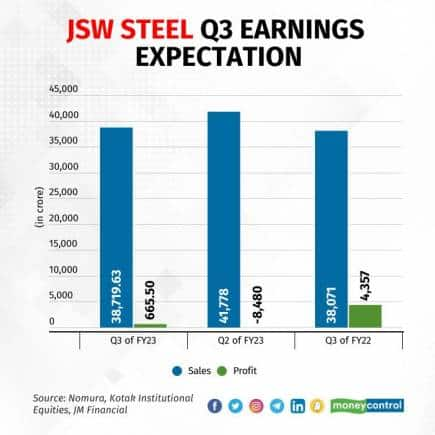

As China’s reopening triggers optimism about steel demand rising, JSW Steel’s consolidated revenue is expected to rise 1.7 percent year-on-year (YoY) to Rs 38,719.63 crore, but decline 7.3 percent sequentially, according to a poll of securities firms conducted by Moneycontrol.

The steelmaker could clock a net profit of Rs 665.5 crore in the quarter ended December, swinging from a loss of Rs 8,480 crore in the previous quarter. It posted a Rs 4,357 crore profit a year ago.

The company will detail its quarterly earnings on Friday, January 20.

Nomura believes the company’s earnings before interest, tax, depreciation and amortisation (EBITDA) margin could shrink to 9.7 percent in the reporting quarter from 24.0 percent in the corresponding period last year.

On a quarter-on-quarter (QoQ) basis, the operating margin could improve from 4.2 percent in the three months ended September.

Analysts believe steel prices are recovering across geographies now, driven by optimism about China’s economy reopening after the Covid-19.

China being one of the largest consumers and producers of steel, its reopening, along with recent stimulus measures announced for the Chinese real estate sector, is seen supporting steel demand.

“Consequently, China HRC steel futures have recovered sharply by around 15 percent from recent lows. With Indian steel prices in line with import parity, any increase in Chinese prices will likely lead to an increase in Indian steel realisations,” explained JM Financial Institutional Securities.

Also read: D-Street Buzz: CLSA tags Hindalco with 'buy', Tata Steel with 'outperform' as metals shine

Volumes across steel companies are expected to be lower sequentially, primarily on account of lower export volumes during the quarter. Nuvama Wealth Management said volumes may decline 4.2 percent QoQ to 4.8 mt.

The wealth management firm expects the standalone EBITDA per tonne to improve by 1.9 times QoQ to Rs 6,966 per tonne, primarily due to lower coking coal and iron ore cost while the realisation is expected to dip by 3.2 percent sequentially to Rs 58,960 per tonne.

Kotak Institutional Equities sees JSW Steel reporting a standalone volume of 4.85 million tons on a low base and ramp-up of volumes at Dovli Phase II and expects steel realisation to decline by 12.1 percent YoY and 2.3 percent QoQ, led by price cuts during the quarter and contract resets.

On January 19, the steel manufacturer’s stock closed at Rs 760.05 on the NSE.

In the past three months, the stock has gained 23 percent while it has rallied over 180 percent in the past three years.

In the last one year, shares of JSW Steel faced the maximum downgrades. From 19 ‘buy’ recommendations a year ago, the stock slipped to just six buy calls, even as the ‘sell’ ratings soared to 16 from six a year ago.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.