The Indian market did well in the financial year 2021 (FY21) despite the coronavirus outbreak which upended lives, brought business activity to a halt for months and ravaged the global economy.

FY21 has been a year of high volatility. The first half was hit hard by the COVID-19 lockdown but the second half saw a gradual improvement as cases dropped, the economy reopened and measures by the government and the central bank pumped in high liquidity, which led to positivity in the market.

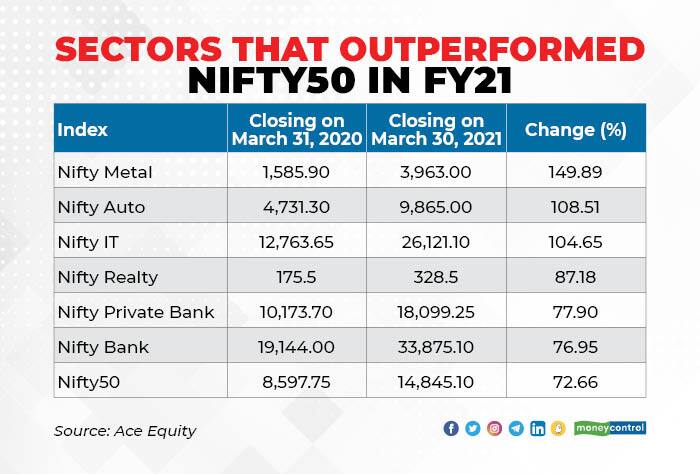

Almost all the sectors witnessed a rebound after a sharp selloff in March 2020, however, metals, auto and IT outperformed by strong margins.

In FY21, so far, Nifty has jumped 73 percent while Sensex has logged a gain of 70 percent even as COVID-19 continues to persist as a major threat. Their winning run may continue in FY22, with economic improvement and wide-scale vaccination.

Nifty Metal has logged a whopping gain of 150 percent, Nifty Auto has jumped 109 percent and Nifty IT has risen 105 percent in FY21.

Read more: India among top performing markets in FY21

While IT found favour with investors as a defensive sector and also because COVID-19 increased our dependence on technology by several notches, metal and auto picked pace as investors anticipated economic recovery.

"The metal sector outshined due to improving demand condition, lower base and shift of business from China to India. For auto companies, growth was driven by higher demand for personal mobility (two and four wheelers), festive discount led to higher sales, strong growth witnessed in tractor sales and lastly lower interest rate too boosted sentiments," Ajit Mishra, VP Research, Religare Broking, pointed out.

"IT companies benefited from work-from-home culture leading to high demand for digitalisation and cloud adoption, also large deals and healthy order pipelines helped them to post strong revenue growth."

Likhita Chepa, Senior Research Analyst at CapitalVia Global Research, also underscored that the demand in the metal sector was majorly driven by strong recovery post easing of lockdowns and progress in vaccines.

Also, Chinese demand and price hikes in iron ore helped steel prices.

"For the auto, the rural segment has contributed to its strong growth throughout the year and acted as a pillar enabling it to post strong numbers post-pandemic. A good monsoon has also helped improve tractor sales. With the resumption of retail demand, the passenger vehicle sales also improved in recent quarters and paved the way for recovery," Chepa said.

The road ahead

The government's focus on infrastructure sectors and an increase in spending across sectors are expected to boost the metal sector.

"With schemes like PLI in place, we expect the production to increase significantly on the back of gradual economic recovery and resuming demand. Budget 2021 proposed projects like Housing for All, Bharatmala

and Sagarmala are expected to add fuel to the fire in the near term," Chepa said.

Chepa expects the auto sector on the road to recovery in the next two quarters.

"The revival in production of passenger vehicles and two-wheelers has been faster than expected. Recovery in exports and aftermarket sales will also help boost earnings in FY22. The capex intensity is also expected to improve as compared to FY21," she said.

With an increase in internet penetration and increased users, the IT sector is likely to post strong numbers. "The pandemic has led to an acceleration in digital adoption. However, the physical activity across most economies is reverting to the pre-COVID levels. Hence, the IT spends may decrease in comparison to the previous quarters. We expect sustainable organic growth in this sector on the back of growing digital transformation and digital becoming the mainstream," said Chepa.

Mishra expects consolidation in these sectors in the near term.

"Considering the sharp run-up, we expect some consolidation in the near term. Our bias remains on the positive side as the ongoing economic recovery would aid revenue and profitability for these sectors. We would recommend being selective and accumulate quality stocks on dips with a long-term investment horizon," said Mishra.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.