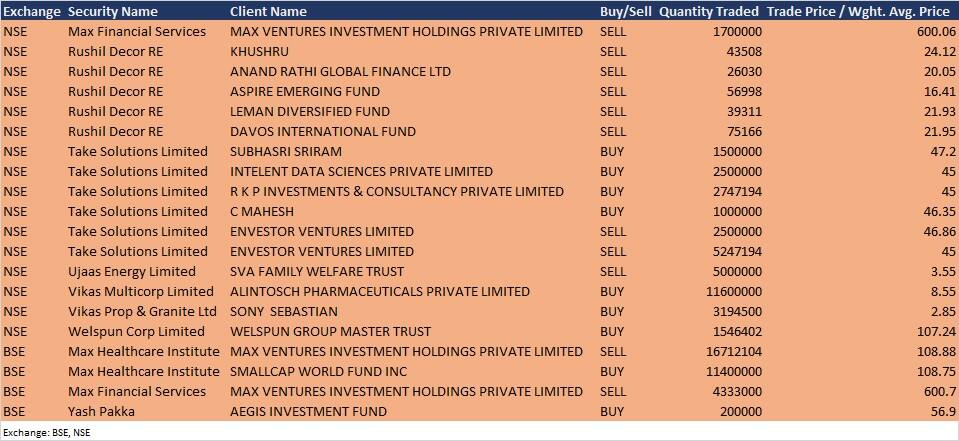

Promoter entity Max Ventures Investment Holdings has offloaded a 2.2 percent equity stake in Max Financial Services via an open market transaction on September 28.

Max Ventures sold 17 lakh shares in the company at Rs 600.06 per share on the NSE and 43.33 lakh shares at Rs 600.7 per share on the BSE, the bulk deals data available on the exchanges showed.

Total shares constituted 2.2 percent of the total paid equity of Max Financial. Max Ventures held a 28.15 percent equity stake in the company as of June 2020.

Max Ventures Investment Holdings also sold 1,67,12,104 shares in Max Healthcare Institute (representing 1.84 percent of the total paid-up equity) at Rs 108.88 per share on the BSE. Promoter Max Ventures held 11.35 percent shareholding in the company as of June 2020.

However, Small World Fund Inc acquired 1.14 crore equity shares in Max Healthcare (representing 1.26 percent of paid-up equity) at Rs 108.75 per share.

Among other deals, promoter entity Welspun Group Master Trust has bought 15,46,402 shares in Welspun Corp at Rs 107.24 per share on the NSE.

Khushru sold 43,508 rights entitlement shares of Rushil Decor at Rs 24.12 per share, Anand Rathi Global Finance 26,030 shares at Rs 20.05 per share, Aspire Emerging Fund 56,998 shares at Rs 16.41 per share, Leman Diversified Fund sold 39,311 shares in the company at Rs 21.93 per share and Davos International Fund 75,166 shares at Rs 21.95 per share on the NSE.

Promoter Envestor Ventures has offloaded the entire 5.24 percent stake in Take Solutions via two block deals on the NSE. Envestor sold 25 lakh shares of Take at Rs 46.86 per share and 52,47,194 shares at Rs 45 per share.

On the other side, Subhasri Sriram bought 15 lakh shares in Take Solutions at Rs 47.2 per share, Intelent Data Sciences 25 lakh shares at Rs 45 per share, RKP Investments & Consultancy 27,47,194 shares at Rs 45 per share and C Mahesh 10 lakh shares at Rs 46.35 per share on the NSE.

SVA Family Welfare Trust sold 50 lakh shares in Ujaas Energy at Rs 3.55 per share on the NSE, while Alintosch Pharmaceuticals acquired 1.16 crore shares in Vikas Multicorp at Rs 8.55 per share on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.