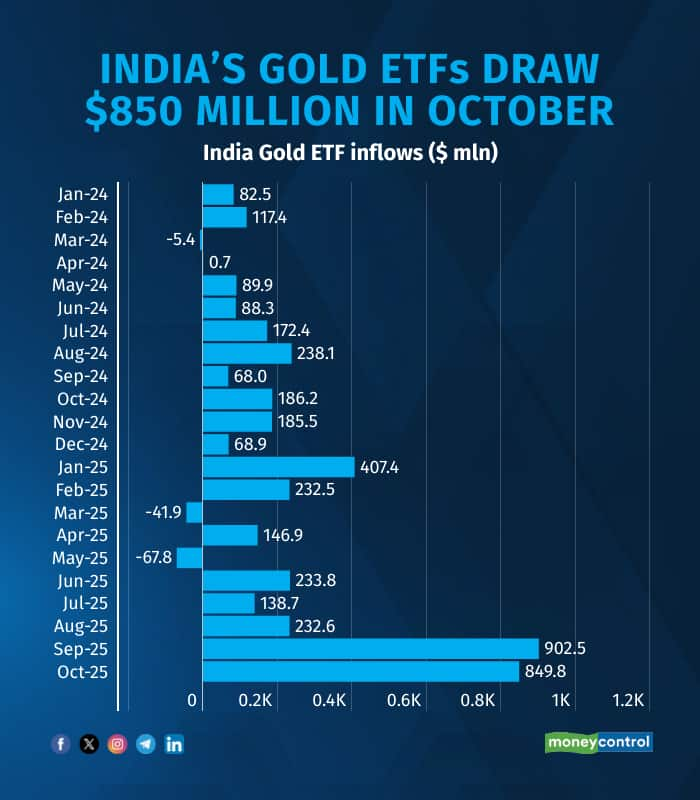

India's gold exchange-traded funds (ETFs) maintained their strong momentum in 2025, attracting $850 million in net inflows during October — the second-largest monthly inflow in Asia.

Data from the World Gold Council showed that while the figure was 6 percent lower than September's $911 million, it marked the fifth consecutive month of positive flows. Except for March and May, every month of 2025 has seen steady investor interest in gold ETFs.

So far this year, inflows into Indian gold ETFs have reached a record $3.05 billion -- the highest level ever for a single year, with assets under management rising to $11.3 billion. This compares with $1.29 billion in 2024, $310 million in 2023, and just $33 million in 2022, reflecting the growing shift toward gold-backed investments.

India ranked third globally in ETF inflows during October, behind the US with $6.33 billion and China with $4.51 billion. Japan followed with $499.5 million, while France recorded $312 million.

In contrast, several European markets faced outflows, led by the UK with $3.5 billion, followed by Germany at $1.17 billion and Italy at $185 million. Overall, global gold ETF inflows reached $8.2 billion in October, placing the market on track for one of its strongest years on record.

Global gold ETFs' total assets under management rose 6 percent month-on-month to $503 billion by the end of October, with total holdings up 1 percent at 3,893 tonnes.

Gold touched its 50th all-time high of the year on October 20, before spot prices slipped 5 percent the next day. Analysts attributed the decline to profit-taking and momentum-driven trading.

Despite the drop, major US-listed gold ETFs reported inflows of $334 million on October 21. As prices continued to retreat, the region later saw $117 million in outflows by week’s end and an additional $1 billion by month-end.

Geopolitical tensions, easing bond yields, and volatile equity markets remained key drivers of gold demand as investors sought diversification. In Europe, outflows stemmed from profit-taking and portfolio rebalancing, while in Asia, inflows surged amid renewed interest triggered by US-China tensions and slowing third-quarter growth, which strengthened the appeal of gold as a safe-haven asset.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.