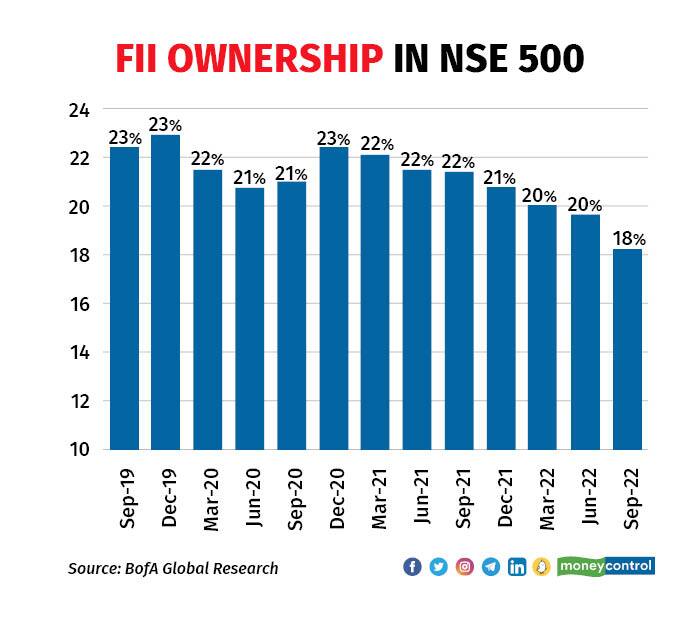

Foreign institutional investors have sold Indian equities worth $28 billion since October 2021, when the Nifty touched its previous all-time high of 18,604. FII ownership in NSE 500 has touched a multi-year low of 18 percent versus 23 percent in 2019, as per data compiled by BofA Global Research.

“A protracted recession in the US could mean FII outflows will continue for longer, however incremental outflow is limited,” the brokerage said.

While China's reopening is feared to eat into India-bound funds flow in 2023, Amish Shah, the head of India equity research at Bank of America Securities, differs.

“India and China do not compete for emerging market (EM) allocation and they are directionally linked. Flows into the EM basket would imply inflows to India,” he argued at a media roundtable.

Following this year script, domestic investors will come to the rescue of the Indian markets next year as well, it is believed. BofA estimates imply a $20- billion inflow into equities from provident fund, pension fund, insurance funds and SIPs.

This could push Nifty valuations further up, the foreign brokerage said. The benchmark is now trading at 20.7x against its long-term average of 18.8x one-year forward earnings of current Nifty constituents.

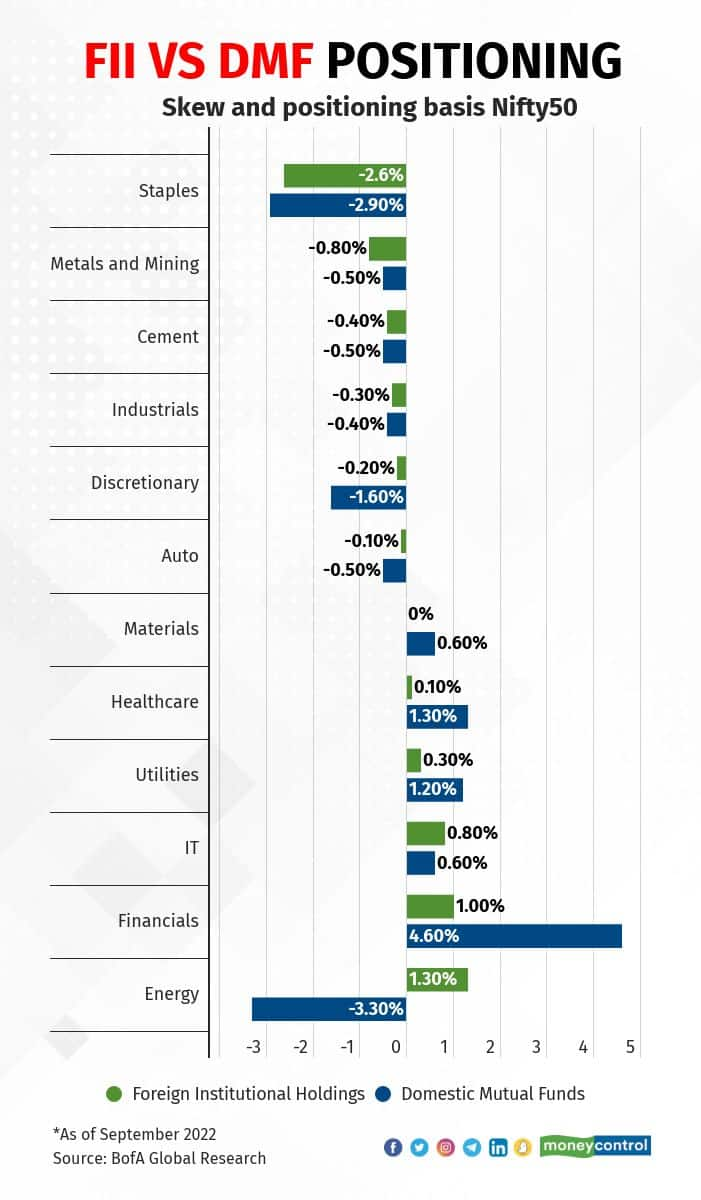

FII versus DMF positioning

Despite the selling this year, foreign investors remained most overweight on financials and information technology. They are materially underweight on staples. Domestic mutual funds remained most overweight on financials, healthcare, telecom and are underweight on energy and staples.

Given this underweight positioning of both FIIs and DMFs in staples, coupled with rural recovery on cards, BofA Securities is bullish on the sector for 2023. It believes staples could witness higher inflows next year.

And, despite the overweight positioning of both FIIs and DMFs in financials, the foreign brokerage remains positive on the pack on back of stronger asset quality and earnings visibility.

Meanwhile, the slightly overweight positioning of FII in the IT sector has potential to reduce further, believes BofA Securities. “Valuations at 24x versus average of 19x don’t give us any comfort,” said Amish Shah.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.