A finfluencer who recently got busted for running a drug racket seems to have been running an illegal money-management firm too.

Ashesh Mehta and his wife Shivangi Mehta, who have lookout notices issued against them from the Madhya Pradesh police for allegedly heading a Rs 300-crore drug-distribution network, were running an illegal money-management business called Bliss Consultants.

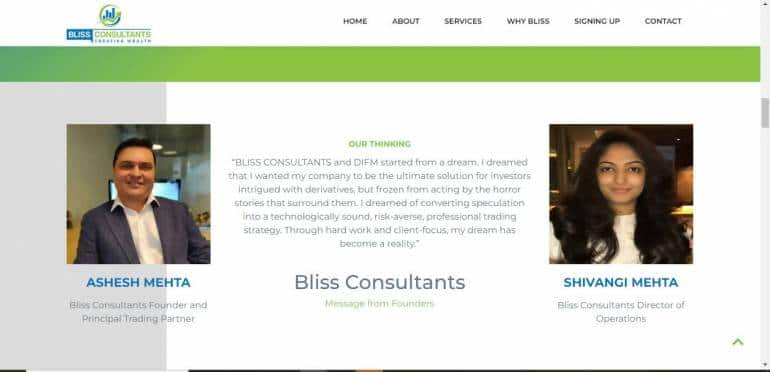

Website of Bliss Consultants that displays its founder and its director of operations.

Website of Bliss Consultants that displays its founder and its director of operations.

On its website, Ashesh Mehta has been named as Bliss’ founder and principal trading partner, and Shivangi Mehta as the firm’s director of operations.

Moneycontrol could not reach Ashesh and Shivangi Mehta for comments but we have sent them an email, and the article will be updated if they respond.

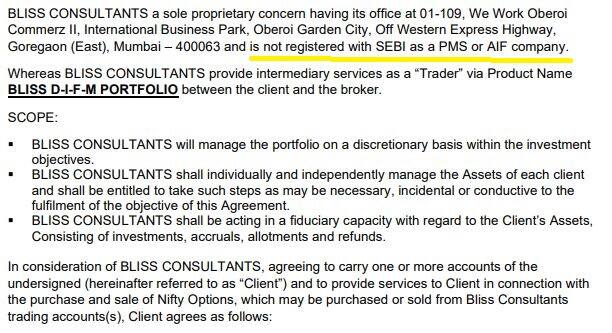

The agreement that clients sign with Bliss Consultants mentions that it is a sole proprietorship having its office in a Goregaon, Mumbai, address and that it is not a Securities and Exchange Board of India (SEBI)-registered portfolio management service (PMS) or alternative investment fund (AIF) company. But this information is buried in a link given in a corner of the website.

Also read: Wockhardt’s former pharma research head asked to part with over Rs 14 lakh for insider trading

Screenshot of the agreement signed

Screenshot of the agreement signed

According to Kruti Gogri, founder of Kruti Gogri & Co and a company secretary who has worked with the financial-services industry for more than a decade, any SEBI-regulated fund management entity has to declare its registration status prominently along with details such as its registration number.

“If they are an alternative investment fund, they also have to say if they are category-I, II or III... though with AIFs the investors are considered more financially sophisticated and, therefore, the disclosures are not specifically mentioned in the regulations,” she said.

Sources told us that Mehta’s business was advertised largely through word of mouth. “Ninety-eight to 99 percent of his clients have not spoken to him (Ashesh Mehta),” said one person in the know, who did not want to be named. Therefore, the clients had no way of checking if the firm was licensed to manage third-party funds.

Despite not knowing the fund manager or the entity in charge of their money, people seem to have been eager to sign up for the Mehtas’ service because their team was giving 2.5-3 percent returns every month. That is 36 percent annual returns.

“These kinds of returns were given consistently for years. There was not a single month in which he posted a loss, so clients were eager to sign up,” said the source. What also seems to have helped the business was the nonchalance with which it seems to have been promoted. That is, Mehta does not seem to have made any effort to promote it directly. Clients said that they could either sign up or not, depending on the reference they’d heard.

That said, Ashesh Mehta was constantly on Twitter advertising his trading prowess by posting profits made. For example, on May 31, he shared a screenshot that showed his having made more than Rs 2 crore profits.

Whatever his business-acquisition tactic, it seems to have worked.

A person Moneycontrol spoke to personally knows at least 200 people who had subscribed for Mehta’s money management service.

Onboarding process

The onboarding starts with a know-your-customer (KYC) link sent to the client. The link, which a client forwarded, now opens to a blank page that only has “Coming Soon” on it.

The page that opens with the KYC link given to clients.

The page that opens with the KYC link given to clients.

Once the KYC details are vetted, the client is asked to transfer funds to a bank account registered under Bliss Consultancy’s name. The onboarded client can now track the ‘portfolio’ and withdraw funds from it using an app called DIFM, for Do-it-for-me. Moneycontrol tried gaining access to it but only registered numbers of clients seem to be allowed in.

Going by the screenshots available on Google’s Play Store, it is a clean app that shows you profit and return on investment on one page, and has options to add funds and withdraw funds on another, among other things.

The person Moneycontrol spoke to has seen people investing amounts between Rs 5 lakh and Rs 20 crore with Bliss Consultants. The profit- and loss-sharing arrangement, according to the agreement signed by the clients, seems to have been 70-30; that is 70 percent of the profit or loss would be the client's and 30 percent of the profit or loss would be Bliss Consultants'.

The website of the company gives a seven-step procedure to be onboarded as a client. It does not mention the common bank account. Instead, it does a sleight-of-hand by saying that the client has to transfer funds to an account managed by a SEBI-registered share broker. This must have been done to give the impression to a future client that there is some regulatory oversight over Bliss’ products.

In reality, a person can send funds only to a bank account attached to a demat/trading account. In this case too, the funds go to the bank account registered in the firm’s name.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.