CNBC-TV18

Raamdeo Agrawal, co-founder of Motilal Oswal financial services, has written a letter to investors on how to evaluate the damage to stocks in cases of extreme price movement to the downside and how to assess its place in your portfolio.

Agrawal also has written extensively about investor strategies.

“Every investor is a value investor so you have to chase the value and not the price. Price will keep moving up and down. The loss is in the price, not in value,” Agrawal said.

"Our investments will be chosen on the basis of value, not popularity," he wrote.

Here is the full text of Raamdeo's Agrawal's letter to investors:

Dear investor friends,

Over the last 3 years, the Nifty Midcap Index (12% CAGR) has outperformed the Nifty (8% CAGR). However, 2018 year to date, the Midcap Index is down 14%. Thus, several Midcaps have seen prices fall by over 25% in a matter of just six months. So, what should the investor do in such a situation?

I address this using the concept of Permanent Capital Loss and Quotational Loss.

Permanent Capital Loss versus Quotational Loss

In his 1962 letter to partners of Buffett Partnership, Warren Buffett writes –

"I cannot promise results to partners. What I can and do promise is that –

“I cannot promise results to partners”

Investors would do well to understand this fundamental truth about equity investing – there is no guarantee not only of returns, but even safety of the capital invested. Equity investors need to be more skillful than the market to ensure safety of capital and reasonable return on investment. Risk-averse investors should invest primarily in bank fixed deposits, and that too of credible banks!

“Our investments will be chosen on the basis of value not popularity”

It is said that, in stock markets, most people know the price of everything but the value of nothing. As Warren Buffett himself has said, “Price is what we pay, Value is what we get.” Thus, before investing in any stock, it is most important to have a clear idea of its value. Mere popularity of a stock is no guarantee of its investment performance.

“We will attempt to bring risk of permanent capital loss (not short term quotational loss) to an absolute minimum”

This is the core of the quote. There are two kinds of risk associated with any stock –

Permanent Capital Loss; and

Quotational Loss.

Permanent Capital Loss

Permanent Capital Loss refers to a massive fall in stock price because the value of the underlying business is significantly eroded. The proxy for value is a company’s profits and profitability. Value erosion (i.e. lower profits), and hence, Permanent Capital Loss in a stock may happen due to a variety of reasons, both industry-specific and/or company specific.

Major reasons for Permanent Capital Loss

| Industry-specific | Company-specific | |

| · Disruptive competition · Emergence of a new substitute · Change in government regulation(e.g. price regulation, import duty changes, etc) | · No clear growth strategy · Mega acquisition gone wrong · Mismanagement or Fraud · No – or weak – succession plan |

Unlike Permanent Capital Loss, Quotational Loss is merely a short-term fall in the stock price with the underlying value broadly intact. Some reasons for

Quotational Loss are –

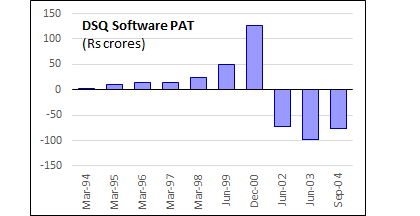

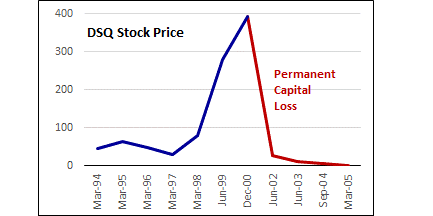

Consider two companies from the same sector, IT – DSQ Software and Infosys. The profits and stock price of both companies hit a high around year 2000, led by the Y2K opportunity and dotcom boom. Post the bust, stock price of both companies collapsed. However, DSQ went into oblivion – it reported huge losses, its stock price never recovered, and the company ended up getting de-listed. Thus, there was a Permanent Capital Loss.

Value erosion (i.e. profit collapse) in DSQ …

… led to Permanent Capital Loss in its stock

In contrast to DSQ Software, Infosys’ profit went from strength to strength. As a result, its stock price recovered within two years of the dotcom bust, and soon cross the previous high. Thus, there was only a Quotational Loss.

In effect, the sharp 50% fall in stock price was a great opportunity to buy Infosys in March 2002 at P/E of 31x versus P/E of 206x in March 2000.

Sustained Value creation (i.e. profit generation) in Infosys … … meant the stock price drop was only a Quotational Loss

“… by obtaining a wide margin or safety in each commitment and a diversity of commitments”

Coming back to Buffett’s quote, there are two ways to avoid Permanent Capital Loss –

At the individual stock level – By building in a wide margin of safety i.e. value significantly higher than price; and

At the portfolio level – By using the principle of diversification i.e. owning a basket of stocks. This way, even in the unlikely event of a Permanent Capital Loss in any stock, the impact on the portfolio is muted.

“My wife, children and I will virtually have our entire net worth in the partnership”

This part of Buffett’s quote is not related to the topic of Permanent / Quotational Loss. Rather, it refers to an important concept called “Skin In The Game” i.e. in any active, what is the level of a person’s participation in both the gains and losses.

This topic merits a separate discussion in itself. For now, there are two key implications for investors –

Choice of companies to invest in: Investors are generally better off investing in companies where the management has high Skin In The Game i.e. management fortunes are closely linked to fortunes of the company. This is typically so in owner-managed companies or where the senior management has a significant level of compensation by way of stock options.

Choice of portfolio manager: Those investors who choose to invest via mutual funds are better off checking whether their portfolio manager has high Skin In The Game. The question to be asked is – Does the portfolio manager stand to lose if I lose value in my portfolio? If the answer is yes, your money is in fairly safe hands.

In conclusion …

We come back to where we started – Several Midcaps have seen prices fall by over 25% in a matter of just six months. So, what should the investor do in such a situation? The answer –

Raamdeo Agrawal

Chairman

Note: The source of all data used in this bulletin is MOAMC internal analysis, unless otherwise mentioned.

Disclaimer

This bulletin has been issued to explain our investment philosophy. The information contained in this document is for general purposes only and should not be construed as investment advice to any party. Readers shall be fully responsible / liable for any decision taken on the basis of this bulletin. Past performance may or may not be sustained in the future. This bulletin is not for circulation in general and is meant for intended recipient only. The bulletin does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in

such statements.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Disclosure: Motilal Oswal is is one of the four launch partners of CNBCTV18.com.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.