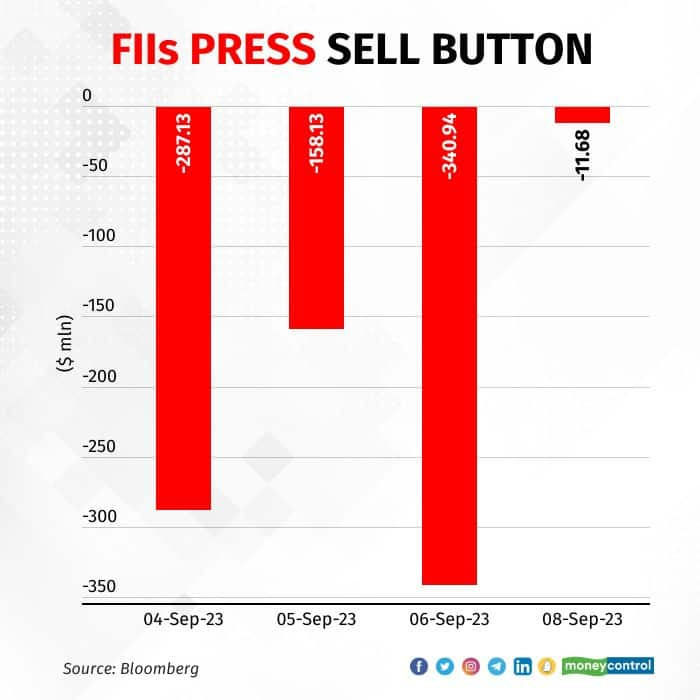

Foreign institutional investors have sold around $800 million in local equities in the past four sessions even as the benchmark Nifty 50 index hit a record 20,000 mark for the first time.

According to NSDL data, the FIIs pumped $16 billion into the Indian markets so far this year.

Both the flagship Sensex and Nifty have extended their gains for the seventh straight session, hitting fresh record highs. The broad-based rally in local equities began on March 28 and since then the indices jumped around 16 percent each, while BSE MidCap and SmallCap surged over 40 percent each.

Analysts suggest that FIIs are selling due to worries about rising crude oil prices and a poor monsoon, posing stability risks. Global markets haven't reached all-time highs, unlike the domestic market. This gap is worsened by a strong US dollar, expectations of a November Fed rate hike, and increasing US bond yields, which are raising doubts about equity valuations, especially in high-performing markets like India, according to analysts.

Read: What makes Karma Cap's Rushabh Sheth bullish on pharma, ports and media?

"The significant depreciation of the Chinese Yuan and Japanese Yen against the US dollar has exerted downward pressure on the Indian Rupee, approaching all-time lows and prompting foreign fund outflows", said Amit Pabari analysts at CR Forex.

Many analysts cautioned investors after a sustained rally in the midcap and smallcap indices and rising valuations. Kotak in its recent note advised investors that it has ceased recommending a midcap portfolio due to the scarcity of stocks beyond the BFSI sector showing potential for a 12-month fair value increase. Kotak attributes the sharp stock price surges to irrational exuberance among investors in the midcap and smallcap markets.

Analysts said the Indian rally is fuelled by liquidity, and investors should exercise caution due to expensive valuations. The Nifty 50, for instance, is trading at a high FY2025 P/E ratio of over 18x, and small/mid-cap stocks are often even pricier.

Some analysts expect a revival in local equity buying in the Indian markets. They are also optimistic about long-term earnings growth and the overall economy, viewing any market correction as an opportunity to invest further.

Read: Nifty scales Summit 20,000: 10 best bets for double-digit returns as bulls keep up the rally

"We believe this is temporary and FIIs would soon return as India with its resilient economy remains the fastest growing nation in the world and would attract higher allocation among the emerging economies. FII buying would resume once the US dollar index and US bonds cool off a little which would depend upon easing concerns around US rate hike cycle," said Sneha Poddar, AVP-Research at Motilal Oswal Financial Services.

Some analysts believe that select mid and small-cap stocks still have the potential for growth due to improved revenue prospects, even though their valuations may be somewhat concerning in absolute terms.

"Some risks to this market rally include inflation, erratic weather conditions, rising crude prices, slowing global growth and resultant impact on domestic exports, escalation in geopolitical tensions. Having said this, we remain optimistic about the long term earnings growth prospect of corporate India and economy. Hence any correction in the market on account of profit booking will be an opportunity to add more", said Kedar Kadam, Director - Listed Investments at Waterfield Advisors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.