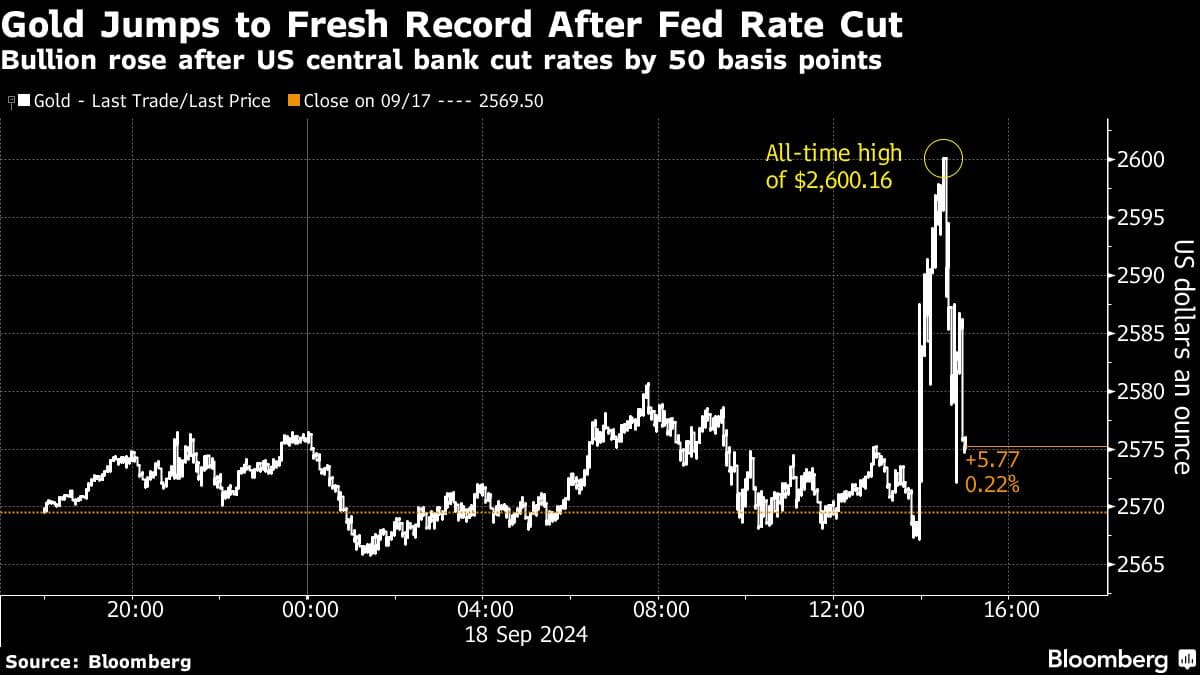

Gold rose to a fresh record above $2,600 an ounce after the Federal Reserve lowered its benchmark interest rate by a half percentage point in an aggressive start to a policy shift aimed at bolstering the US labor market.

Projections released after the Fed’s two-day gathering showed a narrow majority — 10 of 19 officials — favored lowering rates by at least an additional half-point over the US central bank’s two remaining meetings this year. Treasury yields and the dollar pushed lower after the rate decision. Gold, which tends to benefit from lower rates, rose as much as 1.2% before erasing gains after Fed Chair Jerome Powell said in a press conference that no one should see this as a “new pace.”

Gold Jumps to Fresh Record After Fed Rate Cut | Bullion rose after US central bank cut rates by 50 basis points

Gold Jumps to Fresh Record After Fed Rate Cut | Bullion rose after US central bank cut rates by 50 basis points

With the start of the rate-cutting cycle, “interest rates are coming down, the dollar strength will start to wane,” Will Rhind, founder of investment firm GraniteShares Advisors, said in an interview. “The next kick-up for gold will be if there’s a sense that we’re heading into recession, and the fear factor comes out and people need to start buying gold as a hedge.”

Gold prices have broken out dramatically this year, soaring more than 24% to successive records. While the rally at the start of 2024 was underpinned by emerging market demand — particularly from central banks and Asian consumers and investors — the focus in recent months has shifted squarely to the Fed, and the outlook for the US economy. Non-yielding bullion usually benefits in a low-rate environment, and recessionary worries tend to drive investors to seek safety in gold.

Read More: Fed Cuts Rates By Half Point In Decisive Bid to Defend Economy

Gold, Treasuries and the S&P 500 Index have all typically risen as the Fed starts lowering rates, according to a Bloomberg News analysis of the past six easing cycles going back to 1989.

Wednesday’s rate cut caps a period of flux in the gold market, as some analysts have pointed to a return to more traditional trading patterns, and in particular to gold’s longstanding tendency to rise and fall in the opposite direction to real yields. That relationship had broken down in recent years, as gold remained historically elevated even as rates soared — with prices supported instead by huge central bank purchases, as well as surging demand from investors and consumers in Asia.

In recent months, there have been signs of western investors jumping back into the gold market as bets mounted that the Fed was about to pivot. Holdings in gold-backed exchange traded funds have risen for ten of the past 12 weeks, while long-only gold positions in Comex gold futures are hovering near the highest in four years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.