With the equity market clocking record highs, it’s not just small companies but the biggest business groups in the country that are making a beeline for the primary market.

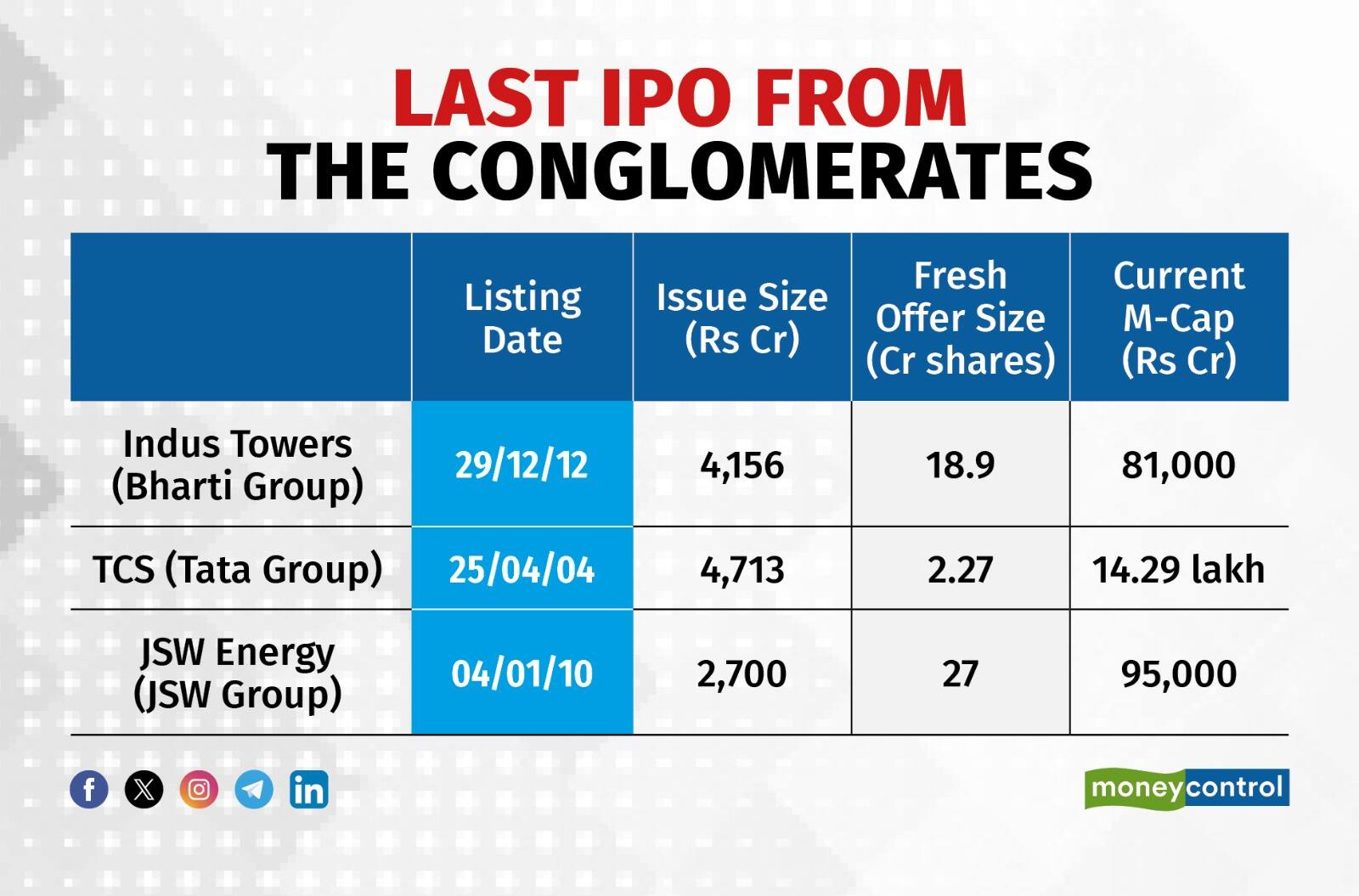

In 2023, JSW kicked off the trend, with its logistics and infrastructure company JSW Infrastructure raising Rs 2,800 crore through fresh equity, 14 years after the group's last listing, with JSW Energy.

Then, it was Tata Technologies in November 2023, and now Bharti Hexacom, which launched its IPO on April 3 with an issue size of Rs 4,275 crore.

Tata Technologies, JSW Infrastructure and the Bharti Hexacom offering are only a few examples of Indian conglomerates making the most of the effervescence in the IPO market. The primary market has been buoyant over the past year with 76 mainboard issues raising Rs 61,915 crore.

Indian Conglomerates: The IPO March

Also Read | Bharti Hexacom IPO: Should you subscribe to Bharti Group’s first public offer in over a decade?

The Tata Technologies IPO was the first by the Tata group in 19 years and the last Bharti Group company to be listed was Indus Towers in 2012.

However, more industry heavyweights are expected to take their companies public in an attempt to unlock value and raise more funds. Reports suggest that the Tata Group is planning to launch several public issues over the next few years.

Tata Capital, Tata Autocomp Systems, Tata Passenger Electric Mobility, BigBasket, Tata Digital, Tata Electronics, Tata Housing, and Tata Batteries are among the companies that are likely to be listed.

On March 29, diversified conglomerate and Shapoorji Pallonji Group-backed construction and engineering player Afcons Infrastructure filed its DRHP with SEBI to float a Rs 7,000 crore issue.

Reliance Industries’ Reliance Retail is also gearing up to launch an IPO. Mukesh Ambani had said back in 2019 that the retail arm of his business empire would seek an IPO in five years. In 2023, Qatar’s sovereign wealth fund invested $1 billion into India’s biggest brick-and-mortar retailer.

Why the sudden rush?

In a conversation with Moneycontrol, Gaurang Shah of Geojit Financial said that a big factor positively impacting the primary market’s mood and the companies that will be listed is the drive to unlock value. The push for value-unlocking is benefiting both promoters and investors.

Also Read | Vijay Kedia-backed TAC Security sees bids worth $1 billion; issue subscribed 422 times

According to Vinit Bolinjkar of Ventura Securities, the demand for quality companies in the market is big. Since large conglomerates like the Birla, Tata and JSW groups have decades of experience, brand recognition and fiduciary knowhow, there is a big appetite for these companies among investors.

Companies that are floating their issues are seeing an extremely positive reception in the stock markets. The average listing gain increased to 29 percent in FY24, compared to 9 percent in FY23, as domestic institutional investors, HNIs, as well as retail investors are buying into the IPO boom.

According to primedatabase.com, the value of the shares applied for in the retail segment stood at Rs 1.95 lakh crore in FY24. This was 216 per cent higher than the total IPO mobilisation during the financial year.

Bolinjkar added that the market, especially large investors, is sitting on ample amounts of cash, which is waiting to be deployed into the market. “The pro-equity mood has taken over,” he quipped. “Companies that are looking to expand and require growth capital are looking towards equity, instead of debt. After all, it’s a lot cheaper.”

India narrative fuelling appetite?

Another reason behind the positivity is the expectation of the Modi government to be re-elected. The government’s push for manufacturing and the Make-In-India drive have led to a lot of countries looking to facilitate manufacturing in India, Shah added.

The narrative around India’s growth cycle has spurred demand for quality investments. With the incentives and increasing capex thrust, the markets are poised to continue their outperformance, leading to positivity across sectors. That should keep the IPO gravy train running.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.