Shares of India’s largest paints maker, Asian Paints, have staged a sharp rebound over the past month, surging more than 22 percent after sentiment around the business turned positive following a management churn at key rival Birla Opus and September quarter earnings prompting bullish commentary from analysts. While the Street believes competition may stay intense, some are of the view that for Asian Paints, it may no longer be as disruptive as previously feared.

What led to the bearishness on Asian Paints?When Aditya Birla Group’s flagship company Grasim Industries announced its paints foray through Birla Opus in February 2024, analysts had feared loss of market share for the incumbents, mainly Asian Paints. Shares of Berger Paints and Asian Paints have fallen around 5 percent and 16 percent, respectively, since 2024, and are still below the highs of last year.

Kumar Mangalam Birla’s ambitious Rs 10,000 crore investment plan for Birla Opus aimed to replicate the successful distribution model of the group’s flagship cement firm UltraTech in the paints business.

Fears of competitive intensity squeezed the sales growth and profitability for established players, which was made worse by a weak demand environment, leading to a muted FY25 for the paints industry. Asian Paints CEO Amit Syngle went on to say that demand during FY25 were possibly the weakest in over past two decades. The company had never seen any financial year with negative growth so far.

The key disruptor, Birla Opus, had managed to chip away at rivals’ market share while charging the same price as Asian Paints. This even prompted smaller competitors to cut prices to retain market share, impacting their margins. The weak sentiment reflected in the share prices too, as Sell ratings piled up.

However, the on-ground situation seems to be turning for the better, according to some experts.

Asian Paints: Turnaround storyEarlier in November, Grasim Industries announced that the Birla Opus CEO Rakshit Hargave has parted ways with the company after a four-year stint, and will pursue a fresh opportunity at fast-moving consumer goods major Britannia Industries.

This triggered some relief for the shares of rival paint makers, especially Asian Paints. Brokerages said Hargave’s sudden exit could impact Birla Opus’ aggressive growth plans, with Jefferies calling the exit a ‘negative surprise’ that would lead to a cautious near-term sentiment.

ICICI Securities too said that Hargave’s exit would hurt the prospects of Birla’s relatively young paints business. “While we expect Birla group to announce a successor soon, we believe the exit of the chief architect will have a potential effect on near medium-term growth prospects,” said ICICI Securities.

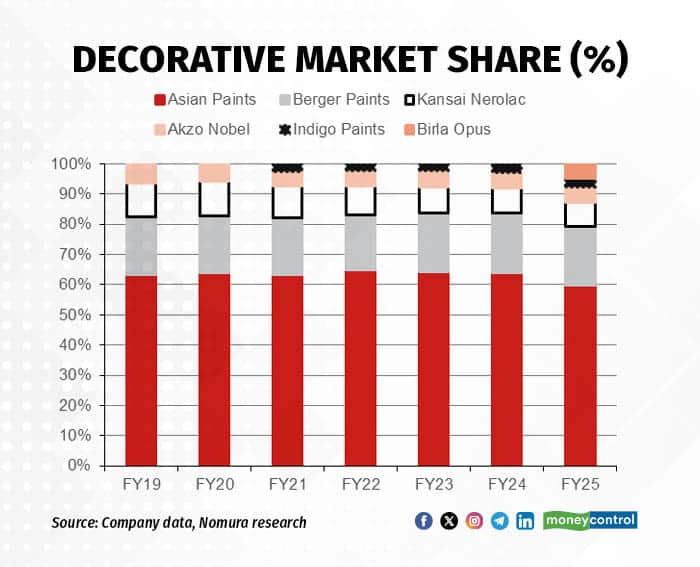

Despite fears of a major disruption by the entry of a strong, pedigreed rival in Birla Opus, any major shift in market share has failed to materialize, and legacy players have maintained their moat. Not just the management churn at Birla Opus, but a nascent demand recovery too has led to a positive sentiment for the paints segment.

Nomura said in a recent note that the impact of weak demand and rising competitive intensity has had a minor impact. For Asian Paints and Berger Paints, the impact on margins was just about 200 and 100 bps respectively, well within their long-term normative band.

“…there has not been any major disruption on product prices, dealer margins or company margins thus far when it ideally could/should have been at its peak during the launch/expansion phase,” Nomura added. Incumbents may also heave a sigh of relief as Birla Opus achieved its target of 50,000 dealers but in the process has exhausted the initially projected investment of Rs 10,000 crore.

While Birla Opus has scaled up faster than any other paint rival historically, gaining mid- to high-single-digit market share, Nomura’s survey has indicated that the parabolic growth has moderated over the past few months, implying that easy pickings from a distribution bump up are likely behind.

Birla Opus saw a sequential decline in sales for the September quarter, not entirely expected, especially given its smaller base. Paint dealers too have started to return to their original suppliers as the margins and sales throughput offered by Birla Opus were insufficient.

“We believe with the major investments and distribution reach being behind us, competition will be gradual going forward and impact of growth/share gains will be more measured, if any,” added Nomura.

Has the Storm Passed?Citing no substantial impact on sales and margins despite a large investment by Birla Opus, Nomura is looking at this as a re-rating trigger for the sector. Even though the competitive intensity may stay high, Nomura believes it will be healthy for the sector, and not disruptive.

For Q2FY26, Asian Paints posted a 43 percent jump in consolidated net profit, soaring to Rs 994 crore, beating analysts’ expectations. What would be heartening for the shareholders is that the gains have came on the back of double-digit volume growth and 6 percent value growth.

Asian Paints is now focusing on its core business drivers, with additional investments in branding, innovation, services, regionalisation, B2B segment and backward integration. Sensing a turnaround, brokerages have rushed to hike their target prices on the share, with some even upgrading their rating.

Motilal Oswal said in a recent note that while the competitive intensity remains elevated, the demand environment is stabilizing. With the peak of disruption behind, some experts believe Asian Paints may well be on its way to steady growth, defending its market leadership.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.