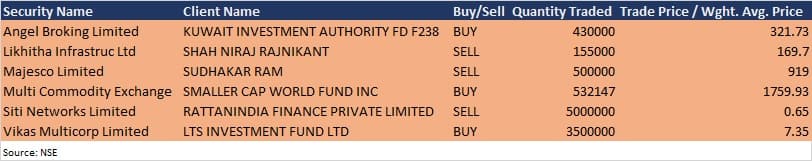

Kuwait Investment Authority has acquired half a percent stake in retail broking company Angel Broking via open market transactions on October 29.

Kuwait Investment Authority FD F238 bought 4.3 lakh equity shares (representing 0.52 percent of its total paid-up equity) at Rs 321.73 per share, bulk deals data available on the National Stock Exchange (NSE) showed.

Angel Broking reported a strong set of earnings for the quarter ended September, with highest ever quarterly consolidated profit of Rs 74.47 crore. Profits rose 47.3 percent sequentially and 288.3 percent year-on-year. Consolidated revenue from operations rose 30 percent quarter-on-quarter (up 80.4 percent YoY) to Rs 309.85 in Q2 FY21.

Among other deals, promoter Sudhakar Ram sold 5 lakh equity shares in IT firm Majesco (representing 1.67 percent of its total paid-up equity) at Rs 919 per share on the NSE. He held 5.46 percent stake in the company as of September 30, while total promoter holding stood at 36.77 percent.

Smaller Cap World Fund bought an additional 5,32,147 equity shares in Multi Commodity Exchange of India (1.04 percent of its total paid-up equity) at Rs 1,759.93 per share on the NSE. The fund already held 6,02,521 equity shares, or 1.18 percent, of its total paid-up equity.

LTS Investment Fund acquired 35 lakh shares in Vikas Multicorp at Rs 7.35 per share on the NSE. It acquired 1.04 crore equity shares over three consecutive days, representing 1.56 percent of its total paid-up equity.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.