When the rupee depreciates, export-oriented sectors stand to benefit as exporters get more of the currency when they convert.

This textbook narrative might not hold true this time around. Analysts highlighted that the currency's status is comparable to last year, and unless there is a significant further depreciation, there won't be any big winners or losers.

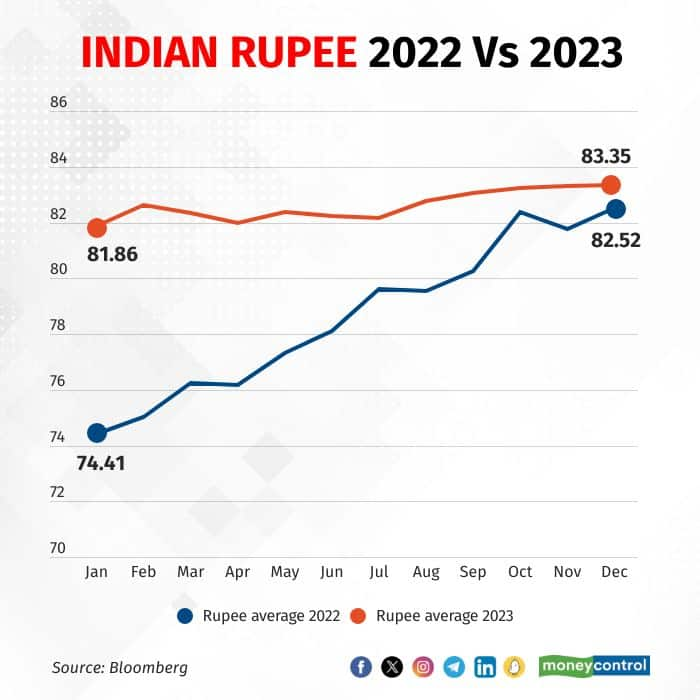

Since September 2022, despite a strong demand for the dollar and a rising trend in the USD/Asia pairs, the spot USD/INR has remained the least volatile and remained within a narrow range of 83-83.40.

The rupee repeatedly hit record lows last month due to persistent pressure. Strong dollar demand from importers drove this weakness despite a supportive macro backdrop. The RBI has taken proactive measures to manage the level and volatility of the rupee, and this trend is expected to continue, traders said.

Pharma companies generate 30-35 percent of their revenue from the US and Europe. Hence, a depreciation of the rupee will be a positive for the sector. However, given that the change in the rupee has not been significant, the impact too is unlikely to be major.

"Moreover, a lot of companies in the pharma sector hedge their currency bets. So, in the current setup when the decline has not been significant, the positive impact may also be diminished to a greater extent," said Surya Patra, research analyst at Philip Capital.

Meanwhile, the impact of a weakening rupee can also not be seen as a generalised trend across the pharma sector. That is because several pharma companies also have a sizable dependence on other export markets. To that extent, Patra feels the performance of the currencies in these other markets with regard to the rupee will also remain a key factor.

For the IT sector, which is reeling under demand challenges, the rupee depreciation can provide some breather but only to the tune of 50-100 basis points of margin expansion in the near term. According to Omkar Tanksale, research analyst at Axis Securities, the relief in margin can be offset by higher on-site expenses.

"Due to high inflation in the US, Indian IT companies are paying more to the employees stationed there. Subcontracting costs are also on the rise. So, margin relief on the back of rupee depreciation will only be a benefit in the near term. In the longer term, it all depends on when demand and client spends return," said Tanksale.

According to a Kotak Institutional Equities analysis, the commentary of leading global enterprises across verticals does not inspire confidence in a quick rebound in discretionary spending. Cost reduction is at the front and centre for a large number of enterprises across sectors, with cost-saving targets that extend well into CY2024.

OMCsFor oil marketing companies (OMCs), a depreciating rupee means marketing profitability will be negatively impacted while refining profitability, which is dollar-denominated, will see an uptick. So, it is a win-lose situation. "Every Re 1 change has a 70 paise impact on the marketing side," said Avishek Datta, oil & gas analyst at Anand Rathi.

"The exact split between the two is difficult to ascertain. In Q1, the marketing segment was strong while in Q2, the refining segment was strong. Net-net, rupee depreciation might be mildly negative for OMCs," said Datta. Ahead of elections, the Street does not expect pump prices to come down.

MC Explainer | Rupee at record low: Positive and negative impacts on sectorsThe Singapore Gross Refining Margin (GRM) for Q3TD is at $4.5/bbl, while gross marketing margins for petrol and diesel stand at Rs 8.2/(-0.6)/litre. Analysts expect Singapore GRM to stabilise at $6/bbl over the long term, with OMCs likely to broadly align with this trend in their reporting.

Textile and Chemicals"A weaker rupee has the potential to benefit the textiles and chemicals industry, particularly with sustained demand from key markets. Currently, India holds the sixth position in global textile exports," said Kranthi Bathini, director, equity strategy, WealthMills Securities.

Some textile companies, like Gokaldas Exports, derive over 70 percent of revenue from the US market alone. Similarly, chemical companies, especially those focused on specialty chemicals, have a sizable presence in the US market.

However, the sector is suffering from sluggish demand, primarily in the export markets due to an increased inflow of low-cost Chinese inventory, which has kept sales for Indian chemical companies under pressure.

On the other side, most of the Indian chemical players are undergoing a phase of capacity expansion. This is adding more pressure on margins. With both margin and sales under pressure while the rupee remains at levels comparable to last year, analysts do not foresee any major relief coming for chemical players.

The decline in the rupee is not significant enough to lift the margins of chemical players yet, believes Patra.

While rupee depreciation can be a positive for these exporters, the persisting macroeconomic challenges diminish its impact. Slowdown in the US has resulted in lean demand from major brands for textile companies and Indian chemical companies are bearing the brunt of Chinese dumping.

Also Read | Why is the Indian rupee a grinch in a Christmassy market?Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.