There is a saying that ‘when US sneezes, the world catches a cold’. What it essentially means is that whatever happens in the US, the repercussions or impact are visible globally, including in India.

Why is the saying relevant right now, one may ask. It is because Donald Trump is all set to take oath as the 47th US President on January 20, and given his strong and extreme views on business and tariff barriers among other things, the impact is already visible much before he moves into the Oval Office.

India and China have been in the limelight ever since he won the Presidential elections with the stock markets of the two most populous counties witnessing heightened volatility as well.

In the Indian context, there have been many concerns related to tariffs and impact on certain sectors including IT and pharmaceuticals. A latest Moneycontrol Poll, however, has revealed that a majority of market experts believe that while there could be sector-specific impact, Trump’s return would largely be neutral for the Indian markets and his expected hard stance on China would actually aid India’s growth.

As many as 59 percent of the respondents said that the overall impact on India’s growth will be neutral with Trump in power.

.

.

Interestingly, 67 percent of the respondents said that they expect Trump to “walk the talk” on China, with a high 70 percent believing that higher tariffs on China would help India’s growth.

In a report released in November last year, global financial major Nomura had stated that Donald Trump's US election win is positive for India as the two countries share a deep economic and strategic interests that are unlikely to be compromised.

“We see India as a relative beneficiary, due to its domestic demand-driven growth model and benefits from lower commodity prices, supply chain shifts and on foreign policy,” stated the Nomura report.

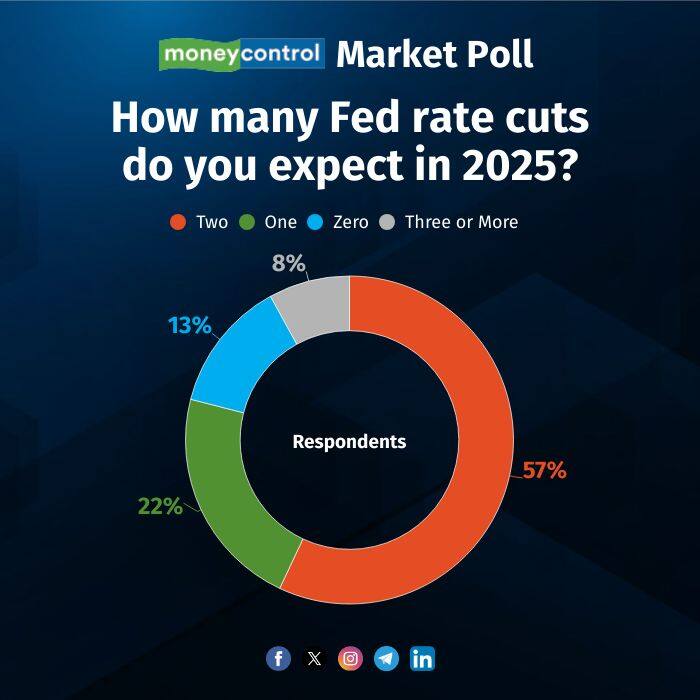

Meanwhile, more than three dozen market players across segments – broking firms, mutual funds, AIFs, PMS and independent experts – participated in the Moneycontrol Poll that also revealed that a large majority of respondents – 57 percent to be precise – expect the US Federal Reserve to announce two rate cuts in 2025.

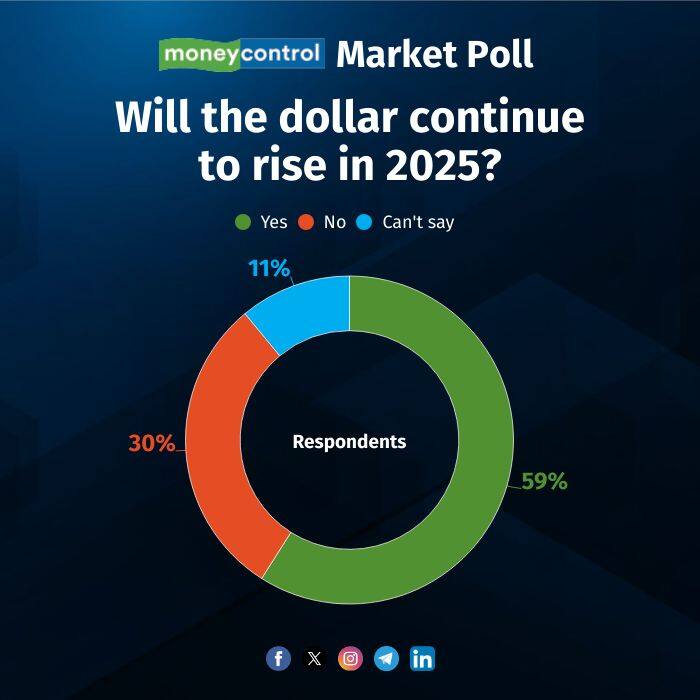

Further, 22 percent of the respondents said that they expect US Fed to announce just one rate cut in the current calendar year with 13 percent expecting nil cuts. On a related note, 58 percent of the respondents said they believe that the dollar will continue to rise in 2025.

This assumes significance for the Indian stock markets as a stronger dollar typically leads to FII outflows, as has been the case on most days in the recent past. Not to forget the larger impact on the economy as imports become costlier.

Also, the recent strong US jobs data has raised concerns about delayed rate cuts by the US Fed, which again would have a bearing on foreign flows coming to emerging markets, including India. FIIs are already net sellers at nearly $4.2 billion in the current calendar year till date.

In terms of key risks for the Indian stock markets emanating from US policy decisions, rising US bond yields emerged as the top ranked risk followed by non-tariff barriers impacting IT firms.

US Bond yields are climbing sharply, with the benchmark 10-year Treasury yield nearing 5 percent, as robust economic data strengthens expectations of prolonged high interest rates by the US Federal Reserve.

As mentioned earlier, the impact of rising US bond yields and a stronger dollar is clearly visible across India and other global emerging markets. The benchmark Sensex and Nifty are already down more than two percent in the current calendar year till date.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.