When it comes to the stock markets, just like cricket, Bollywood, or even politics, everyone has an opinion. But the market opinions that matter the most belong to the people who actually manage the money. The Moneycontrol Market Sentiment survey aims to gauge the mood of the market and get a sense of its future direction by polling some of the money managers.

With the economy showing signs of recovery, experts are more optimistic about growth going forward. The International Monetary Fund’s October World Economic Outlook released last week re-affirmed that a smart recovery was afoot in India.

The international agency has retained its GDP growth projection at 9.5 percent for the country for FY22. But more importantly, it said that in FY23, India will grow at 8.5 percent. Again the World Bank last week driven by an 8.3 percent growth for the Indian economy this year itself.

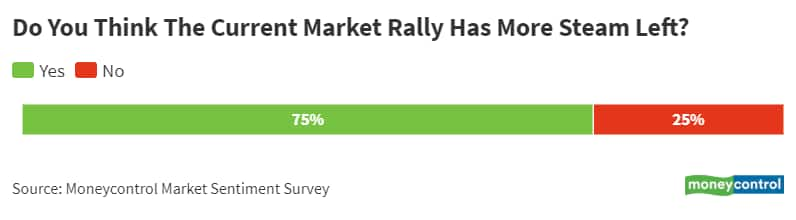

On the home turf, the Nifty50 index crossed the 18,500 mark on October 18, with the market sustaining its upward momentum driven by flow of money from new-age and institutional investors despite global weakness and risk of inflation due to increasing oil prices.

Moneycontrol carried out its fifth edition of the Market Sentiment Survey against this backdrop. Twelve fund managers, managing Rs 2.25 lakh crore of assets, took part in the study.

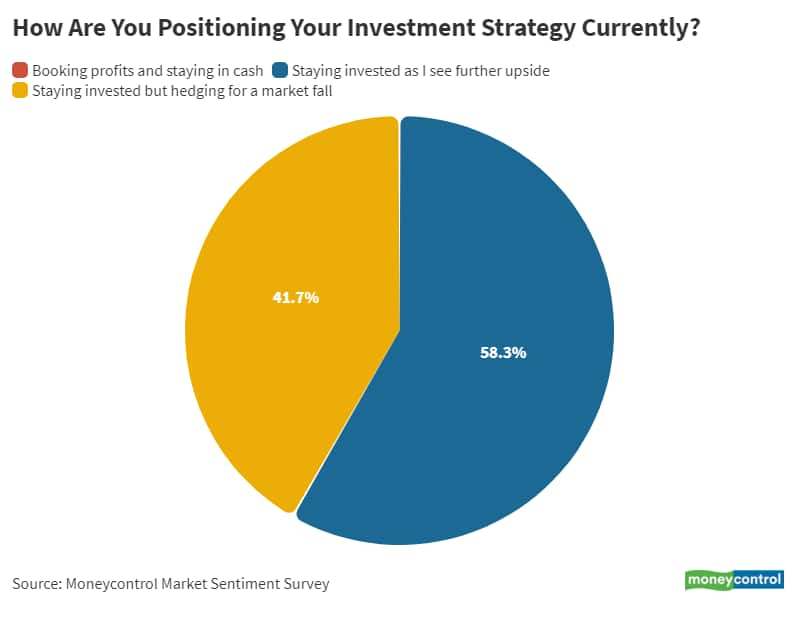

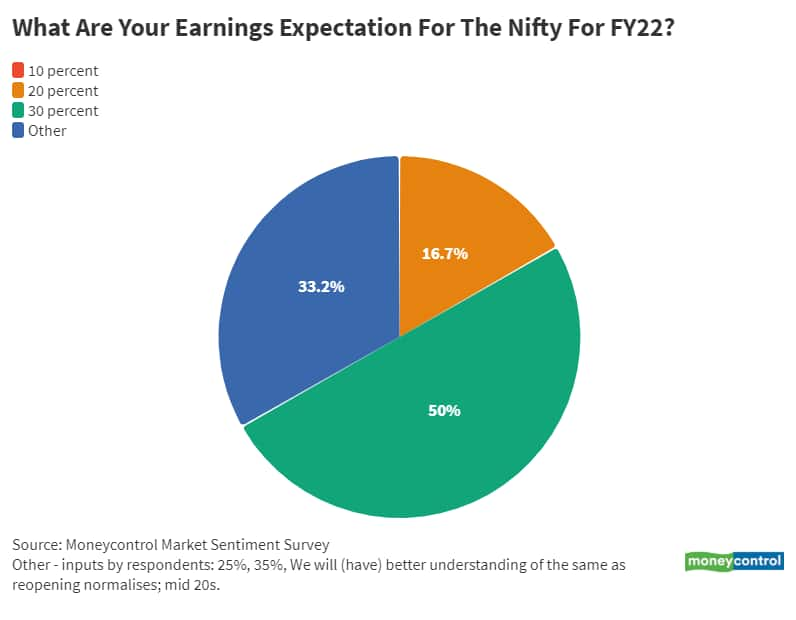

Half of the fund managers believe that equities will generate the best returns over the next year with the Nifty expected to reach 20,000 during the same period. Make in India, followed by internet companies, were seen as the two big investment themes over the next 12 months, the survey found.

