Domestic markets edged higher in early trade on May 18 amid low-level buying and firm global cues after US President Biden expressed confidence in achieving a debt-ceiling deal.

Foreign investors continue to pour money into Indian equities, keeping the sentiments on the Street high. In May, so far, foreign institutional investors have net purchased over Rs 16,000 crore worth of shares.

At 11 am, the Nifty was traded 0.31 percent, or 57 points, higher at 18,239.

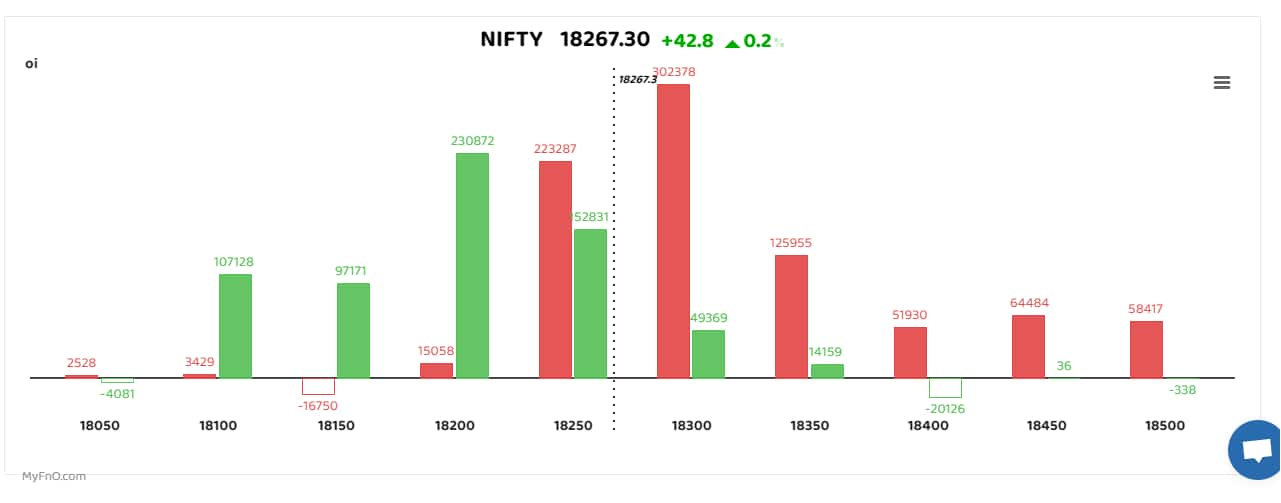

The index, however, is still witnessing heavy shorts at 18,300, which is turning out to be a key hurdle for the index. Traders were also seen taking Straddle positions at 18,250, which is a neutral strategy and pays off when the market does not move much.

The bars reflect changes in open interest (OI) during the day. The red show call option OI and the green put option OI.

The bars reflect changes in open interest (OI) during the day. The red show call option OI and the green put option OI.

“The Nifty may gain strength only above the 18,473 mark, while support is seen at 18,079 level,” said Prashanth Tapse, Senior VP (Research), Mehta Equities.

Follow our live blog for all the market action

Sameet Chavan, Head Research, Technical and Derivatives, Angel One, said a crucial support zone lies between 18,000 and 18,100, coinciding with a 50-percent retracement of the recent rally and the 20 EMA. Only if this support is broken, further weakness would creep in, he added.

Among individual stocks, financial stocks such as CanFin Homes, AU Small Finance Bank, and Chola Finance saw traders creating long positions. On the other hand, Godrej Properties continued to see short additions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.