvement and breakout above 15,250 (Nifty 50 Index).

The momentum indicators like RSI, MACD continue showing divergence, the market is likely to take a pause around this level and stay in a range. We expect the 15,230-15,250 level to act as short-term resistance.

Consolidated net profit rose 43.1% at Rs 147 crore versus Rs 102.7 crore and revenue was up 18.2% at Rs 830.2 crore against Rs 702.4 crore.

Sales is expected to grow a 38.5% over FY21-23E with PAT turning positive in that timeframe to Rs 1337 crore in FY23E. We remain positive on Ashok Leyland as a prime play on the impending cyclical CV upswing.

The company’s progress on exports is a monitorable given its vision of becoming a global top 10 maker. We maintain BUY, valuing it at Rs 150 on SOTP basis, assigning 15x EV/EBITDA to CV business on FY23E numbers and 1.5x P/B for investments (previous target price at Rs 120).

Crude oil prices are trading lower from the last two trading sessions, following strength in the Dollar Index, and weak demand forecast from an International Energy Agency (IEA) monthly report. Global jet fuel demand is also keeping a cap on oil prices, due to travel restrictions in many countries, following a fresh breakout of coronavirus cases.

The IEA cut its 2021 global oil demand forecast by -200,000 bpd, to 96.4 million bpd, from 96.6 million bpd, in its monthly report.

The IEA also sees non-OPEC+ crude supply climbing by +830,000 bpd in 2021. Meanwhile, data from the Official Airline Guide (OAG) shows that weekly scheduled airline flights globally were down 47% from a year ago, and were down -39%, based on daily actual commercial flight tracking by FlightRadar24. Travel restrictions are likely to keep a cap on the current oil prices rally.

Meanwhile, US crude oil inventories, as of February 5, were +1.8% above the seasonal 5-year average, gasoline inventories were -0.1% below the 5-year average, and distillate inventories were +6.9% above the 5-year average as per a recent EIA report.

US crude oil production in the week ended February 5 rose +0.9% w/w, to 11.0 million bpd, and is down by -2.1 million bpd, from the record high of 13.1 million bpd.

Crude oil prices are likely to trade firm, while above the key support levels around the 20- days EMA at $55.16, and the 50-days EMA at $51.53. Meanwhile, an immediate resistance is seen around $59.55 and $60.50 levels.

Bayer CropScience (BCSL) on Thursday reported a 34.18 percent decline in profit before exceptional items and tax (PBT) to Rs 106.1 crore for the quarter ended December 2020.

Bayer CropScience’s (BCSL) PBT stood at Rs 161.2 crore during the same quarter of 2019-20, Bayer CropScience said in a statement.

The revenue from operations grew by 7.51 percent to Rs 918.2 crore during the quarter under review, compared to Rs 854 crore in the year-ago period.