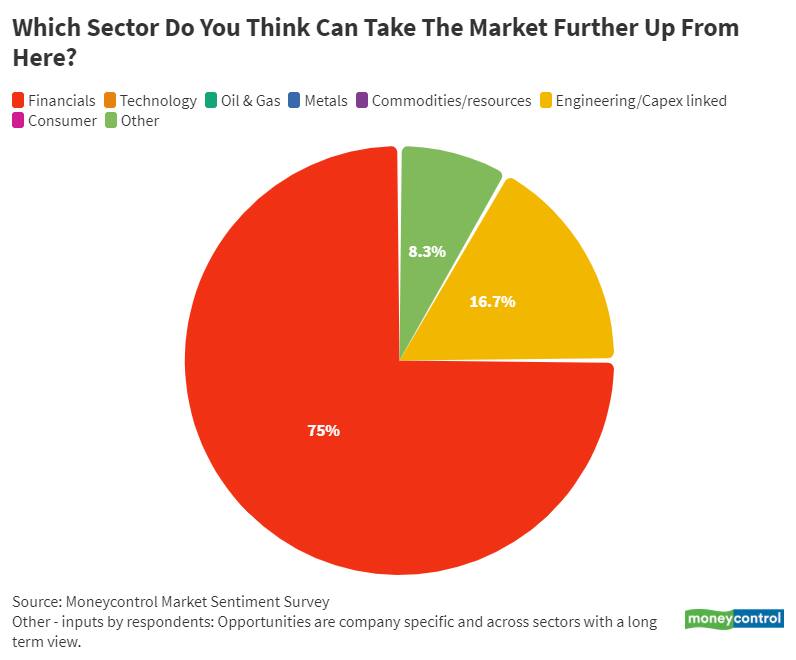

Around 75 percent of the experts think that the financial sector has the potential to take the markets further up. The US Federal Reserve raising the interest rates earlier than expected is seen as the biggest risk to the present market rally, followed by inflation.

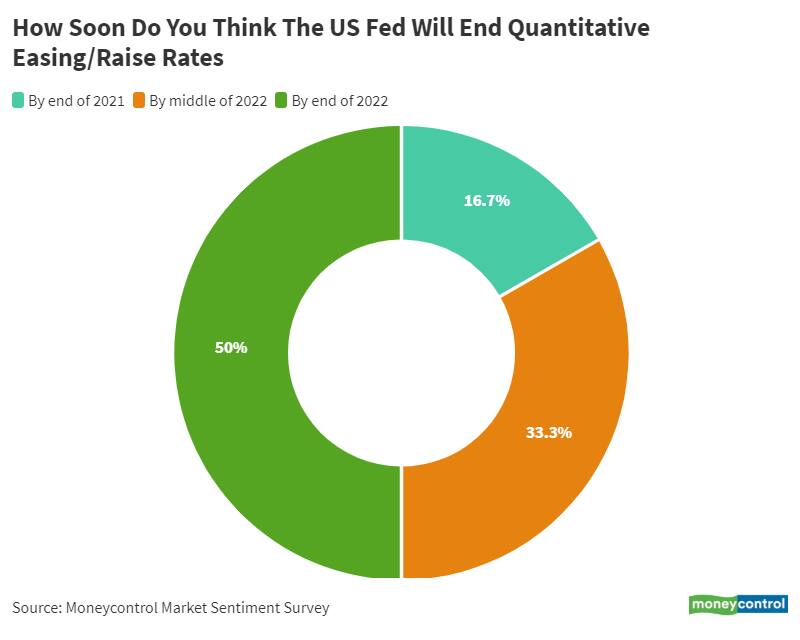

Half of the respondents expect the US quantitative easing to stop by end-FY22, and nearly a third expect it to end by the middle of FY22.

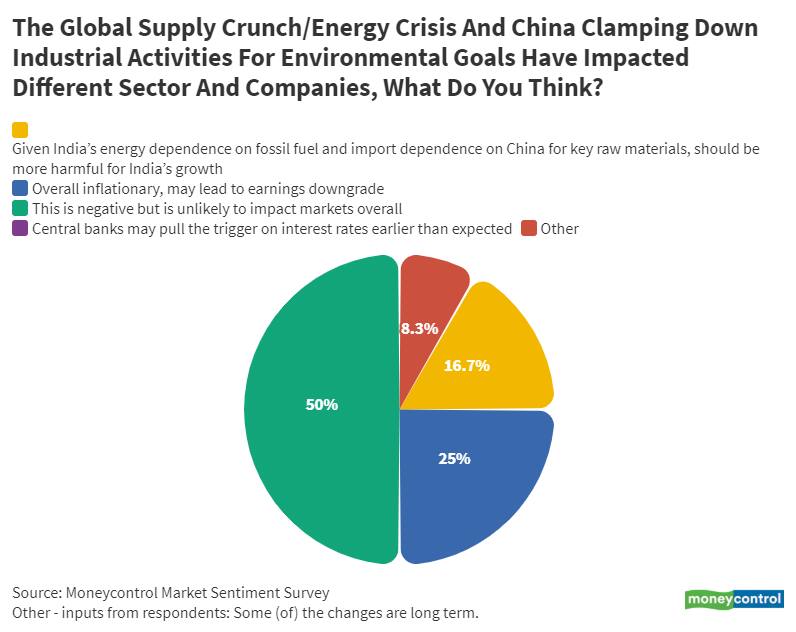

Likewise, when asked about ‘the global supply crunch/energy crisis and China clamping down industrial activities for environmental goals impacting different sectors and companies, 50 percent of the respondents said this was negative but was unlikely to impact the markets.

Here’s what the overall survey findings revealed:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.