The Indian stock market experienced a pre-budget rally last week, bouncing back from Monday's low to gain nearly two percent. However, the muted reaction on budget day, despite the finance minister's bold announcement of income tax exemption up to Rs 12 lakh per annum, suggests investors are taking a cautious approach.

The true market response may unfold on Monday as participants digest the fine print and react to global market movements. This rally occurred in the face of significant Foreign Institutional Investor (FII) selling, which reached Rs 19,621 crore for the week, bringing the total FII outflow for the year to a staggering Rs 88,702 crore.

Meanwhile, the US markets presented a mixed picture. While the Dow Jones recorded its third consecutive week of gains, there was a sharp correction in Artificial Intelligence-related stocks, particularly affecting the tech-heavy Nasdaq Composite. This downturn was triggered by reports of Chinese AI developer DeepSeek releasing open-source software at a fraction of the cost of U.S. market leaders, causing ripples across the global tech sector. The impact was felt acutely by chip maker NVIDIA, which saw its shares plummet nearly 17 percent on Monday, wiping out about $600 billion in market value.

Adding to the global economic uncertainty, President Trump's second week in office was marked by the announcement of new tariffs on imports from Mexico, Canada, and China, potentially igniting a trade war. This move, coupled with the Federal Reserve's decision to keep interest rates unchanged and adopt a wait-and-see approach regarding future rate cuts, has created a complex economic landscape for investors to navigate.

In Europe, markets showed strength, with the pan-European STOXX 600 reaching an all-time high, buoyed by the European Central Bank's decision to cut rates by 25 basis points to 2.75 percent. This positive sentiment was reflected across major European indices, with Germany's DAX, Italy's FTSE, France's CAC 40, and the UK's FTSE all posting gains.

Asian markets, however, painted a more sombre picture. Japan's Nikkei 225 Index fell by 0.90 percent during the week, affected by the sell-off in US tech stocks and concerns over potential interest rate hikes by the Bank of Japan. China's markets, open for only one day due to the Lunar New Year holiday, faced pressure following reports of declining profits among large Chinese companies for the third consecutive year.

As we look ahead, the market's reaction to the detailed analysis of India's budget, coupled with the global implications of Trump's tariff impositions, will likely dominate investor sentiment.

One thing is certain: volatility is set to remain a constant companion in the short term, as markets grapple with these multifaceted economic and political developments.

This week, the Nifty index has indicated signs of reversal, forming a bullish engulfing pattern on the weekly chart. Many sentiment indicators were already signalling oversold conditions last week. With the current confirmation of price action reversal, bullish momentum could continue for the next few weeks, if not longer.

The percentage of stocks above the 100-day average within the Nifty index is currently hovering at the lower end of its range. Typically, a significant upward movement occurs when this percentage exceeds the 100-day average, particularly when it reaches around the 20 mark. Currently, the reading is at 18 and has dipped as low as 8, indicating extreme oversold conditions.

Historically, even in worst-case scenarios—such as the corrective phase in the first half of 2022—the Nifty index has experienced meaningful recoveries whenever this indicator fell below 20. From a medium-term perspective, 24200 – 24800 will be crucial upside levels to watch as the Nifty index rebounds from these extreme bearish sentiments.

Source: web.strike.money

The Open Interest PCR (OI PCR), a near-term indicator, has started to inch higher, indicating that some bullish sentiment is returning in the short term after the indicator was in the oversold zone for quite some time.

As the OI PCR recovers from the oversold conditions, we should see the Nifty index inching higher in the forthcoming trading sessions. Breaking out from the medium-term resistance line, which is currently around 23850, will give bulls the upper hand.

Source: web.strike.money

After witnessing a positive divergence, the 20-Day A/D ratio has started to recover from the oversold zone where the Nifty index made a lower low, and the 20-Day A/D ratio made a higher low. Between October – November 2024, we observed a similar pattern. When the Nifty index broke out from the falling trendline, it saw a decent up move in the short term. Currently, the Nifty index has broken out from the resistance line. Recovery of the 20-day A/D ratio indicator hints towards a decent up move and a broadening of breadth in the short term.

Source: web.strike.money

Sector RotationThe benchmark Index-Nifty 50 rallied by almost 2% in this 6-day week.

The sectors that showed an increase in momentum on the weekly RRG include Nifty Oil & Gas, Nifty Auto, Nifty FMCG, and Nifty India Consumption. In contrast, a loss of momentum was observed in Nifty PSU Bank, Nifty Private Bank, Bank Nifty, Nifty Financial Services, Nifty IT, Nifty Consumer Durables, and Nifty Media.

Even the Nifty Metal index, which entered the Improving quadrant just last week, took a U-turn and re-entered the Lagging quadrant this week, indicating weakness and underperformance compared to the benchmark Nifty 50.

Source: web.strike.money

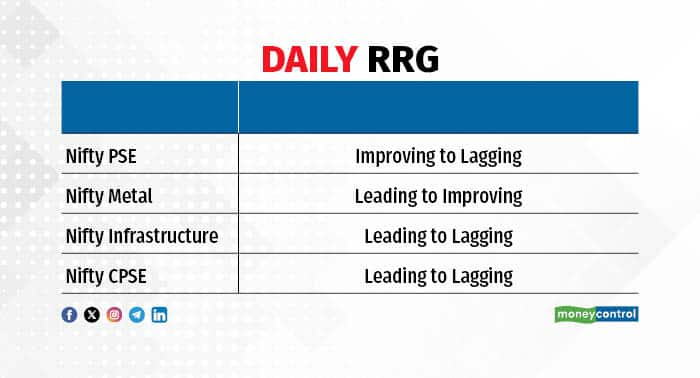

On the Daily Relative Rotation Graph (RRG), there was a significant loss of momentum and underperformance compared to the benchmark in Nifty Infra and Nifty CPSE. These indices dropped directly from the Leading quadrant to the Lagging quadrant on Saturday, which was Budget Day. Similarly, Nifty PSE could not maintain its position in the Improving quadrant and has now entered the Lagging quadrant as well.

Nifty Metal also underperformed the benchmark on Budget Day, losing momentum as it transitioned from the Leading quadrant to Improving. Additionally, Nifty PSU Bank showed a loss of momentum within the Improving quadrant, while Nifty Commodities appears to be moving towards the Weakening quadrant from the Leading quadrant.

On a positive note, there was an increase in momentum for Nifty India Consumption, Nifty Auto, and Nifty IT within the Lagging quadrant. Nifty Realty is progressing in the Improving quadrant, and the Nifty FMCG sector has gained significant momentum, moving directly from the Weakening quadrant to the Leading quadrant.

Source: web.strike.money

Stocks to watchAmong the stocks expected to perform better during the week are Kotak Bank, UPL, SRF, Bajaj Finance, Laurus Labs, Navin Flourine and Muthoot Finance.

Among the stocks that can witness further weakness are CanFin Homes, Abbot India, Tata Motors, IOC, Tata Chem, Gujarat Gas, Tata Comm and Apollo Tyres.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.