Dear Reader,

Traders, especially in the US, view September with dismay. Historically, it has been one of the worst-performing months for stocks, with the S&P 500 averaging a 0.7 percent loss since 1950. Over the past four years, the index has recorded notable declines in September—down 4.9 percent, 9.3 percent, 4.8 percent, and 3.9 percent, respectively. This year has followed suit, with markets starting on a negative note. In the first week of September, US markets slipped, pulling global markets down with them.

Indian markets also experienced selling pressure, with the benchmark indices closing 1.5% lower for the week despite reaching new all-time highs earlier. The broader market fell in sync, with Friday seeing a steep decline across all sectors, closing in the red. However, Indian markets proved more resilient, recording the smallest fall globally for the week.

Despite Friday's steep decline, Indian markets performed the best globally during the week. In contrast, the U.S. markets saw their worst weekly performance in 18 months. The S&P 500 was hit hard, led by a sharp drop in Nvidia, which lost nearly $300 billion in market value amid rumours of a potential Justice Department antitrust investigation. The decline in oil prices also weighed on overall market sentiment. As a result, the Dow Jones dropped 2.93%, the S&P 500 fell by 4.25%, and the Nasdaq plunged 5.77% over the week.

European markets had a tough time as well, with the pan-European STOXX 600 losing 3.52% due to concerns about a global economic slowdown. France's CAC 40 fell by 3.65%, Germany's DAX slipped 3.20%, and the UK's FTSE dropped 2.33%.

Japanese markets were among the worst performers globally, with the Nikkei 225 dropping 5.8% over the week. The decline was driven by semiconductor stocks, which followed the sell-off in the U.S. tech sector. Meanwhile, China's markets also struggled, with the lower-than-expected PMI figures and weak retail sales adding to concerns. As a result, Chinese stocks fell 2.69%, while Hong Kong's Hang Seng Index lost 3.03% during the week.

The Worst May Not Be Over

The Nifty ended the week lower, snapping a three-week winning streak. From a technical perspective, the index formed a bearish engulfing pattern on the weekly candlestick chart. The pattern is seen when prices open higher than the previous week's close but finish below the previous week's open, signalling potential further downside in the coming weeks. The follow-up pattern will be crucial in determining the next move.

The daily swing indicator has finally dropped into the oversold zone in the short term after multiple negative divergences. Should it continue to fall into the lower single digits, it could reach the extremely oversold zone, which may present a bounce-back opportunity. However, at this stage, it's prudent to adopt a wait-and-watch approach and see if the market reaches extreme oversold levels before making any moves.

Daily Swing

Source: web.strike.money

FIIs have steadily reduced their long positions after holding one of the highest levels in years. This creates a negative divergence between the Nifty index and FII positions, a pattern reminiscent of what occurred in September last year. If history repeats itself, the market could see a significant decline as FIIs may fully unwind their long positions and shift towards short positions.

(FII net index futures)

