Retail investors, more often than not, burn their fingers with direct stock investments based on unsolicited advice, peer influence, intuition and even half-baked knowledge. Given the lack of time, inclination and expertise needed for fundamental analysis, they pay the price for their wishful thinking. After suffering substantial losses, they either steer clear of the stock market or look up to mutual funds, which are definitely a popular investment option. However, while they are happy to place their faith in the judgment of mutual fund managers across different schemes, few among them are bogged down by typical constraints like steep costs, stiff lock-ins, and delayed redemptions. Many investors also feel the need for further diversification. They seek more decision-making autonomy, as also professional help for creating, curating and managing portfolios.

Ready-to-invest portfolios: Conviction-led investing

There is a potent investment strategy that can help retail investors make the best of both worlds: ready-to-invest portfolios based on specific investment themes, models and propositions.

Ready-to-invest portfolios come in as many flavours as ideation can allow—from a small-sized basket devoted to specific sectors like renewable energy or tech startups to a theme focused on ideas like largecap bets and disruptive technology picks.

Stock picks can also be tailored to meet the goals and aspirations of individual investors, linked to life goals like marriage, higher education, sabbatical, early retirement and the like.

They can also include investment propositions based on some measured conviction, for instance a theme, which believes companies of a certain sector are likely to benefit from a recent government policy mandate, or a pack of bundled scrips that are expected to gain from sectoral consolidation, or a hamper of stocks where the managements are known to employ a prudent strategy that is been identified as critical for sustainable growth besides generating alpha in optimal time.

A ready-to-invest portfolio could have an investing theme of effective pandemic strategies based on research that suggests COVID-19 mitigation strategies will be integral to the success of any organisation.

So, the portfolio managers would include pre-defined non-financial parameters in conjunction with conventional financial metrics to curate a basket of stocks scoring high on pandemic preparedness.

The stock-picking is preceded by authentic research, rigorous back-testing and comprehensive stock screening, as also apposite weightage and asset allocation in line with the defined strategy.

Host of benefits

Ready-to-invest portfolios offer an investor several value-adds including dashboard-driven digital convenience, complete portfolio ownership, real-time monitoring, seamless customisation, and cost-effective and transparent transactions. Their subscription price tags are low, while the flexibility to filter themes or smartly rebalance picks based on circumstances or periodicity is extremely high.

Ready-to-invest portfolio offerings clearly mention upfront the minimum investment amounts, subscription fees, portfolio themes, purpose, goals, investing philosophies, risk-reward relationships, historical and current CAGR performances, and rebalancing strategies. Common investors have a plethora of themes to choose from and benefit from long-term capital appreciation.

Stellar performance vis-à-vis indices

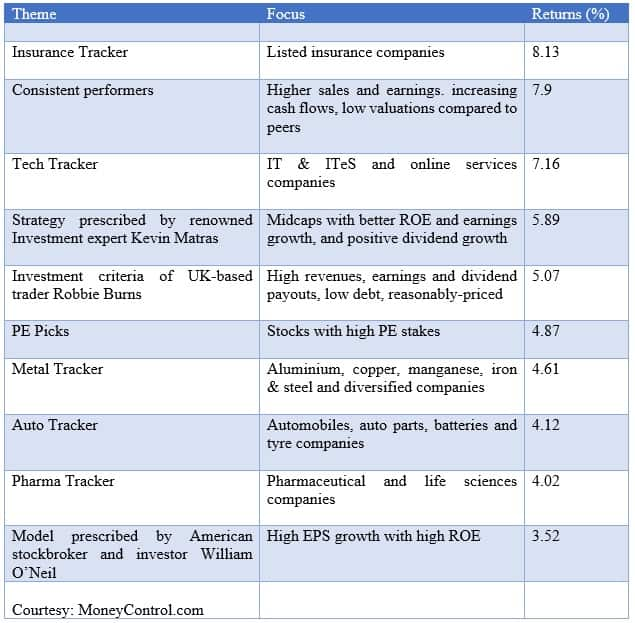

The performance of the leading ready-to-invest portfolios during April 9, 2021-May 8, 2021 has been impressive when compared to 1.53 percent gains in the NIfty during the same time period.

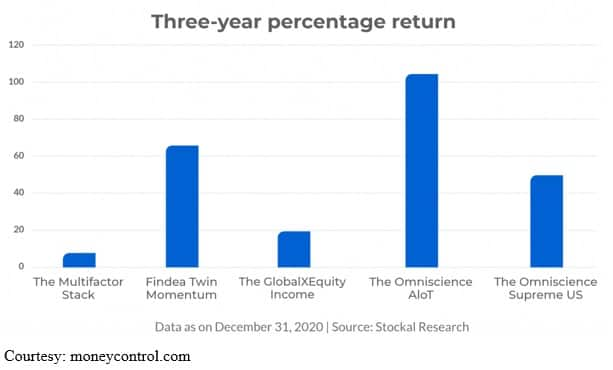

Talking of global markets, where ready-to-invest portfolios are referred to as stacks, meaning pre-configured thematic baskets of stocks and ETFs, the 2020 performance was definitively stellar. The top stacks fetched an average 109 percent in the last three years up till December 2020.

The returns of other prominent stacks have been a mixed bag at best. Here's a snapshot:

Common myths and misconceptions

Notwithstanding the undeniable benefits of ready-to-invest portfolios, there are potential pitfalls that an investor must guard against. Many retail investors erroneously equate “ready-to-invest” portfolios with “ready-to-invest” returns.

Small investors usually have little understanding of market peculiarities and risks associated with different products. The take time and effort even to understand the nitty-gritty of mutual funds which have been in vogue since long, and for which a plethora of investor education literature is available at the click of a mouse.

It is hence wrong to expect that common investors will easily comprehend the tenets of ready-to-invest portfolios that are at a nascent stage of evolution.

In fact, there is a glaring risk of unrealistic expectations, defeating the potential and performance of managed portfolios. Making the most of ready-to-invest portfolios calls for wisdom, more than mere knowledge, which comes from a judicious blend of market experience and professional expertise.

Virtues of 'staying invested'

It is imperative to consult an expert with a proven track record of curating and managing such baskets through diligent research and analysis, as also advising clients on appropriate basket offerings based on their risk profiles and reward expectations.

The stock market inevitably goes through a litany of highs and lows, a mixed outcome of speculative forces as also macro-level triggers and upheavals, both global and domestic.

Most themes governing ready-to-invest portfolios hence tend to be medium to long-term propositions to counter market volatility. Hence, it is extremely important to stay invested till the target etched to the portfolio has been achieved.

Many times investors abruptly mark their exits the moment they see the CAGR exceeding the growth originally envisaged. In doing so, they miss out on long-term rewards which help build wealth.

Summing up, the virtues of “long-term” apply as much to ready-to-invest portfolios as to mutual funds, exchange-traded funds, or any conventional PMS or wealth management products.

The absence of a lock-in period is not a licence to make impulsive or premature redemptions. The key to unlocking the value of ready-to-invest portfolios lies with “staying invested”, which forms the core of disciplined investing.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.