The 25 percent Securities Transaction Tax (STT) hike on selling futures and options will dent the margins and bottom line of high-frequency trading firms (HFTs), scalpers, arbitrage firms and large proprietary traders at a time when sentiment is weak and retail investor interest shaky on account of markets flatlining, traders have said.

The hike in STT was added as an amendment to the Finance Bill 2023, which was approved by the Lok Sabha on March 24.

STT is levied only on one leg of the transaction while selling futures and options. Buyers are not subject to the tax but they also end up paying when they square off their positions.

Over the last three years, retail traders have come into their own as volume drivers. Second only to HFTs and arbitrage firms, small-time retail traders, many of them young and raring to get a taste of derivatives trading, have given a boost to F&O trade on the bourses.

A recent Securities and Exchange Board of India (SEBI) study found that 89 percent—nine out of 10 retail traders—in the F&O segment end up making losses.

Over the past year, traders have suffered higher losses as volatiles markets made it harder for retail investors to call market moves correctly. While trending markets offer safer opportunities for retail traders to profit, volatile markets make it tricky because of the risk of getting caught on the wrong side of the trade.

Though trading losses are a result of trader’s indiscipline, the additional levy will further eat into returns, traders said.

The STT shocker

Finance Minister Nirmala Sitharaman’s STT move took everyone by surprise.

From April 1, a trader will now have to fork out Rs 6,200 on the sale of options of Rs 1 crore, up from the Rs 5,000 being paid currently. The leap signals a hike of 24 percent.

On the other hand, when the said trader sells future contracts, they will have to fork out Rs 1,250 instead of Rs 1,000, a jump of 25 percent.

A blow to scalpers, arbitragers

Shrey Jain, founder and CEO of SAS Online, a deep discount brokerage firm, told Moneycontrol that the move may not have a direct impact on retail traders but will impact the margins and bottom lines for scalpers, arbitrageurs and HFTs as their transaction expense would go up by 25 percent.

"More than 90 percent of volume in Indian markets originate from scalpers, arbitrage houses and HFT firms. An increase in their cost of trading in markets may impact the overall volumes and spreads for retail may go up as well," Jain said.

It is FPIs and proprietary traders who will be most affected by the move, said Manu Bhatia, a veteran trader, while cautioning that retail traders will also bear the impact, given they have to sell to square off their in-the-money (ITM) and at-the-money (ATM) positions on the expiry day.

Will the hike dampen retail traders' participation?

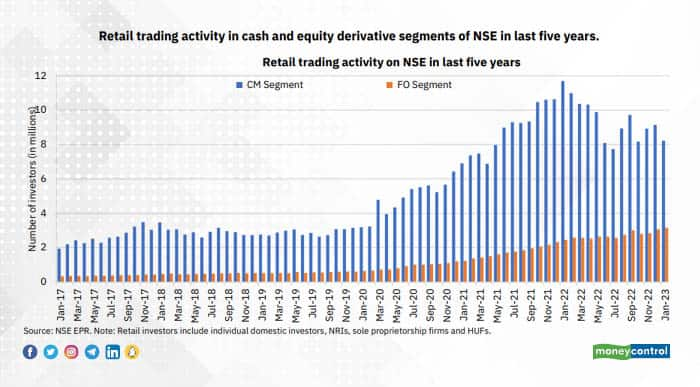

The number of retail investors participating in the secondary markets has surged notably since January 2020 from 3 million to nearly 8.2 million in January 2023 in NSE’s cash market segment, reaching its peak in January 2022 at 11.7 million.

Despite the drop in the first half of 2022, the number of active investors continues to remain above the pre-pandemic level. In the F&O segment, the number of retail investors touched 3.2 million in January 2023.

Over the past eight fiscal years, retail investors have been net buyers in the last three. During this period, they invested nearly Rs 2.9 trillion, as of February 2023, in equities directly through secondary markets. Of it, Rs 1.6 trillion was invested in the last financial year (2021-22).

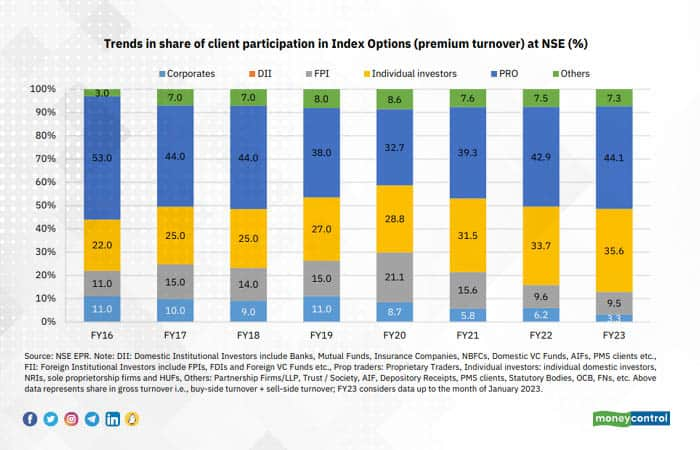

Since FY16, the share of retail participation in index options as seen from the lens of premium turnover has been on the rise. From a measly 22 percent in FY16, their participation rose to 35.6 percent. In the case of stock options, the participation of retail investors has risen from 30 percent in FY16 to 31.5 percent in FY23 before reaching a peak of 33 percent in FY22.

Participation in index and stock futures, however, has remained muted. Retail traders accounted for 32 percent of client participation in index futures in FY16, which grew to 39.3 percent in FY21 before coming down to 32 percent in FY23. The story worsens when it comes to stock futures, which was at 26 percent in FY16 and came down to 15.7 percent in FY23.

Seen from the notional turnover lens, the total contribution of retail traders in equity derivatives has shot up from 23 percent in FY16 to 28.1 percent in FY23.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.