Source: web.strike.money

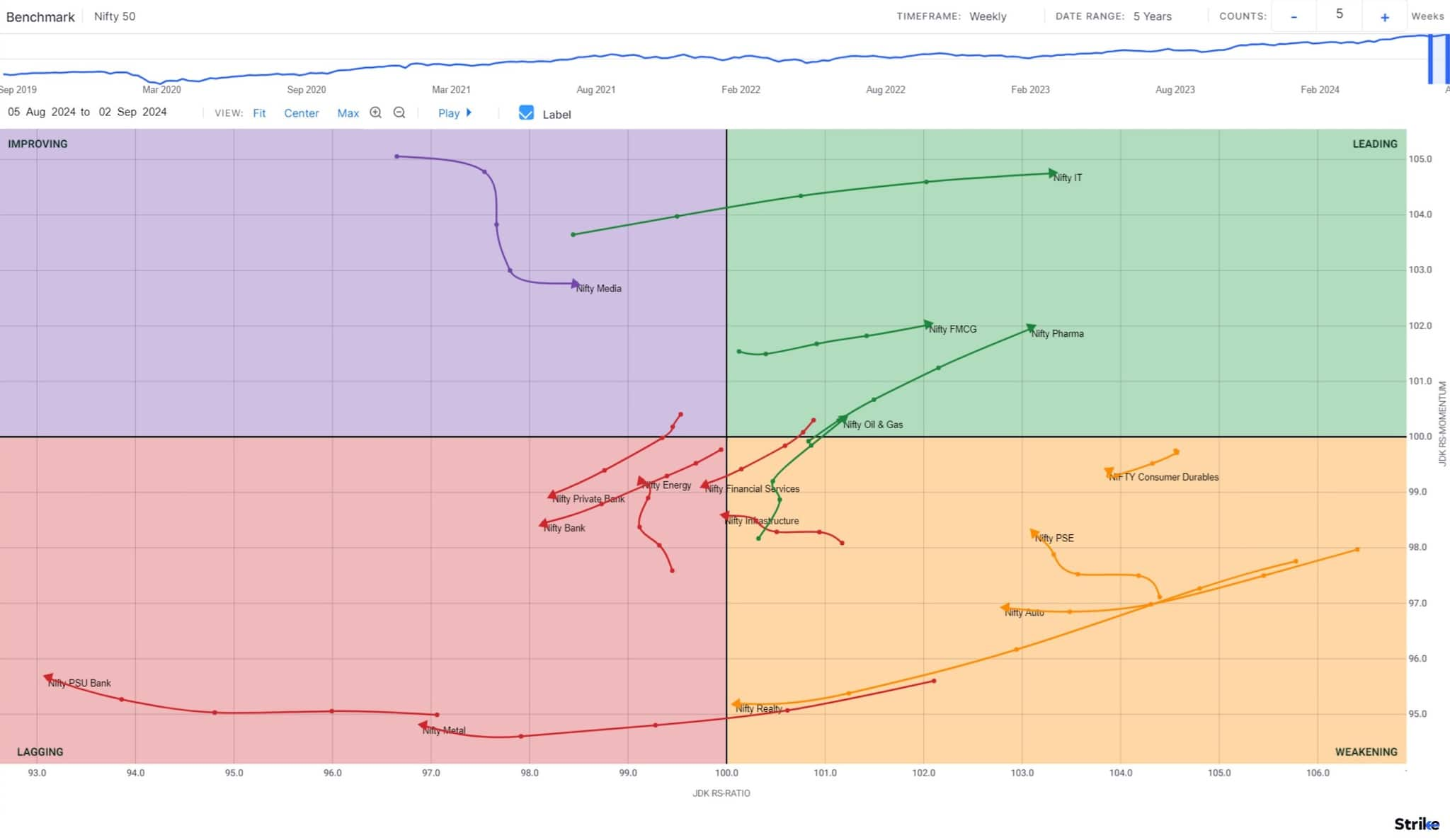

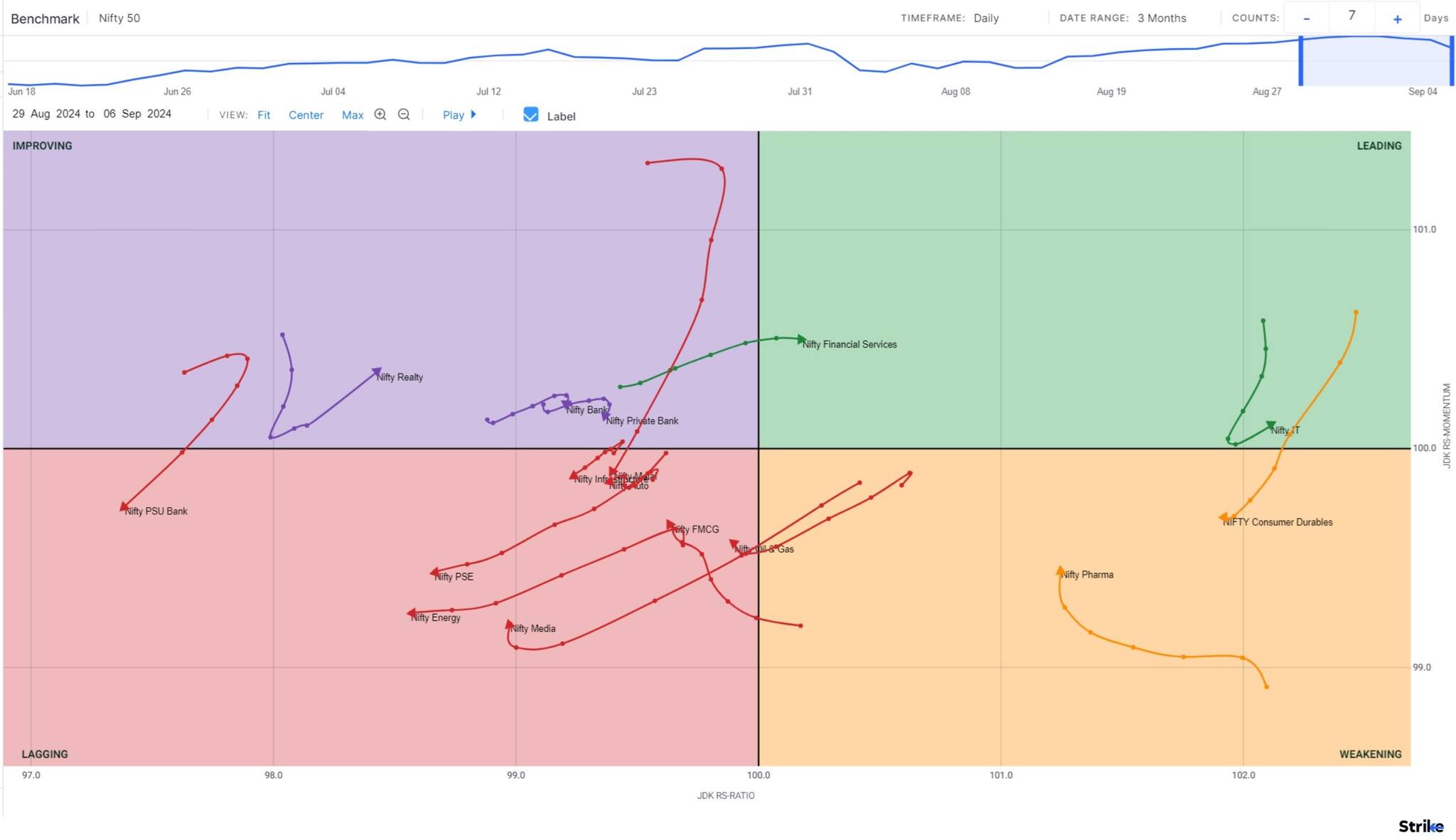

Sector Rotation

The Weekly Relative Rotation Graph (RRG) from India Charts shows that not much has changed in the RRG setup. Defensive sectors like FMCG and Pharma are in the leading quadrant, while Banking, PSU Banks, and metals are in the lagging quadrant.

The Daily RRG shows that the FMCG and Consumer Durables index were the only sector indices to close positive for the week. However, Nifty Consumer Durables lost momentum and entered the weakening quadrant. Though Nifty IT is still in the leading quadrant, it has lost momentum during the week.

Despite being in the weakening quadrant, Nifty Pharma has shown a promising increase in its relative momentum.

Nifty Financial Services outperformed other banking indices and is in the leading quadrant. Nifty Metal saw a huge decline in momentum and entered the lagging quadrant in both the Daily and Weekly timeframes.

Stocks to watch

Among the stocks expected to perform better during the week are MCX, Pidilite, Muthoot Finance, Shriram Finance, M&M Finance, Apollo Hospital, and PI Industries.

Among the stocks that can witness further weakness are IDFC First Bank and RBL Bank.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.