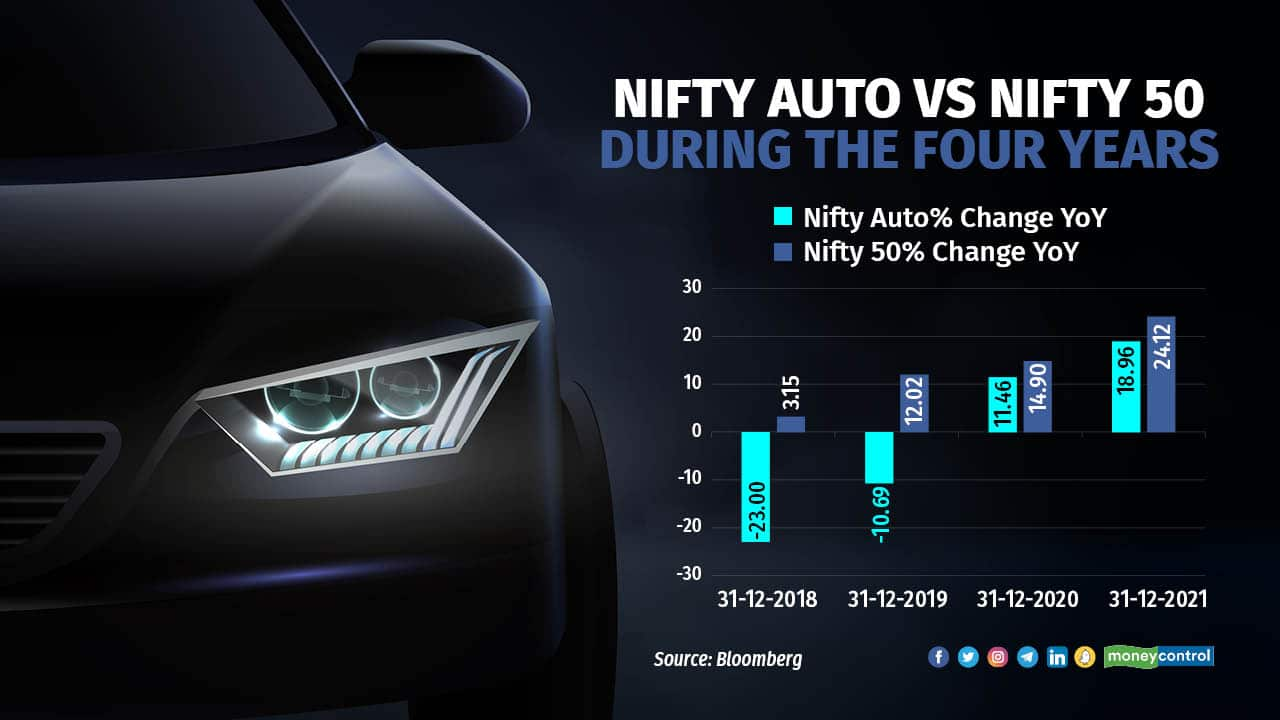

After four tumultuous years, the Nifty Auto index has finally bounced back and outperformed the Nifty 50 index. The four-year underperformance, Jefferies says, was largely due to a regulatory cost push and financing issues, which were later compounded by the coronavirus pandemic and a sharp rise in commodity prices during the 2018-2021 period. Interestingly, the underperformance ended eight years of the index consistently surpassing the Nifty 50.

However, analysts at the global brokerage house believe that an improvement in the demand and margin trajectory, along with a good product cycle for several companies, are some of the key reasons for this change in momentum. As per data, the Nifty Auto Index has gained 36 percent as against the 5.6 percent gains of the Nifty 50 in 2021-2022.

Follow our market blog for all the live action

Earnings projection giving stocks a boost

The performance of the stocks that Jefferies is looking at is mostly influenced by how much money these companies are expected to make in the coming year. For example, in the case of Tata Motors and Ashok Leyland, the returns on their stocks for this year so far are mainly driven by what the market expects them to earn in the coming quarters.

"For Tata Motors and Ashok Leyland, the current year-to-date returns are entirely led by earnings outlook while one-year forward PE or price to earning ratios have contracted in 2023," Jefferies analysts said in a recent note.

The analysts added that even for Maruti Suzuki and Samvardhana Motherson, the earnings outlook has contributed more than 85 percent of stock gains. For Mahindra and Mahindra, up 25 percent since the start of the year, the core earnings and subsidiary value have driven 88 percent of the total returns.

Jefferies predicts auto stocks under coverage to post double-digit EPS over FY23 to FY26.

Valuations seem justified

The analysts are of the view that despite the fact that FY24-based multiples are not cheap for most stocks any longer, FY25-based valuations on their estimates are still in line or are below long-term averages for most stocks. “We find this reasonable in the context of the expectation of strong double-digit earnings CAGR across our coverage over FY23-26E,” they wrote.

Currently, Jefferies has assigned a buy rating on 9 of the 11 auto stocks under its coverage, with TVS Motors as its top pick. It has projected that cyclical demand recovery, good product capabilities in scooters and premium bikes, and scope for further margin expansion would be key growth levers for the two-wheeler giant in the coming quarters.

Jefferies also has a buy rating on Maruti Suzuki. India’s passenger vehicle (PV) market is recovering from its worst downturn in four decades. “We believe the industry is on the cusp of a replacement cycle, too,” analysts wrote. PVs offer a healthy long-term growth outlook given the low penetration and high aspiration levels in the country. New sport utility vehicle (SUV) launches such as Invicto and Jimny should help arrest the fall in market share, the report added. Healthy volume growth and margin recovery should drive strong earnings growth over FY23-26E.

Stable margins

Brokerage firm Axis Securities, in its report, added that margins for auto companies are expected to remain stable in FY24 or even improve, going forward. “This will be led by a richer product mix, higher realization, and positive operating leverage,” it noted. Raw material costs have remained largely benign over the last few months, Axis Securities analysts said.

The report also said that two-wheeler volumes will be sustained at current levels, led by vehicle launches, especially in the premium category. “Moreover, we expect the Premiumisation trend to continue in FY24/25. In FY23, 2W domestic sales grew by 17 percent YoY to 15.9 million units. A low base of FY23 is expected to support modest growth in the domestic volumes of the 2W industry to the tune of 6-9 percent YoY in FY24,” the report added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.