April 03, 2023 / 16:17 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

The benchmark indices experienced range-bound activity. Although the Sensex gained 114 points, the Nifty ended 38 points higher. While intraday profit booking was observed in a few Oil and Gas and Metal stocks, the Auto and PSU Banks indices among sectors both increased by over 1%.

Technically, the Nifty is holding a bullish pattern on daily charts, and it is continuously producing a higher bottom shape on intraday charts, which is mostly favourable. The market structure is positive in our opinion, but owing to briefly overbought conditions, we could see some profit taking at higher levels.

Buying on dips and selling on rallies would be the best course of action for traders at the moment. In the near future, the index's important support and resistance levels will be 17,300–17,250 and 17,500–17,550 respectively.

April 03, 2023 / 16:09 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services

Domestic equities remained lacklustre ahead of RBI policy meeting outcome. Nifty opened higher but immediately gave up its initial gains to trade flat for most part of the session. It however, recovered in the last hour to finally close 38 points higher at 17398 levels.

Sectorially it was mixed bag with major buying seen in Auto and PSU Bank. Auto sector saw a renewed interest after auto majors announced better than expected monthly numbers. Power sector too remain in focus after Tata Power and Adani announced tariff rise for Mumbai region.

Upstream oil companies were also in limelight after crude oil prices rose to 1-month high post OPEC’s surprise production cut. RBI’s policy announcement would be the key event to watch out this week where in investors would gauge for indication with regards to rate hike pause. This along with shortened trading week would keep the market range-bound.

April 03, 2023 / 16:06 IST

Dilip Parmar, Research Analyst, HDFC Securities

Indian rupee started the month on the back surge in crude oil prices after OPEC+ nations decided to cut the output. The higher crude oil prices will be rupee negative as India imports a major chunk of its energy demand by importing.

The importers rushed for the dollars on a holiday truncated week to start the new fiscal year requirements.

Spot USDINR is expected to trade between 82 to 82.50 ahead of the RBI monetary policy decision, scheduled on April 6.

April 03, 2023 / 15:51 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas

Nifty witnessed a day of consolidation and closed with marginal gains. On the daily charts we can observe that the Nifty for the whole day consolidated in the zone of 17,310 – 17,430 where crucial Fibonacci retracement level (17,429) and the 40-day moving average (17,406) is placed.

After a sharp up move in the previous couple of trading sessions, a consolidation is a healthy sign and also provides an opportunity to enter for those who have missed out. The hourly momentum indicator has triggered a negative crossover which is a sell signal.

Considering that prices are trading around a hurdle level and the momentum indicator triggering a negative crossover can lead to a consolidation. Overall, the uptrend is intact and this consolidation should be used as an opportunity to initiate fresh longs. On the upside, the immediate short-term target is placed at 17,500.

April 03, 2023 / 15:47 IST

Vinod Nair, Head of Research at Geojit Financial Services

Investors were of the view that the easing price pressure would provide the central bank with leeway to pause the rate hike. However, the surprise production cut by OPEC+ has fuelled concerns about inflationary pressure, which may prompt central banks to remain hawkish.

The downside pressure in the market was mitigated as auto stocks rallied in response to the latest sales data, indicating a surge in demand. Additionally, India's manufacturing PMI exceeded expectations, demonstrating its swiftest growth rate in three months due to increased output and new orders.

April 03, 2023 / 15:34 IST

Rupee Close:

Indian rupee closed 16 paise lower at 82.33 per dollar against Friday's close of 82.17.

April 03, 2023 / 15:30 IST

Market Close:

Benchmark indices ended marginally higher in the volatile session on April 3.

The Sensex was up 114.92 points or 0.19% at 59,106.44, and the Nifty was up 38.20 points or 0.22% at 17,398. About 2692 shares advanced, 846 shares declined, and 121 shares unchanged.

Hero MotoCorp, Coal India, Bajaj Auto, Maruti Suzuki and Eicher Motors were among the biggest gainers on the Nifty, while losers were BPCL, Apollo Hospitals, Adani Enterprises, ITC and Infosys.

On the sectoral front, auto and PSU Bank indices gained 1 percent each and realty index up nearly 1 percent, while selling was seen in the FMCG, metal, power, oil & gas and information technology stocks.

