Foreign institutional investors (FIIs) who turned net sellers last month poured in $7.3 billion in Indian markets in March quarter, data from Motilal Oswal showed, while domestic institutional investors recorded outflows of $3.2 billion.

FIIs raised stake in over 60 percent of the Nifty-50 companies on a QoQ basis, while DIIs reduced stake in 62 percent of Nifty-50 companies.

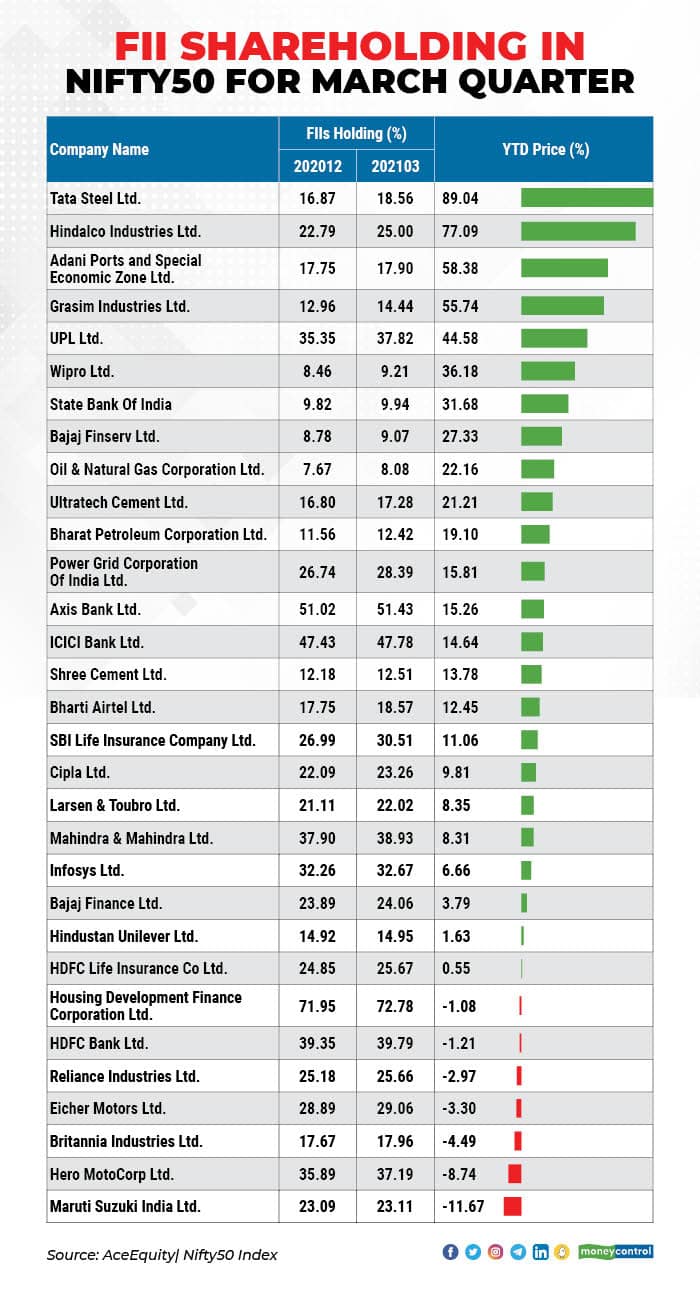

Foreign investors raised stakes in 31 companies in the Nifty50 as on May 10. These include Tata Steel, Hindalco, UPL, Wipro, ONGC, BPCL, ICICI Bank, Axis Bank SBI and Bajaj Finance.

SBI Life Insurance, UPL, Hindalco, Tata Steel, Power Grid, Grasim, Hero MotoCorp, and Cipla were the top stocks to see an increase of more than 1% in FII holdings on a QoQ basis.

DII holdings in Nifty stocks increased the most in BPCL, Bajaj Auto, IndusInd Bank, and SBI Life Insurance.

A deep dive into the rejig of FII shareholding suggests that foreign investors are looking at sectors that are likely to benefit from a rise in COVID cases as well as those sectors which could see a bounce back in near future as things stabalize.

FIIs increased weights in two-thirds of the sectors such as Telecom, Metals, Consumer Durables, Real Estate, and Cement), while DIIs trimmed weights on a quarter-on-quarter basis.

Sequentially, FIIs increased stake in Telecom (+130bp), Metals (+100bp), Consumer Durables (+100bp), Real Estate (+80bp), Cement (+60bp), Chemicals (+60bp), Insurance (+50bp), and Healthcare (+40bp).

“If COVID restrictions stay for a longer time (more than 45 days) we may see a shift in allocation towards export-oriented sectors like IT and Pharma,” Atish Matlawala, Sr Analyst, SSJ Finance & Securities said.

“Consumer discretionary will also take a hit as income of the low middle class takes a hit due to COVID. Although, we expect this to be temporary and once growth returns we expect FIIs to invest aggressively in Banks and Metals,” he added.

FII & DII Ownership in Nifty500

FII holdings in the Nifty-500 were back at pre-COVID levels in 4QFY21 – they declined a marginal 20bp QoQ, but increased 160bp YoY to 22.3%, data from Motilal Oswal showed.

In the Nifty-500, FIIs have the highest ownership in Private Banks (47.9%), followed by NBFCs (32.9%), O&G (23.1%), Insurance (22.2%), and Real Estate (21.5%). DIIs have the highest ownership in Capital Goods (21.9%), Private Banks (20.4%), Metals (18.3%), Consumer Durables (17.8%), and PSU Banks (17.6%).

Sequentially, FIIs increased stake in Telecom (+130bp), Metals (+100bp), Consumer Durables (+100bp), Real Estate (+80bp), Cement (+60bp), Chemicals (+60bp), Insurance (+50bp), and Healthcare (+40bp).

In contrast, FIIs reduced stake in NBFCs (-40bp), Auto (-30bp), Consumer (-20bp), and Technology (-10bp).

DII holdings in the Nifty-500 were down 10bp QoQ / 50bp YoY to 14.2% at a seven-quarter low, the data highlighted. The FII-DII ownership ratio in the Nifty-500 remained at 1.6x in 4QFY21 (unchanged from the previous quarter).

Using the Nifty-500 as the benchmark, DIIs are significantly overweight in Metals, PSU Banks, Capital Goods, Consumer, and Utilities and underweight in NBFCs, Private Banks, and Technology.

Overall, the top-5 sectoral holdings of DIIs in the Nifty-500 account for 66% of the total allocations – BFSI (27.8%), Technology (11.5%), Consumer (10.7%), O&G (9.8%), and Auto (6.2%).

Disclaimer: The views and investment tips expressed by the expert on Moneycontrol.com are his own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.