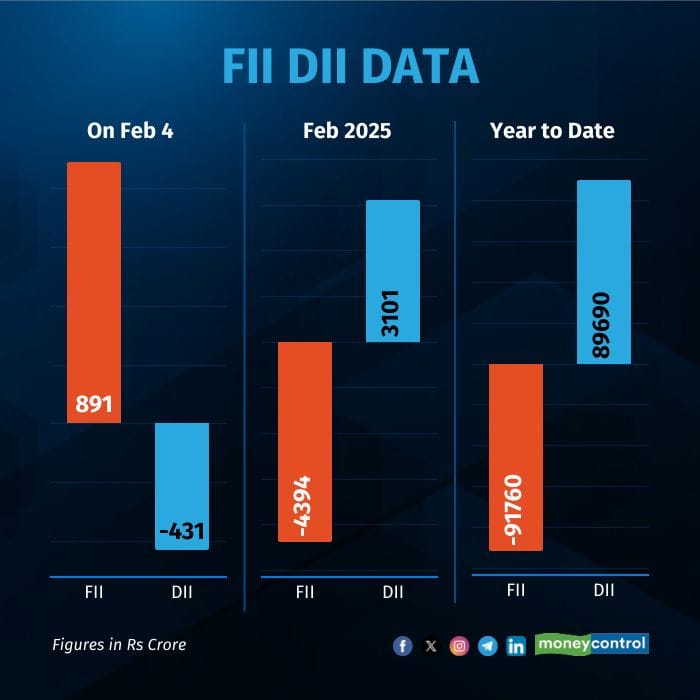

Foreign institutional investors (FIIs) turned net buyers on Tuesday for the first time after 23 successive sessions of net selling. On Februay 4, FIIs were net buyers at Rs 809 crore -- the first instance of net buying since January 2 when FIIs net bought shares worth Rs 1507 crores.

Meanwhile, domestic institutional investors (DIIs) continued their buying activity with shares worth Rs 431 crore.

During the trading session, DIIs bought Rs 15,003 crore and sold shares worth Rs 15,433 crore, while FIIs purchased shares worth Rs 18,106 crore while offloading equities worth Rs 17,297 crore.

Also read: Taking Stock | Sensex surges 1.8%, Nifty tops 23,700; capital goods, banking, energy lead rally

For the year so far, FIIs have net sold Rs 91,760 crore, while DIIs have net bought Rs 89,690 crore worth of shares.

Market View

At close, the Sensex climbed 1.81% (1,397.07 points) to 78,583.81, while the Nifty advanced 1.6% (378.20 points) to 23,739.25.

Among sectoral indices, BSE Capital Goods led the gains, followed by BSE Healthcare and Oil & Gas, BSE Industrials and Power.

On today's market, Devarsh Vakil, Head of Prime Research, HDFC Securities noted that the equity benchmarks demonstrated robust performance, with both the Sensex and Nifty recording substantial gains. "This upturn was primarily attributed to the United States' decision to suspend planned tariffs on Canada and Mexico, validating our morning market commentary," he said.

Vakil added that the Nifty has now surpassed both its 50 and 200-day exponential moving averages on a closing basis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!