The BSE midcap index up 0.4 percent, while smallcap index rose 1 percent.

April 03, 2023 / 15:24 IST

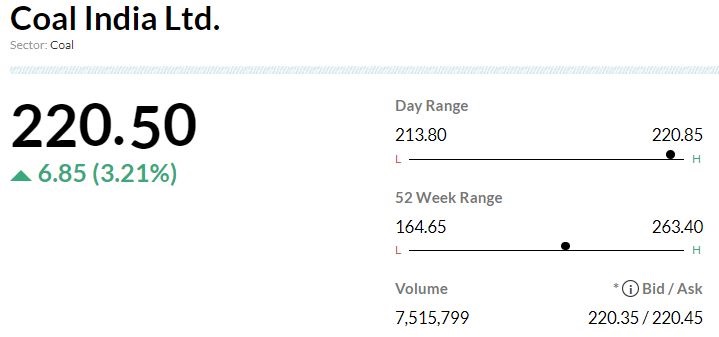

Coal India's shares jump nearly 3% as production in FY23 hits 17-year high

In March, production by Coal India and its subsidiaries rose by 4 percent on year, while in April-March of financial year 2023, output grew by 12.9 percent to 703.2 million tonnes.

The company said it had breached its annual production target of 700 million tonnes, the first time it had surpassed its goal since the fiscal year that ended in March 2006.

Coal offtake also rose 3.4 percent in March, and 5 percent during the financial year 2023. Offtake is simply the amount of coal supplied from the pitheads.

April 03, 2023 / 15:20 IST

Morgan Stanley View On Autos:

-Retail sales growth was steady

-Pre-buying ahead of emission related cost hikes also aided volume growth

-Mix, margin & market share will be key stock drivers in FY24

-Maruti Suzuki, Bajaj Auto & Tata Motors are preferred picks

BSE Auto Top Stock Gainers (Intra-day)

April 03, 2023 / 15:12 IST

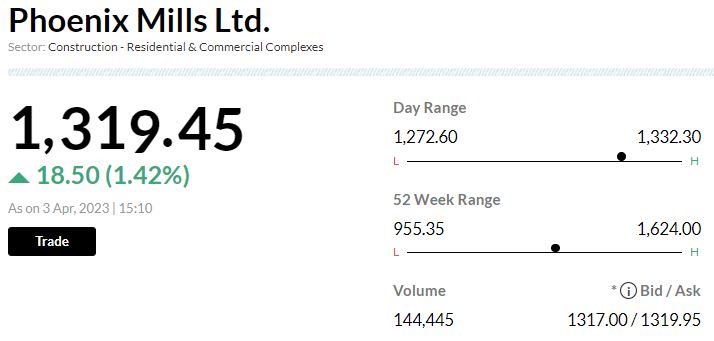

Government of Singapore offloads Rs 670 crore shares in Phoenix Mills

Foreign portfolio investor Government of Singapore has sold 51.49 lakh equity shares or 2.88% stake in Phoenix Mills via open market transactions, at an average price of Rs 1,300.15 per share. Government of Singapore held 4.28% shareholding in the company as of December 2022.

April 03, 2023 / 15:10 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee depreciated on the back of strong dollar and weak domestic markets. Dollar surged as OPEC+ surprisingly cut crude oil production over the weekend. This led to sharp rise in global crude oil prices, renewing inflation concerns. Core PCE inflation showed cooling inflation in US, raising expectations that Fed may be at the end of its rate hike cycle. However, upbeat macro-economic data cushioned the downside. India’s manufacturing PMI rose to 56.4 in March 2023, topping forecast of 55 and a reading of 55.3 in the previous month.

We expect Indian Rupee to trade with a negative bias on a strong Dollar and surge in crude oil prices. This may impact global economic recovery. However, easing worries over the banking crisis in the US may support risk assets at lower levels. Traders may look out for ISM manufacturing PMI data from the US. Investors may remain cautious ahead of RBI’s monetary policy decision and US jobs market report later this week. USDINR spot price is expected to trade in a range of Rs 81.60 to Rs 82.80 in the near term.