Mutual funds turned net buyers in equity and equity-oriented schemes for the first time, in the last nine months, in March 2021 thanks to the correction in the equity market that started mid-February.

"A slight correction in the market in March has led this resurgence of flows into equity-oriented mutual funds," said Narnolia. The benchmark indices corrected 5 percent from their record high levels seen in February.

Equity funds saw inflows of Rs 9,115 crore in March against outflows of Rs 10,468 crore in the month prior. Of the total inflow mutual funds pumped in Rs 2,476.45 crore during the previous month.

All the equity and equity-oriented mutual funds except for Multicap funds witnessed inflows in March. Moreover, the investment through systematic investment plan (SIP) rose to all-time high levels.

"SIP contribution rose to an all-time high at Rs 9,182 crore in March with SIP account additions also up to all-time high in March with higher average ticket size," ICICI Direct said. Average new additions of SIP last year stood at Rs 7 lakh per month, while in the month of March it stood at Rs 16.71 lakh.

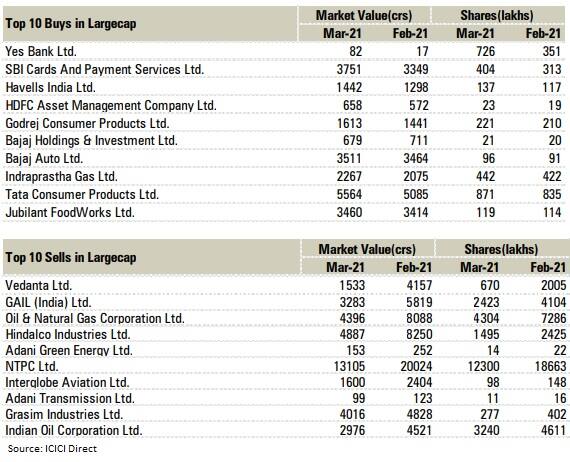

ICICI Direct collated a list of 10 stocks each from large, mid and small-cap categories which saw the highest buying and selling in March.

In the largecap space, the highest buying by asset management companies was seen in Yes Bank, SBI Cards and Payment Services, Havells India, HDFC Asset Management Company and Godrej Consumer Products.

However, Vedanta, GAIL (India), ONGC, Hindalco Industries and Adani Green Energy witnessed the highest-selling by mutual funds.

Among midcaps, fund houses bought Wabco India, Max Healthcare Institute, Tata Communications, Granules India and L&T Finance Holdings, whereas the selling was seen in TVS Motor Company, Vodafone Idea, LIC Housing Finance, Motilal Oswal Financial Services and Amara Raja Batteries.

In the smallcap space, the highest buying by mutual funds was seen in Hathway Cable & Datacom, Varroc Engineering, Sterling and Wilson Solar, Welspun Corp and IFB Industries.

On the other side, Mahindra Lifespace Developers, Ashiana Housing, IDFC, Igarashi Motors India and Shilpa Medicare saw the highest selling among smallcaps in March.

Foreign institutional investors (FIIs) also continued to be net buyers in March, which could be one of the reasons that the market has not seen a major sell-off. In fact, there has been buying on every major dip seen in the last two months. FIIs net bought Rs 16,959.73 crore worth of shares against an inflow of Rs 19,747.39 crore in the previous month.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.