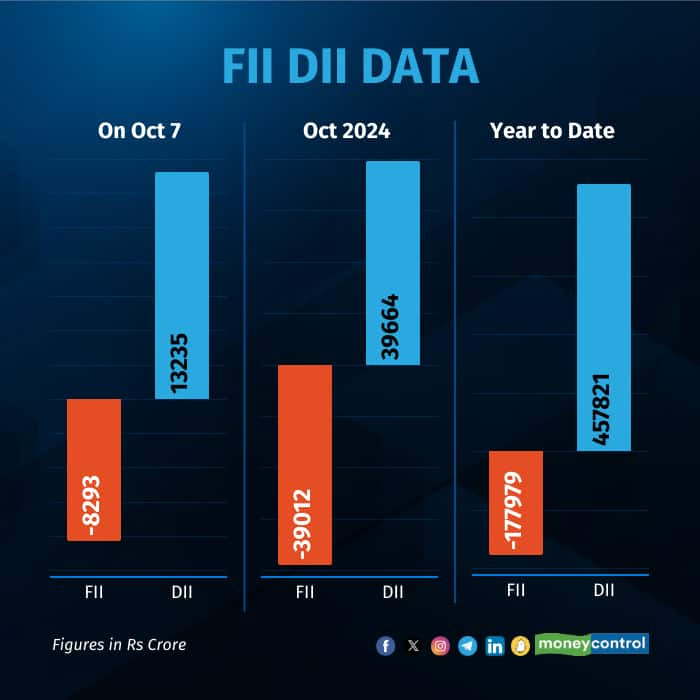

On October 7, Domestic Institutional Investors (DII) net bought shares worth Rs 13,235 crore as Indian markets saw their longest losing streak since October 2023. On the other hand, Foreign Institutional Investors (FIIs) net sold shares worth Rs 8,293 crore, provisional data from NSE showed.

DIIs bought Rs 23,924 crore worth of shares and sold shares worth Rs 10,679 crore. Meanwhile, FIIs purchased Rs 14,057 crore in shares and offloaded equities worth Rs 23,351 crore during the trading session.

In the year so far, FIIs have net sold shares worth Rs 1.78 lakh crore, while DIIs have bought shares worth Rs 4.58 lakh crore.

Market View

At close, the Sensex was down 638.45 points or 0.78 percent at 81,050, and the Nifty was down 218.80 points or 0.87 percent at 24,795.80.

Biggest Nifty losers included NTPC, Adani Ports, Adani Enterprises, SBI, Coal India, while gainers were ITC, Bharti Airtel, Trent, M&M and Infosys.

Except IT index, all other sectoral indices ended in the red.

On today's market, Vikram Kasat, Head - Advisory, PL Capital - Prabhudas Lilladher noted that today's decline was fueled by negative global cues, weak international indices, and growing concerns over the BJP's electoral setbacks in two states, which has led to profit booking ahead of the Maharashtra elections. "Geopolitical tensions and anticipation of the Reserve Bank of India's monetary policy decisions further contributed to the bearish sentiment. Despite these domestic challenges, global stock markets displayed resilience with Asian markets closing in green. Looking ahead, the Indian market's trajectory will hinge on global developments, investor reactions to electoral outcomes, and the implications of the RBI's policy stance,” he explained.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!