Aditya Agarwala

YES Securities

The Nifty continues to form higher highs and higher lows and closed at a fresh high. It is approaching the upper end of the rising channel placed at 11,830-11,850 levels. A sustained trade above 11,770 can extend the current upmove towards 11,850-11,925. However, a trade below 11,650 can trigger profit booking and can drag the index lower to 11,550, which is also the lower end of the channel.

Moreover, a close below 11,550 will trigger a breakdown from the channel which can lead to a correction to 11,500-11,400 levels. The relative strength index is comfortably placed in the bull zone which suggests further upside to 11,850-11,925 levels.

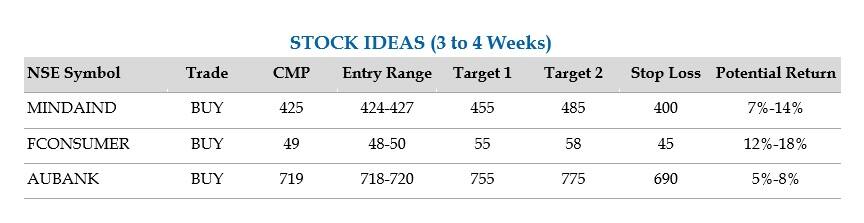

Here is a list of three stocks that could return 5-18 percent in the next 3-4 weeks:

Minda Industries Limited: Buy| CMP: Rs 425| Target: Rs 455-485| Stop Loss: Rs 400| Return 7-14%

On the daily chart, Minda Industries Ltd. (MINDAIND) is on the verge of a breakout from a Triangle pattern (as indicated on chart) neckline placed at Rs 430.

A breakout above Rs 430 with healthy volumes can resume the uptrend taking it to levels of Rs 455-485. On the daily chart, it continues to form higher highs and higher lows affirming strong bullishness dominant in the stock.

Currently, the stock is on the verge of a breakout from the neckline of an Ascending Triangle pattern neckline placed at 455.

Moreover, RSI turned upwards after taking support at the lower end of the bull zone i.e. 40 level suggesting higher levels in the coming trading sessions. The stock may be bought in the range of 424-427 for targets of 455-485, keeping a stop loss below 400.

Future Consumer Ltd: Buy| CMP: Rs 49| Target: Rs 55-58| Stop Loss: Rs 45| Return 12-18%

On the daily chart, Future Consumer Ltd. (FCONSUMER) is on the verge of a breakout from a wedge pattern triggering a resumption of the uptrend on cards.

A sustained trade above 50 will extend the uptrend to levels of 55-58. Further, on the weekly chart, it has turned upwards after taking support at the 100-DMA indicating that the bullishness is intact in the stock.

The RSI has turned upwards after forming a double bottom suggesting extended bullishness in the coming trading sessions. The s tock may be bought in the range of 48-50 for targets of 55-58, keeping a stop loss below 45.

AU Small Finance Bank Ltd: Buy| CMP: Rs 719| Target: Rs 755-775| Stop Loss: Rs 690| Return 5-8%

On the daily chart, AU Small Finance Bank (AUBANK) has broken out from a bullish wedge pattern affirming bullishness building up in the stock.

Further, the stock has turned upwards after forming a positive reversal on the daily chart suggesting higher levels in the coming sessions. The RSI is also placed in the bull zone.

The stock may be bought in the range of Rs 718-720 for targets of Rs 755-775, keeping a stop loss below Rs 690.

Disclaimer: The author Technical Analyst at YES Securities (I) Ltd. The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.