The Indian market rose to record highs in June with over 17 percent gain so far in the year 2017, but many silent warriors might have gone unnoticed.

Nearly 100 stocks which were trading less than Rs 100 at the start of the year 2017 more than doubled investors wealth so far in the year with gains of up to 700 percent.

They might not have a place in Sensex or Nifty and certainly can’t be called Bahubalis of D-Street but they have certainly made money for investors in a matter of just six months.

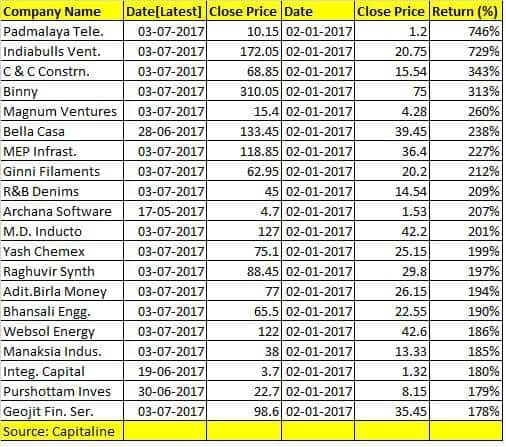

Two-digit stocks which more than doubled investors’ wealth so far in the year 2017 include names like Padmalaya Telefilms, Indiabulls Ventures, MEP Infrastructure, Aditya Birla Money, Indiabulls real Estate, Geojit Financial Services, etc. among others.

Padmalaya Telefilms and Indiabulls Ventures rose more than 700 percent while C&C Construction and Binny rose over 300 each so far in the year 2017.

Single digits stocks with low market capitalisations are often termed as penny stocks, but not all two-digit stocks can be termed as penny stocks, suggest experts. Although risk factor is high at the same time it could reward investors.

“Not all two digit stocks can be considered as penny stocks. The term “penny stocks” conventionally refers to stocks that are very lowly priced, but a practical classification would be to consider them as stocks which are trading below face value,” Anand James, Chief Market Strategist at Geojit Financial Services told Moneycontrol.

“While every investment action has an element of speculation, when it comes to penny stocks, the investment motive is close to zero, and as it becomes a speculative act. It is possible that such a trade might end up lucrative, and it is equally certain that the risk is commensurately high,” he said.

Most analysts will advise you not to venture into penny stocks or two-digit stocks largely because of two basic reasons -- a) they have low liquidity and b) lack of public information.

Most of these stocks are not tracked by analyst community which makes it difficult for investors’ to take a call especially for the ones who don’t have prior experience of investing.

If investors are willing to take the risk with the small amount of their capital, the risk could be huge. Let’s take an example – Indiabulls Ventures was quoting at Rs20 at the start of the year 2017 and if you have taken 100 shares the total investment would not be more than Rs 2000.

The total amount you invest is just meagre Rs2,000. If the stock loses value, your maximum loss is limited to Rs2000 but if it gains, it is unlimited. In this case, the market value rose to Rs17,200 in just six months which translates into a gain of over 700 percent.

“The word penny itself is like a two-faced sword which if used intelligently may reward while on the other hand, it may hurt the overall capital of investors if not used wisely,” Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

The problem starts when investors or traders take penny stocks as psychologically something which is cheap and holding on to the same may give good rewards which is certainly not the right way to look at them.

“Penny stocks can also be stocks which have beaten down due to compliance, high debt, etc. while others can be emerging gems which may be transforming the business model and certainly achieve the same if got it right,” said Mustafa.

He further added that it is prudent to say that penny stocks does give an opportunity for smart investors but should never be looked as something which is available cheap as otherwise, it may turn out to be a trap.

Things to consider while choosing a two-digit stock:

While choosing to invest in a two-digit stock, one must look at business cycle, management, vision and market place of products/services etc, suggest experts.

Nadeem of Epic Research advises investors to do their own research before putting their money in such stocks such as management vision, product portfolio etc. among other things.

“That is something that should be of critical concern since price is not the point of concern as it is already cornered as a "penny". But, overall growth of price is something investors expect,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.