Holdings of foreign portfolio investors (FPIs) in NSE-listed companies saw a marginal quarter-on-quarter (QoQ) dip in percentage terms in the March quarter of FY21 (Q4 F21).

As per a report by primeinfobase.com, FPI holding stood at 22.60 percent as of March 31, 2021, down from 22.74 percent as of December 31, 2020. The quarter witnessed a net inflow of Rs 55,741 crore.

However, in rupee value terms, FPI ownership reached an all-time high of Rs 44.66 lakh crore as of March 31, 2021, up 6.77 percent from Rs 41.83 lakh crore as of December 31, 2020, said the report.

In terms of ownership by the number of shares (average of FPI holding as a percentage of total share capital across all NSE-listed companies), FPI ownership went up to 5.96 percent as of Q4 FY21 from 5.82 percent in

Q3 FY21, said the report from primeinfobase.com.

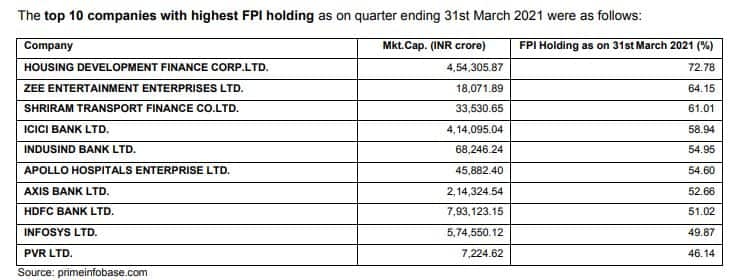

In terms of percentage holding, HDFC, Zee Entertainment, Shriram Transport, ICICI Bank and IndusInd Bank were among the top 10 companies with the highest FPI holding in the March quarter.

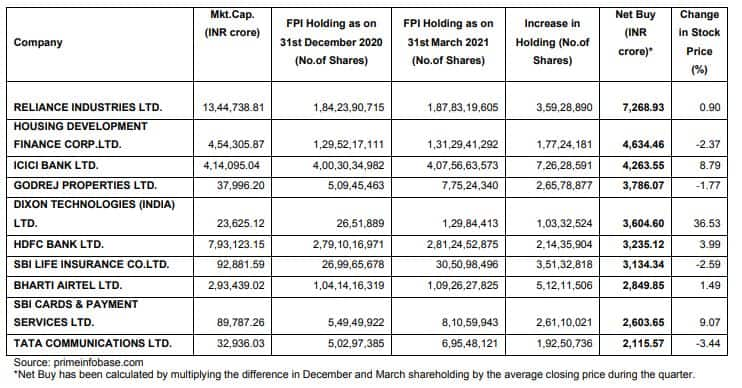

Reliance Industries, HDFC, ICICI Bank, Godrej Properties, Dixon Technologies and HDFC Bank were among the companies which saw the highest buying by FPIs in the previous quarter.

On the other hand, TCS, Kotak Mahindra Bank, Adani Green Energy, HCL Tech, IndusInd Bank, Asian Paints, Bajaj Auto, Dr Reddy's Labs, Sun Pharma and Info Edge saw the highest-selling by FPIs in the March quarter.

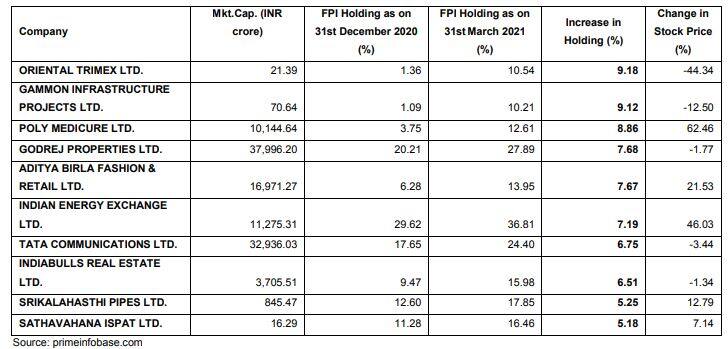

Oriental Trimex, Gammon Infrastructure Projects, Poly Medicure, Godrej Properties and Aditya Birla Fashion and Retail were among the stocks that saw the highest increase in FPI holdings in percentage terms from the previous quarter.

On the flip side, Vikas Multicorp, Majesco, Max India and IDFC were among the stocks that witnessed the highest decrease in FPI holdings in percentage terms.

On an overall basis, FPI holding went up in 497 companies listed on NSE in the last quarter, the report from Prime Infobase said.

"The average stock price of these companies in the same period increased by 13.96 percent. On the other hand, FPI holding went down in 413 companies listed on NSE. The average stock price of these companies

in the same period increased by a much lower 7.70 percent, the report said.

FPIs have been sellers in Indian equities in April and May 2021 so far after being buyers in the previous three months.

Concerns of rising inflation and rising debt levels are keeping emerging markets suppressed. Most emerging market currencies continue to depreciate against the dollar which is also leading to FPI outflows in most of them, experts point out.

"Going forward, if the recovery in US economy is far higher than emerging markets then it could pose a risk to the reflation trade and flows to emerging markets," said Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities.

In India, the surging COVID-19 cases and extended restrictions by several states are taken negatively by FPIs. India now accounts for more than 40 percent of new COVID cases worldwide which is big negative news for FPIs.

"We expect FPI flows into India to remain muted till the time cases don’t peak in India. The possibility of a third wave is also a concern that is surfacing which could be harmful to the economy and earnings. We can expect FPI flows to resume in a meaningful way as and when cases start going down sharply in India and there is a lesser threat of any third wave," said Oza.

Deepak Jasani, Head of Retail Research, HDFC Securities pointed out that between May 20 and March 21, India received a disproportionate share of FPI flows and these outflows may be part of reverting back to normal.

"This situation could be a temporary one in case the COVID-19 situation comes under control soon and the monetary policies followed by the global central banks are not tightened," Jasani said.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!