The Nifty managed to close above 18,000 psychological mark for the third straight session and formed a Doji candle on daily charts. However, it is important to note that in the recent up move, the index has been forming small bodied candles indicating loss of momentum.

The RSI (relative strength index) indicator on lower timeframes is showing price momentum divergence.

The Nifty has resistance in the 18,270-18,330 zone whereas the support lies at 17,900 mark.

The index looks over-stretched and could possibly be rangebound and witness a pullback towards 17,900-17,950 levels. On the flip side, if index manages to cross 18,330 then it can move higher towards the life time high of 18,600.

Here are three buy calls for next 2-3 weeks:

Tata Steel: Buy | LTP: Rs 1,221.15 | Stop-Loss: Rs 1,150 | Target: Rs 1,480 | Return: 21 percent

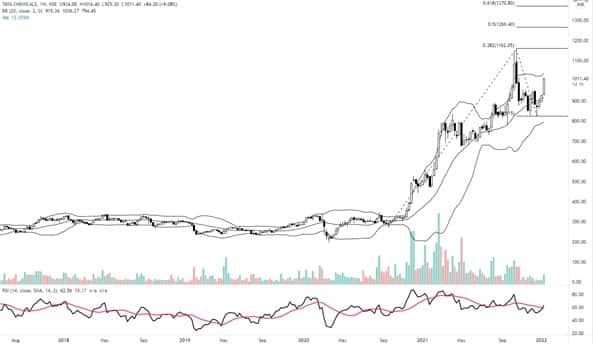

Tata Steel has been moving lower in a corrective phase ever since it tested a high of Rs 1,534 in the month of August 2021. The stock seems to have halted its down move and entered a consolidation after finding support near the Rs 1,065 which is placed close to the 38.2 percent retracement level of the up move from Rs 250-Rs 1,534.

On January 13, 2022 the prices gained momentum and managed to break above the 8-week high, with above average volume.

The RSI plotted on the weekly chart can be seen moving higher after forming a bullish hinge near the 40 mark, indicating increasing bullish momentum in the prices.

Going ahead we expect the prices to move higher towards Rs 1,370 mark immediately followed by Rs 1,480. We recommend a strict stop-loss of Rs 1,150 on daily closing basis.

Tata Chemicals: Buy | LTP: Rs 1,014.05 | Stop-Loss: Rs 955 | Target: Rs 1,158 | Return: 14 percent

Tata Chemicals had been moving in a range between Rs 955-825 for the past 10 weeks. On January 13, the prices gained momentum and managed to move above the 10-week high, with good volume build-up, indicating participation in the up move.

The RSI plotted on the weekly chart managed to sustain above the 50 mark through the correction and is currently moving higher towards the overbought level, indicating increasing bullish momentum as the prices move higher.

Going ahead we expect the prices to move higher towards the Rs 1,158 mark. If the prices manage to breach and sustain above the Rs 1,158 level, we might see further up move towards the Rs 1,266 and Rs 1,370 mark eventually.

We recommend a strict stop-loss of Rs 955 on daily closing basis.

Sequent Scientific: Buy | LTP: Rs 189.85 | Stop-Loss: Rs 175 | Target: Rs 225 | Return: 18 percent

Sequent Scientific has recently broken out of the falling trendline along with the 50-Day moving average resistance with strong volumes.

The stock has broken above the previous swing high of Rs 185 and negated the lower high lower low formation.

The RSI indicator is confirming the breakout and moving higher indicating strong momentum.

Looking at the prices action and the momentum indicators we believe this stock is a perfect bottom fishing candidate.

One can look to buy Sequent Scientific with a target of Rs 225 and maintain a stop-loss of Rs 175 on Daily closing basis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.