With Nvidia Corp. due to report an unusually complex quarter as the world’s most valuable company, traders are preparing for a potentially mammoth stock swing.

The options-implied move for Nvidia shares the day after earnings is about 8% in either direction, according to data compiled by Bloomberg. That would equate to close to a $300 billion swing in market value — bigger than all but 25 companies in the S&P 500 Index. And according to strategists at Bank of America, the report carries more risk for the benchmark than the next Federal Reserve meeting or inflation data.

As the poster child of the artificial intelligence trade, Nvidia has been the biggest event on the earnings calendar for more than a year. But for the chipmaker’s fiscal third quarter, due on Wednesday after the market close, there’s more uncertainty than normal about how the results and guidance will play out.

That’s because there are varying views on Wall Street about what to expect from the company’s newest product line, Blackwell. Nvidia has said that the new chips will contribute several billion dollars in revenue in the fiscal fourth quarter, while Chief Executive Officer Jensen Huang described demand for the chips as “insane.” But production delays have made modeling supply — a notoriously difficult task — even harder.

“There’s a big unknown around Blackwell capacity,” said Dan Eye, chief investment officer at Fort Pitt Capital Group. “The CEO has established a lot of credibility, but the bar is very high,” he said, adding that it will likely be challenging for Nvidia to give blowout guidance for next quarter.

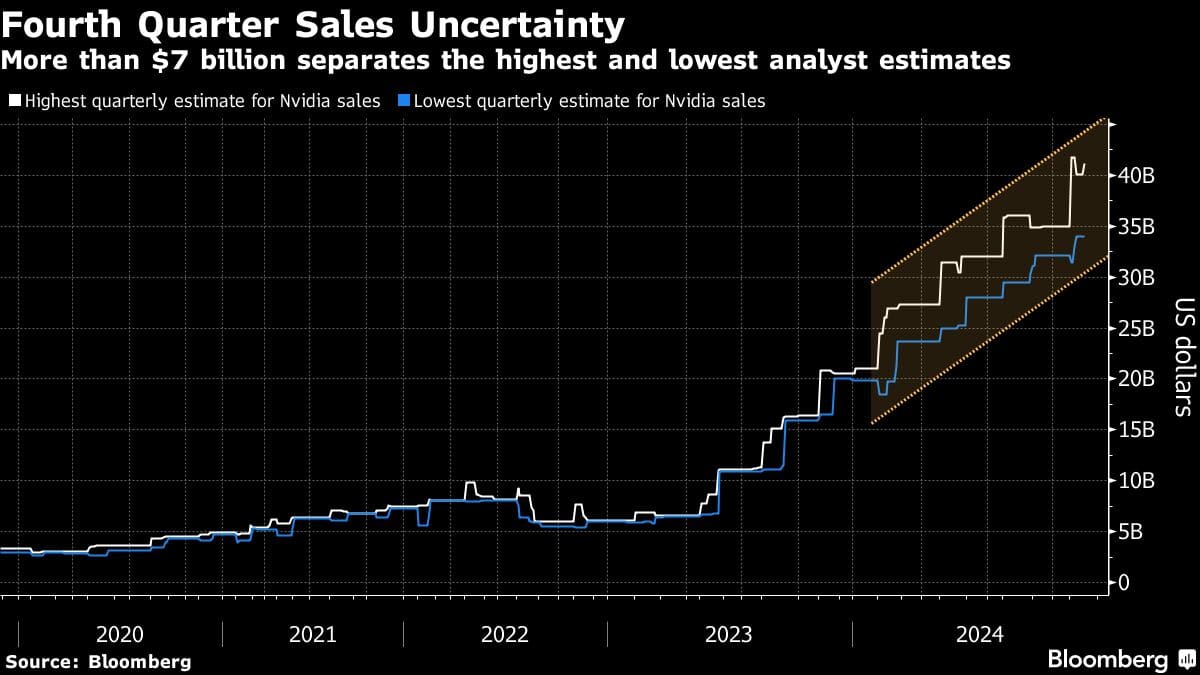

The questions around Blackwell have led to a wide spread in analyst expectations for the fiscal fourth quarter that ends in January. Consensus is at $37.1 billion — with the gap between the highest and lowest projections at more than $7 billion, according to estimates compiled by Bloomberg. Nvidia typically provides revenue guidance for the upcoming quarter with its results.

Part of the reason for the gap in analyst forecasts is that some expect customers to delay purchases of Blackwell’s predecessor products, called Hopper, in anticipation of the newer chips.

That’s what Morgan Stanley analyst Joseph Moore is anticipating and why he’s calling Wednesday’s results a “transitional” quarter. Nvidia is likely to give a conservative forecast that’s only slightly ahead of the average analyst estimate, which should satisfy most investors as long as everything points to a very strong full-year Blackwell ramp, Moore wrote.

Jim Worden, chief investment officer of Wealth Consulting Group, is also less concerned about the timing of Blackwell, with all signs pointing to strong demand.

“I expect we’ll see a very good showing with Blackwell and how much it is shipping,” he said. “That trend should continue on into next year.”

The chipmaker’s biggest customers, including Microsoft Corp., Alphabet Inc., Amazon.com Inc. and Meta Platforms Inc., all pledged in their most recent results to pump more into capital spending in the year ahead.

However, with a history of beating estimates in a big way, thanks to unbridled demand for its accelerator chips, Nvidia may need to do more than provide assurances that Blackwell’s ramp up remains strong. In the past five quarters, Nvidia sales have beaten consensus by an average of about $1.8 billion, according to data compiled by Bloomberg.

If Nvidia results fall short of that bar, it could spell trouble for the stock, which is trading close to a record high after nearly tripling this year.

“The stock could be volatile, even on a really good report,” Worden said. The market may be expecting perfection, “and to the extent it isn’t perfect, the stock could pull back.”

Rick Bensignor, chief executive officer of Bensignor Investment Strategies and a former Morgan Stanley strategist, agrees.

“It can’t just beat the consensus, but also the whisper-type numbers that people are looking for,” he said. “If it disappoints, we can easily see it come off 10% or so.”

For the broader market, the implications of Nvidia’s results might not have been fully priced in, said Charlie McElligott, Nomura’s cross asset strategist at Nomura. Option straddles on the Invesco Nasdaq 100 ETF are only implying a 1.7% move for Thursday. “That maybe ‘feels’ light,” McElligott wrote.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.